Note: It was announced in November 2023 that MoneyOwl will be acquired by Temasek Trust to serve communities under a re-purposed model, and will move away from direct sale of financial products. The article is retained with original information relevant as at the date of the article only, and any mention of products or promotions is retained for reference purposes only.

______________

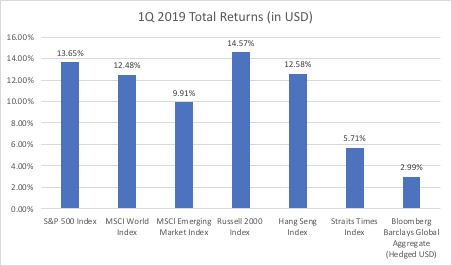

What do stocks do after one of the worst Decembers on record in terms of market performance? Start 2019 with one of the best first quarters in history! (For global equities. The STI is another story).

Large-cap stocks did well for the quarter with the S&P 500 up 13.65%, lifting the global MSCI World index to a 12.48% return for the quarter. Small caps did even better with the Russell 2000 index up 14.57% for the quarter. Emerging markets did their part with a 9.91% return in the quarter, as the Hang Seng Index posted a strong 12.58% return for the first 3 months of 2019. In fact, the Hong Kong market is almost starting a new bull market, up 20% from its October 2018 low.

Bonds had a fantastic start to 2019 with the Bloomberg Barclays Global Aggregate up 3% in the quarter as a pause in the rate hike cycle by the Fed, and an earlier than expected end to the balance sheet runoff has boosted the demand for long term bonds. The 10-year Treasury yield is now 2.416% as compared to 2.684% at the end of 2018 and as high as 3.23% in Nov 2018 before the talk of a ‘pause’ in rate rises started.

The equity rally has come on the back of a period of scepticism as EPFR Global data has recorded outflows from US stock funds for almost every week (except for two) this quarter. Aside from $9.1 billion the week of Feb 27 and 25.45 billion the week of Mar 13, every other week in 2019 so far has seen negative flows from US stock funds. So, even though investors have been pulling out of US equities, the market has risen, and should the data turn more favourable, or some geopolitical overhangs (such as the US-China trade war) resolve themselves, the markets might find further support as investors switch back in.

If you had stayed invested despite the volatility in December 2018, you would have benefitted fully from the strong rally in 1Q 2019 and mostly recovered from the fall experienced in late 2018.

So while we monitor the markets closely, we don’t let market events guide our investment decisions. Rather, when there is uncertainty, use it to take stock of our present situation and adjust our financial and lifestyle plans to build the buffers we need.

This article was written by the Solutions Teams of MoneyOwl and Providend. MoneyOwl and Providend are associate companies and share a similar investment and financial planning philosophy.

Announcement: With effect from 1 June 2022, MoneyOwl is a 100% NTUC Enterprise (NE)-owned company.