Note: It was announced in November 2023 that MoneyOwl will be acquired by Temasek Trust to serve communities under a re-purposed model, and will move away from direct sale of financial products. The article is retained with original information relevant as at the date of the article only, and any mention of products or promotions is retained for reference purposes only.

______________

The second Must-Have in retirement is a monthly retirement income for life to cover our expenses. It is no coincidence that those belonging to the Merdeka Generation are at one of the important milestones of their retirement planning – crossing the statutory retirement age of 62, CPF payout eligibility age of between 63-65 and re-employment age of 67.

But before we talk about retirement income, let us talk about whether one should seek to retire in his or her 60s.

You’ve worked and saved hard for most part of your life and finally, retirement is in view. But retirement is not a destination but rather another phase of your life. Retirement can stretch for as long as 15-20 years in view of today’s average life expectancy of 84 years – that is as long as half our economically productive years!

In 2018, more than 53% of those aged 60 to 69 are employed.1 Some may continue working due to lack of choice, but perhaps many do so to remain physically, mentally and socially active. If you have ever taken a gap year in your work, you would realise how quickly one runs out of things to do after a few months and the emotional and psychological complexities of that.

Indeed, what is often underestimated is the emotional journey of a retiree. According to the New Retirement Mindscape II study (Ameriprise Financial Inc), there are six stages in this journey:

- Imagination (6 to 15 years prior to Retirement Day)

- Hesitation (3 to 5 years prior)

- Anticipation (2 years prior)

- Realisation (Retirement Day and the year following)

- Reorientation (2 to 15 years after)

- Reconciliation (16 years or more after)

As a member of the Merdeka Generation, you may be either in the Imagination stage, where you might feel unprepared for retirement or the Hesitation stage, when you are actively seeking advice and the ability to cover your healthcare costs becomes a particularly important concern for you. This is also why the Merdeka General Package focuses on help for medical expenses, the coverage of which is our third Must-Have, of which we will write more in a future part of this series. Or, you might be in Anticipation, which is the happiest stage of the six stages. A few might have just retired and the Realisation or feeling of being a little let down can be hard, the most difficult being the loss of income, and this emotional stage improves only upon some Reorientation.

Retirement is thus not all sun, sand and laughter, emotionally or otherwise. Retirement can only be truly fulfilling if you are active and doing something that is of meaning to you. Financially also, you need to consider if you would benefit from delaying retirement. As you are your most important financial asset, don’t discount how you can still contribute to your own well-being monetarily or otherwise. With the $100 top up to your PAssion Silver Card from the Merdeka Generation Package, don’t miss out on the various courses and activities that you can sign up for at your local community centre.

The Government has been improving the infrastructure to help those who are able and willing, to work longer. The statutory retirement age in Singapore is 62 years old. What this means is that your employer can choose to terminate your employment without compensation when you turn 62 years old. But in view of our tight labour market, decreasing fertility rate and increasing life expectancy (60 is the new 50), the Re-employment Act was passed in 2012. With this in place, your employer will need to offer you (subject to eligibility criteria) re-employment beyond 62 years old, on an annual basis, up to age 67. There are also recent policy changes to increase CPF contribution rates and an additional 1% interest rate is now paid on CPF savings for workers aged 55 and above.

In addition, the government also announced that the Tripartite Workgroup on Older Workers will be looking into further changes to the CPF contribution rates. As announced in Budget 2019, the Workfare Income Supplement Scheme will also be enhanced from 2020. The qualifying income cap will be raised to $2,300 and the maximum annual payouts will be increased by $400. So, if you continue to work, you can potentially get up to $4,000 per year in income supplements.

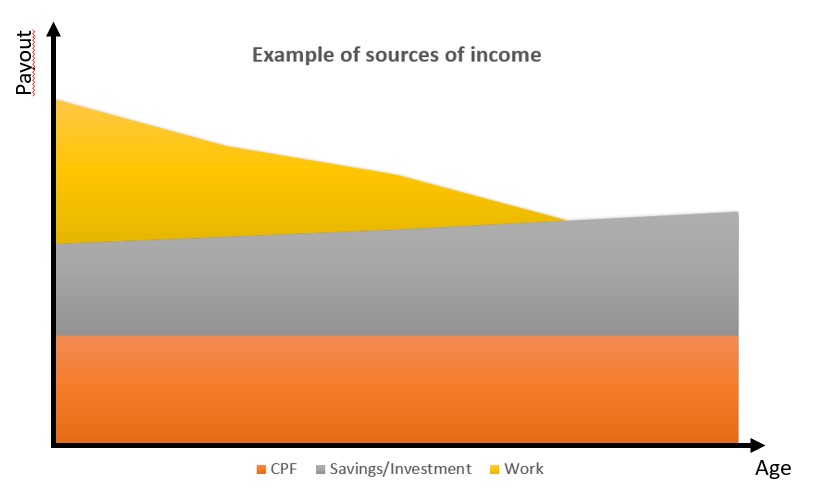

Nonetheless, whether you choose to continue working, knowing that you have a retirement plan in place will provide you with a peace of mind. Based on a recent survey of baby boomers, the top three sources of retirement income are CPF (78%), savings/investments (55%) and work (37%)2. We will explore these sources of retirement income in our next few instalments in this article series.

MoneyOwl is Singapore’s 1st bionic financial adviser. To find out more about us, visit www.moneyowl.com.sg

Source: Manulife 3-Gen Survey, November 2018

1 Based on MOM’s Labour Force Survey, 2018 (Table 4)

2 Manulife 3-Gen Survey, Nov 2018