Note: It was announced in November 2023 that MoneyOwl will be acquired by Temasek Trust to serve communities under a re-purposed model, and will move away from direct sale of financial products. The article is retained with original information relevant as at the date of the article only, and any mention of products or promotions is retained for reference purposes only.

______________

Although the markets continue to decline, our investment team shares why you should still stay invested.

(16 May 2022 – 20 May 2022)

Last week, the year-to-date sell-off in stocks accelerated, the S&P 500 and MSCI World were down 3.01% and 1.68% respectively while MoneyOwl’s 100% equity portfolio was down 1.70%. The S&P 500 barely avoided entering a bear market at Friday’s close after having briefly fallen earlier in the afternoon to a level 20% below its record high set on 3 January 2022. Historically, a drop of more than 20% is seen as a bear market. The S&P 500’s weekly losing streak now stands at seven weeks in a row, the longest since 2001.

In Fixed Income, the US 10-year Treasury yield fell 15bps to 2.78%, which helped global bonds to end the week on positive territory with the Bloomberg Barclays Global Agg index up 0.08%.

Declining markets can be a frightening experience, with indices dropping for weeks, months and even years at times. There are many questions that will flash through an investor’s mind – “How long will this last? How much will the value of my portfolio decline? Is now the time to sell?”

Prolonged market downturns can be unsettling. But it is at times like this that investors should remain focused on the long-term benefits rather than making short-term decisions based on short-term movements of the stock market. At MoneyOwl, we have received numerous queries on what is the best option going forward with volatility staying rampant in all asset classes. Regardless of the dire picture in market performance now, some comforting statistics that show stock gains can add up after big declines may help to broaden your investing perspective and help you stay invested for the long term.

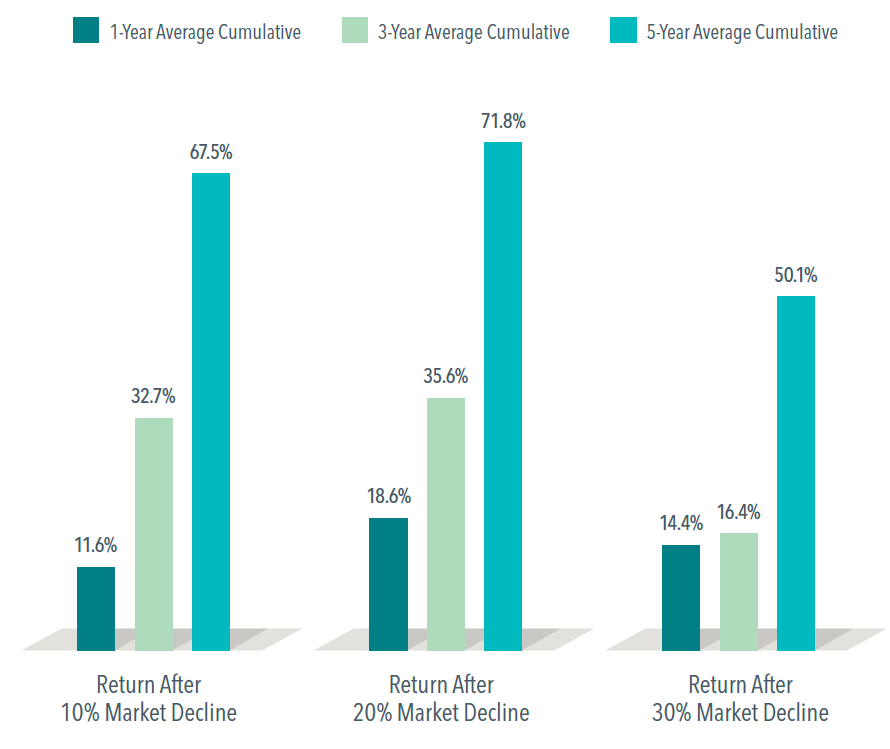

Source: Dimensional Fund Advisors

Historically, US equity returns following sharp downturns have, on average, been positive. A broad market index tracking data in the US since 1926 shows that stocks have tended to deliver positive returns over one-year, three-year, and five-year periods following steep declines. The cumulative returns showing this is even more striking, five years after market declines of 10%, 20%, and 30%, the compounded returns all top 50%. If we view the returns in an annualised term, the average over the entire period is 9.6%.

Investing for the long term gives your money the greatest chance of growing in value. But this means keeping calm during periods of significant stock market volatility, and remembering that, as history shows, markets typically recover. The global economy has endured plenty of adversity over the decades, and yet the stock market has continued to climb, given time. As the old investment adage goes, it’s time in the market – not timing the market – which is key to returns. By delaying, or cashing in your investments and taking losses, you risk missing out on the best days in the market, which could significantly affect your bottom-line investment performance in the long term.

Here is a look at some other noteworthy market headlines:

Crypto Stampede

It’s been mayhem in the crypto world recently. In a nutshell, the TerraUSD stablecoin, a celebrated cryptocurrency that has its value pegged to the US dollar, recently crashed in a dramatic fashion. But it doesn’t end there. Terra’s collapse has triggered a stampede out of many of the digital-asset market’s most popular cryptocurrencies, and destroyed many investors’ life savings as the currency itself crashed more than 99% in a span of a few days. Meanwhile, TerraUSD’s backers are struggling to win investor support for a rescue. For crypto billionaires, it’s the latest painful episode in a weeks-long struggle that’s seen vast fortunes wiped out.

The cryptocurrency markets are notoriously volatile. Unlike investing in the stock market, where you become a part-owner of a productive business that allows you to share in the profits, cryptos are really just a token trading at whatever price people are willing to pay. While we have heard some success stories with investors who had invested in Bitcoin early on, the jury is still out on the future of cryptocurrencies and its real-world utility. Thus, it is advisable not to bet your life savings on it but only on money you can afford to lose.

China Paying the Price

China’s economic activity is collapsing in the face of tough Covid-Zero rules, with industrial output and consumer spending sliding to the worst levels since the pandemic began. And it’s not only China that’s suffering. Building projects in the US are being held up by delayed materials and Vietnamese clothing makers are struggling to fill orders as Chinese supplies dry up – and that’s just the tip of the iceberg. Economists are attributing the problem to China’s lax policy on vaccination, where for the past two years, focus on vaccination was focused on the younger population. Despite an abundant supply of homegrown vaccines and vast enforcement power, many of China’s over-60s remain unvaccinated more than a year after shots became available.

China’s central bank has cut a key interest rate for long-term loans by a more-than-expected 15 basis points in a move seen as supportive for the country’s property market. The sector of the economy has experienced eight straight months of home-price reductions with property developers under extreme pressure.

Twitter jitters

Elon Musk declared he won’t proceed with his $44 billion takeover of Twitter Inc. unless the social media giant can prove bots make up fewer than 5% of its users, casting some uncertainty over the takeover deal. Twitter Inc.’s board said it plans to enforce its $44 billion agreement to be bought by Elon Musk, saying the transaction is in the best interest of all shareholders. The proposed takeover includes a $1 billion breakup fee for each party, which Musk will have to pay if he ends the deal or fails to deliver the acquisition funding as promised.

McBye-Bye

McDonald’s said it will pull out of Russia after more than 30 years in the country, stepping up the corporate response to the invasion of Ukraine. CEO Chris Kempczinski said he was proud of all of the company’s workers employed in Russia and that the decision was “extremely difficult”. The departure carries huge symbolic weight because the fast-food chain was one of the first Western brands to set up shop in Russia when it opened a branch in Moscow in 1990, just before the fall of the Soviet Union.

Ukraine support

The G7 countries have agreed on more than 18 billion euros ($19 billion) in aid for Ukraine to guarantee the short-term finances of the government in Kyiv. This comes as the Biden administration announced $100 million in military assistance to Ukraine, including artillery, radar and other equipment ahead of the $40 billion aid package for the East European country. The latest shipments will bring the total amount of US military assistance provided to Ukraine since Russia’s invasion to $3.9 billion.

Read more Market Insights here.

Disclaimer: While every reasonable care is taken to ensure the accuracy of information provided, no responsibility can be accepted for any loss or inconvenience caused by any error or omission. The information and opinions expressed herein are made in good faith and are based on sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy, completeness or correctness. Expressions of opinions or estimates should neither be relied upon nor used in any way as an indication of the future performance of any financial products, as prices of assets and currencies may go down as well as up and past performance should not be taken as an indication of future performance. The author and publisher shall have no liability for any loss or expense whatsoever relating to investment decisions made by the reader.