Note: It was announced in November 2023 that MoneyOwl will be acquired by Temasek Trust to serve communities under a re-purposed model, and will move away from direct sale of financial products. The article is retained with original information relevant as at the date of the article only, and any mention of products or promotions is retained for reference purposes only.

______________

When will value stocks rise? While value stocks remain more stable despite the market conditions and takes time to gain in price, it can be tempting to predict their rise and invest in value stocks. However, our Investment Team shares no one can predict the markets and what investors should do instead.

(05 December 2022 – 09 December 2022)

Global equities fell over the week, with S&P 500 and MSCI World Index down 3.37% and 2.57%, respectively and MoneyOwl’s 100% equity portfolio was down 2.70%. The market gave back much of the previous two weeks’ gains as some surprisingly strong economic data dampened hopes that the Federal Reserve might soon be able to curb its program of raising interest rates to cool inflation. Within equities, energy shares fell sharply as international oil prices tumbled to their lowest level since January, and the typically defensive healthcare, consumer staples and utility sectors fared best.

Fixed Income asset classes were relatively resilient compared to equities. Bloomberg Barclays Global Aggregate Bond Index fell a measly 0.2% despite the benchmark US 10-year Treasury yield rising 10bps over the week to 3.59%, on hopes that the rate hiking cycle of the Federal Reserve will continue due to stellar economic data released during the week.

Value equities take the year

With the S&P 500 and MSCI World Index down 14.39% and 15.81%, respectively, on a year-to-date basis, MoneyOwl’s 100% equity portfolio that is tilted towards value equities has been floating strong, with year-to-date returns down only 10.75%. Moreover, the latest data as of the end of November 2022 shows that the year will most likely end with value outperforming growth equities.

For some context, growth equities are stocks that demonstrate rates of growth that outpace the market average. The big idea behind prioritising growth stocks is the opportunity to enjoy above-average revenue and earnings growth potential.

On the other hand, value equities are stocks that remain steady through all sorts of market conditions and take time to gain in price. Value stocks trade at inexpensive valuations when compared to growth equities for their earnings and long-term growth potential. These are stable, sometimes even boring, businesses that generate small but steady gains in revenue and profits. A company’s business can even be in decline, but if its stock price is so depressed as to lowball the value of its future profit potential, it is considered to be a value stock.

Historically, looking at the world’s biggest economy, the United States, value stocks have outperformed growth stocks, and the outperformance in a given year has often been striking.

Yearly observation of value vs growth factors

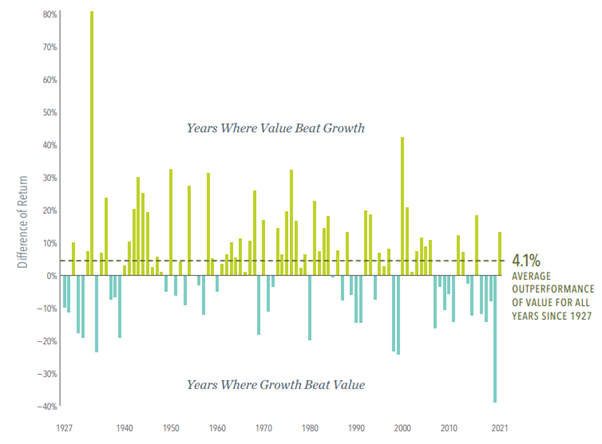

Value minus Growth: US Markets, 1927 – 2021

From the chart, data covering nearly a century back up the notion that value stocks have higher expected returns. Moreover, the value factor has often shown up quickly and in large magnitudes. For example, while the average annual value outperformance since 1927 has been 4.1%, in years when value outperformed growth, the yearly average value factor return was over 14%!

There is no evidence investors can reliably predict when or which year value will outperform growth. Instead, a consistent focus on value stocks is essential to capturing these outsize value premiums when they appear over the long term.

Logic and history support a commitment to value stocks so investors can be positioned to take part when those shares outperform in the future.

China’s rapid spread

China is seeing Covid infections start to pick up rapidly as zero-tolerance curbs are relaxed. With requirements for frequent lab testing dialled back significantly, anecdotal evidence suggests undetected cases are surging, and large hospitals have been asked to set aside special wards to treat vulnerable patients. However, despite the fear of soaring case numbers, the country’s economic growth will “keep picking up” as new Covid control policies are implemented, outgoing Premier Li Keqiang said. Meanwhile, Hong Kong has shortened the isolation period for infected people and eased testing for travellers.

Inflation and expectations update

US producer prices rose 7.4% in November from a year earlier after having increased 8% in October. Friday also brought the release of the University of Michigan’s preliminary survey of consumer sentiment for December, which added to evidence from hard data that the near-term outlook for the US consumer is broadly stable. However, long-term inflation expectations were unchanged at 3%, which is on the higher end of the historical range for the data series. Both producer prices and the consumer survey data will be among the final pieces of significant data ahead of this week’s Federal Reserve rate decision.

Bullish on stocks

Some of the world’s most prominent investors predict that stocks will see low double-digit gains next year, which would bring relief after global equities suffered their worst loss since 2008. Amid recent optimism that inflation has peaked — and that the Federal Reserve could soon pivot — 71% of respondents in a Bloomberg News survey of 134 fund managers expect equities to rise, versus 19% forecasting declines. For those seeing gains, the average response was a 10% return.

Cheaper oil?

The oil markets remained in focus amid the recent choppiness in crude oil prices that came in the wake of this week’s decision by OPEC and its allies, known as OPEC+, to hold its production plans steady while the G-7 imposed a $60 per barrel price cap on Russian oil. Additionally, new sanctions by Europe went into effect on Monday that ban maritime services for the transportation of Russian oil.

Game over?

The US Federal Trade Commission is seeking to block Microsoft’s $69 billion acquisition of Activision Blizzard, saying the tie-up between the Xbox maker and popular gaming publisher would harm competition. Regulators said Microsoft’s ownership of Activision could hurt other players in the $200 billion gaming market by limiting rivals’ access to the latter company’s biggest games. The transaction would turn Microsoft into the No. 3 gaming company behind Tencent and Sony.

Read more Market Insights here.

Disclaimer: While every reasonable care is taken to ensure the accuracy of the information provided, no responsibility can be accepted for any loss or inconvenience caused by any error or omission. The information and opinions expressed herein are made in good faith and are based on sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy, completeness or correctness. Expressions of opinions or estimates should neither be relied upon nor used in any way as an indication of the future performance of any financial products, as prices of assets and currencies may go down as well as up and past performance should not be taken as an indication of future performance. The author and publisher shall have no liability for any loss or expense whatsoever relating to investment decisions made by the reader.

Follow MoneyOwl on social media for more awesome content on investments, insurance, and financial planning!