A flexible income solution that caters to your changing financial needs, jointly created by MoneyOwl and Fullerton Fund Management.

Licensed by

Monetary Authority of Singapore

Notice: MoneyOwl is winding down its financial advisory business and all commercial activities will cease by December 31, 2023. For more information, please visit our microsite here.

No matter your age, you can start establishing a sustainable retirement lifestyle with Fullerton MoneyOwl WiseIncome. This fund is specifically designed to provide you with a steady stream of passive income for the long term.

WiseIncome is co-created by MoneyOwl and Fullerton Fund Management, each with a deep heritage of care, expertise and stability. We’re dedicated to prioritising your financial well-being through our services.

Managed by Fullerton Fund Management, your WiseIncome portfolio will offer:

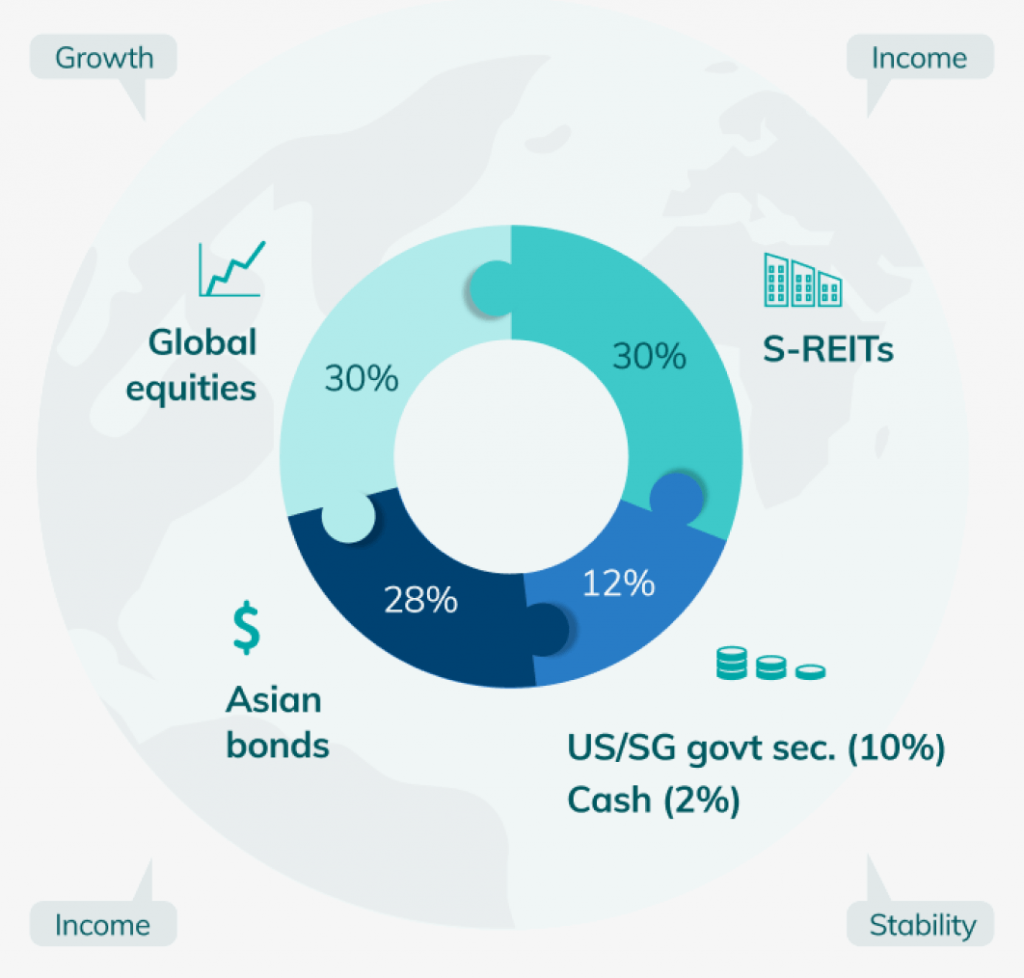

Global Equities

Globally diversified stocks around the world that boost returns and capital growth.

S-REITs

Singapore listed investment trusts that invest and manage real estate in Singapore and overseas. These provide rental yields to support income and potential for asset growth.

Asian Fixed Income

Investment grade corporate bonds issued by Asia-based companies.

US/Singapore Bonds

High-quality Singapore or US government-issued bonds across all maturities. Provides stability and some yield for income.

Investment-grade corporate bonds issued by Asia-based companies.

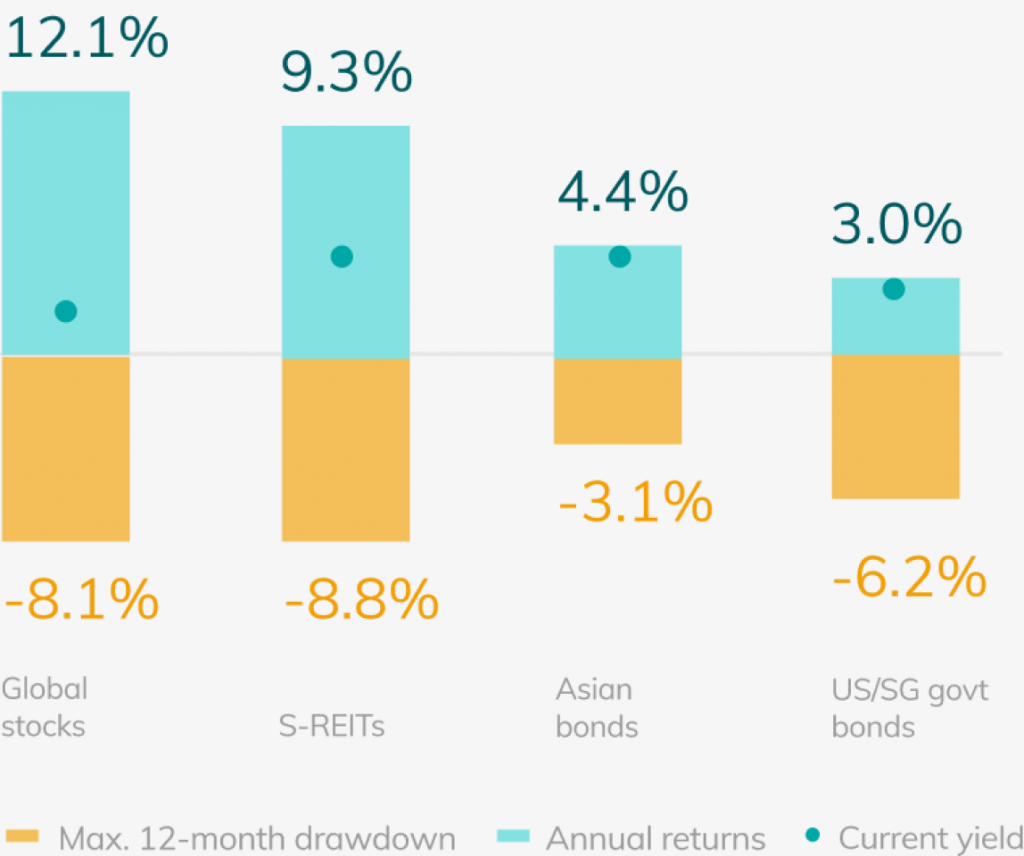

Asset Class Historical Performance

Source: Bloomberg, as of 31 December 2021 , in SGD terms with dividends (if any) reinvested, based on calendar month returns. Measurement period from February 2014 to October 2021. Global stocks represented by MSCI World Net Index, REITS by iSTOXX® Singapore Developed REITS Index, Asian bonds by JACI Composite SGD Hedged and Singapore government bonds by Markit iBoxx ALBI Singapore Government 7-10 TR Index. Current yield data as of 3 February 2022. Asian bond yield represented by JACI Composite YTW, SG gov. bonds by JACI Singapore YTW. Past performance is not indicative of future performance.

With a sustainable stream of passive income, WiseIncome will supplement your CPF LIFE payouts to ensure financial comfort in your golden years.

Multi-asset portfolio with broad sources of returns for sustainable income

Flexible quarterly payout options with no lock-in period

Start investing with as little as $1000, with either cash or SRS

Low fund-level fees, no sales charge and hidden trailer commissions

Grow & Invest

Balance Growth With Income

Income Focused

| Year | Portfolio Value | Total Payout |

|---|---|---|

| Now | $22,842.48 | 0 |

| Year 2 | $36,304.79 | 0 |

| Year 3 | $50,416.84 | 0 |

| Year 4 | $65,209.99 | 0 |

| Year 5 | $80,717.11 | 0 |

| Year 6 | $96,972.66 | 0 |

| Year 7 | $114,012.77 | 0 |

| Year 8 | $131,875.29 | 0 |

| Year 9 | $150,599.93 | 0 |

| Year 10 | $170,228.29 | 0 |

| Year 11 | $190,803.98 | 0 |

| Year 12 | $212,372.74 | 0 |

| Year 13 | $234,982.48 | 0 |

| Year 14 | $258,683.45 | 0 |

| Year 15 | $283,528.32 | 0 |

| Year 16 | $309,572.30 | 0 |

| Year 17 | $336,873.25 | 0 |

| Year 18 | $365,491.85 | 0 |

| Year 19 | $395,491.69 | 0 |

| Year 20 | $426,939.43 | 0 |

| Year 21 | $459,904.96 | 0 |

| Year 22 | $494,461.53 | 0 |

| Year 23 | $530,685.92 | 0 |

| Year 24 | $568,658.64 | 0 |

| Year 25 | $608,464.07 | 0 |

| Year 26 | $650,190.65 | 0 |

| Year 27 | $693,931.11 | 0 |

| Year 28 | $739,782.65 | 0 |

| Year 29 | $787,847.15 | 0 |

| Year 30 | $838,231.42 | 0 |

This graph illustrates the growth of your portfolio and the accumulated quarterly payouts over your selected investment period.

Total invested considers the amount of initial investment as well as the total monthly investments over your selected investment period. Total gain refers to the difference between the combined amount of payouts received and portfolio value, and total amount invested over your selected investment period.

It is assumed that the portfolio grows at a constant rate of 5.30% p.a. net of fund level fees and compounded monthly. Any dividend payout and advisory fees are subtracted from the portfolio on a quarterly basis. The amount of payout is based on the payout option chosen, i.e. 4.5% p.a. or 8.0% p.a., while advisory fees are assumed to be at 0.6% p.a. This graph is only for illustration purposes, and does not represent actual investor performance. Actual performance will vary due to changes in market conditions, differences in fees and deviation from intended payout rate.

4.5% p.a. payout - *While the fund manager intends to distribute 4.5% p.a. payout, the fund manager has the discretion to deviate from this including reducing payout to achieve sustainability of the fund in the interest of unit holders, or alternately, paying a higher rate of up to 4.8% p.a. in some years. Please refer to Fund Prospectus or Product Highlights Sheet for more information.

Distributions or payouts (if any) may be declared at the absolute discretion of the fund manager, except for the fixed 8% distribution payout and are not guaranteed. Distribution may be declared out of income and/or capital of the fund and may result in a partial return of your original investment and reduced future returns.

| Inital offer period: | 25 – 31 March 2021 |

| Inital offer period: | 25 – 31 March 2021 |

| Initial issue price: | SGD 1.00 per unit |

| Island Trading | Helen Bennett |

| Min. initial/subsequent subscripton amount: | Minimum initial – SGD 1,000 Subsequent – SGD 100 |

| Dividend payout (quarterly) : | Class R: Distributing (with option to reinvest) Class R1: Distributing. Fixed at 8% p.a. |

| Deal frequency : | Daily |

| Dealing deadline: | 3pm daily, Singapore time |

| Sales charge : | No sales charge |

| Standard rate: | 0.5-0.6% |

| Management fee (p.a): | 0.4% |

| Investment mode: | Cash/SRS |

| Subscription settlement : | T+4 business days |

| Redemption settlement: | T+8 business days |

| Fund dealings: | No dealing and NAV publication on Singapore and Luxembourg public holidays |

Give your child or loved ones the gift of financial security by opening a joint investment account with them.

A joint investment account can be opened for any of MoneyOwl’s investment products (excluding SRS, CPF monies) with a minor (under 18 years old) or an adult.

Read our joint account FAQs here.

Get more bang for your buck with these promotions.

Fullerton Fund Management, a subsidiary of Temasek Holdings, is an Asia-based investment specialist with 16 years of experience in managing investments across multiple asset classes. Through this partnership, we were able to co-create a multi-asset income distributing fund that is aligned with MoneyOwl’s investment philosophy of focusing on strategic asset allocation, broad diversification and at the lowest cost possible.

Fullerton is also aligned with MoneyOwl’s social mission to provide low-cost fit for purpose solutions to the mass market with their commitment of having one of the lowest annual management fees within this class of funds.

The Fund manager holds about 30% of the sub-fund in Global Equities (made up of passive index tracking ETFs), 30% in Singapore REITs, 28% Asian Credit (mostly investment-grade Asian corporate bonds), 10% in Singapore Government Bonds and 2% in cash.

Unlike its peers, the portfolio is constructed with a strategic asset allocation strategy, which means that the weights of the underlying funds are unlikely to change although the fund manager has the discretion to allow a drift of +/- 5% deviation from the portfolio’s target allocation (+/-10% between the two large asset classes in times of extreme market conditions) for efficient portfolio management.

There is no option to change the asset allocation for this portfolio.

For share class R (i.e. 4.5% payout option):

The fund will declare a quarterly distribution of about 4.5%* p.a. (i.e. 1.125% per calendar quarter) of the portfolio value with potential to distribute up to 4.8%* p.a. during periods of outperformance. This dividend will be paid out of income received by the fund and/or capital. The fund manager has full discretion to vary the payout rate to sustain the longevity of the fund. For this share class, there is a choice to either receive or reinvest the payouts.

For share class R1 (i.e. 8% payout option):

The fund will declare a fixed quarterly distribution of 8% p.a. (i.e. 2% per calendar quarter) of the portfolio value out of the income received by the fund and/or capital. The amount paid out of capital, if any, would be substantially higher than the *4.5% payout option and over time could lead to a reduction of the portfolio value. There is no option to reinvest the payouts for this share class.

*While the fund manager intends to distribute 4.5% p.a. payout for the R share class, the fund manager has the discretion to deviate from this including reducing payout to achieve sustainability of the fund in the interest of unit holders, or alternately, paying a higher rate of up to 4.8% p.a. in some years.

Please refer to Fund Prospectus or Product Highlights Sheet for more information.

Yes. You can set up as many as you want with your choice of payout options. Further personalise them by renaming your portfolios.

There is no lock-in period for WiseIncome. However, we do advise our clients to have a minimum holding period of at least 8 years to minimise the risk of loss. Please follow these steps to redeem your investment from WiseIncome:

| Step | Details |

| 1 |

Log in to your MoneyOwl Account |

| 2 |

Click on “WiseIncome Portfolio” |

| 3 | Select the portfolio that you would like to redeem from |

| 4 | Click on “More” at the top right corner of the screen |

| 5 | Select the “Withdrawal” option |

| 6 | Submit a request to redeem from Portfolio to Cash Account or Portfolio to Bank Account |

Your proceeds will be credited into your cash account or bank account accordingly within 7-8 business days.

TER for both share classes comprises of annual management fees of 0.4% p.a. and other fund level fees required to run the fund. It is ranked in the lowest quartile in terms of management fees for multi-asset and target return funds registered in Singapore, based on Morningstar Direct*. As this is a newly launched fund, we are not able to provide the full TER of the fund as this is dependent on fund size. TER is not deducted from units but is implicit; its impact is incorporated into the Net Asset Value of the sub-funds and reflected in fund performance. *Source: Morningstar Direct, as of 31 December 2020. Morningstar universe includes 104 ‘Allocation’ and ‘Target Date’ funds under the EAA Morningstar category, with available management fee data that are registered for sale in Singapore.

Explore our selection of investment guides and insights.

Thrive in your golden years by growing your wealth with WiseIncome.

Invest with WiseIncome to enjoy a steady stream of long-term funds

Explore the answers to commonly-asked questions.

Leave your enquiry with us and we’ll get back to you promptly.

Sign up for our Owlhoots newsletter and never miss out on the latest financial news and updates!