Articles

Build your financial literacy with tips and guides from MoneyOwl’s team of expert advisers.

Today's Pick

5 Jul 2024

Investments

Explore the Latest Articles

All

Personal Finance

Insurance

Investment

National Schemes

Estate Planning

All

25 Sep 2025

Insurance

Get the best rates for your term life insurance coverage with our comparison tables.

25 Sep 2025

Insurance

Get the best rates for your term life insurance with critical illness plan with our comparison tables.

29 Aug 2025

Insurance

8 Aug 2025

Financial Planning

Discover key insights from Singapore’s national household balance sheet and learn how to apply them to improve your personal finances, savings, and investments.

7 Aug 2025

Financial Literacy

25 Jul 2025

Housing

A practical guide for first-time home buyers in Singapore, covering budgeting, loan options, and choosing between BTO and resale flats.

Personal Finance

Insurance

25 Sep 2025

Insurance

Get the best rates for your term life insurance coverage with our comparison tables.

25 Sep 2025

Insurance

Get the best rates for your term life insurance with critical illness plan with our comparison tables.

29 Aug 2025

Insurance

27 Mar 2025

Insurance

14 Mar 2025

Insurance

We answer your burning questions on investment-linked plans

12 Jul 2024

Financial Planning

Learn how to navigate the challenges of managing your money and set yourself up for long-term financial success.

3 May 2024

CIO Letter

Our CEO and Chief Investment Officer, Chuin Ting Weber, shares her perspectives on Integrated Shield Plans.

Investment

14 Apr 2025

Financial Planning

8 Apr 2025

Financial Planning

What Trump’s Tariffs Mean for Your Investments and Financial Plan

5 Feb 2025

Financial Planning

Our CEO and Chief Investment Officer Chuin Ting Weber shares her thoughts on taking a bet on high payoffs with low probabilities versus investing for a high likelihood of acceptable returns.

1 Nov 2024

Family

How to Plan and Pay for Tuition Fees in Singapore

12 Jul 2024

Financial Planning

Learn how to navigate the challenges of managing your money and set yourself up for long-term financial success.

5 Jul 2024

Investments

Learn how investing in low-cost, globally-diversified funds can help you beat inflation and grow your wealth.

24 Oct 2023

CIO Letter

MoneyOwl’s CEO and Chief Investment Officer encourages investors to look beyond the down moments to the logic and evidence of the markets, and to embrace a sufficiency mindset.

28 Jul 2023

Insurance

In recent years, Investment Linked Policies (ILPs) have attracted much interest (and debate), from their flexibility and potential for higher returns to the criticisms of high fees and disappointing investment returns. Discover how to check if your ILP still fits your personal needs and financial goals in three steps!

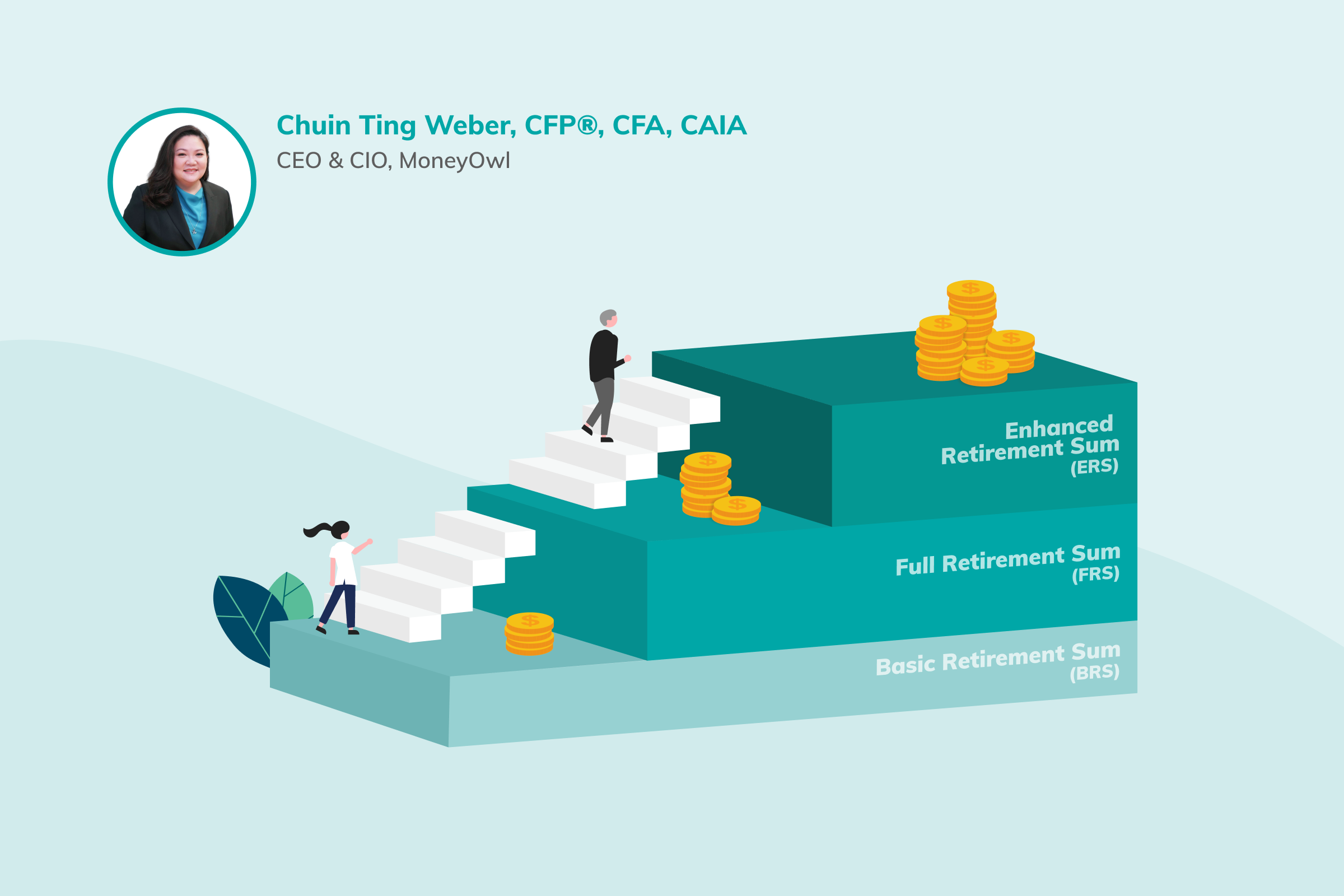

National Schemes

Estate Planning

Discover Upcoming Events

REACH

7 October 2025

7:30 -

9:30 pm

REACH

27 September 2025

3:00 -

6:00 pm