MoneyOwl’s acquisition by Temasek Trust is now complete. Stay tuned—an exciting new website is coming your way soon!

Notice: MoneyOwl is winding down its financial advisory business and all commercial activities will cease by December 31, 2023. For more information, please visit our microsite here.

Life is rarely smooth-sailing, which is why the right insurance plan is vital in helping us weather unpredictable storms and support our long-term goals.

MoneyOwl’s comprehensive insurance comparison engine, coupled with sound advice from our client advisers, will help you secure the best insurance plan for your needs. Live life to the fullest, knowing that you and your family are well-protected should anything unforeseen happen.

The right insurance plan keeps us resilient during unpredictable storms. While it doesn’t solve all financial issues, it provides crucial financial security in adverse situations like death, disability, or critical illness.

Everyone can get covered without paying an arm and a leg or compromising their goals to grow wealth and retire with a good income.

Ensure income continuity for you or your loved ones in case of death, disability and/or critical illness.

Protect against substantial medical expenses incurred during hospitalisation.

Prepare for long term costs if long term care or treatment is needed.

Because insurance is always an expense, we believe in buying as much protection as you need, while paying as little as you can. Use insurance only where the impact is severe, for risks that you can’t control.

This can be achieved by using:

Life is rarely smooth-sailing, which is why the right insurance plan is vital in helping us weather unpredictable storms and support our long-term goals.

MoneyOwl’s comprehensive insurance comparison engine, coupled with sound advice from our client advisers, will help you secure the best insurance plan for your needs. Live life to the fullest, knowing that you and your family are well-protected should anything unforeseen happen.

Find The Best Insurance

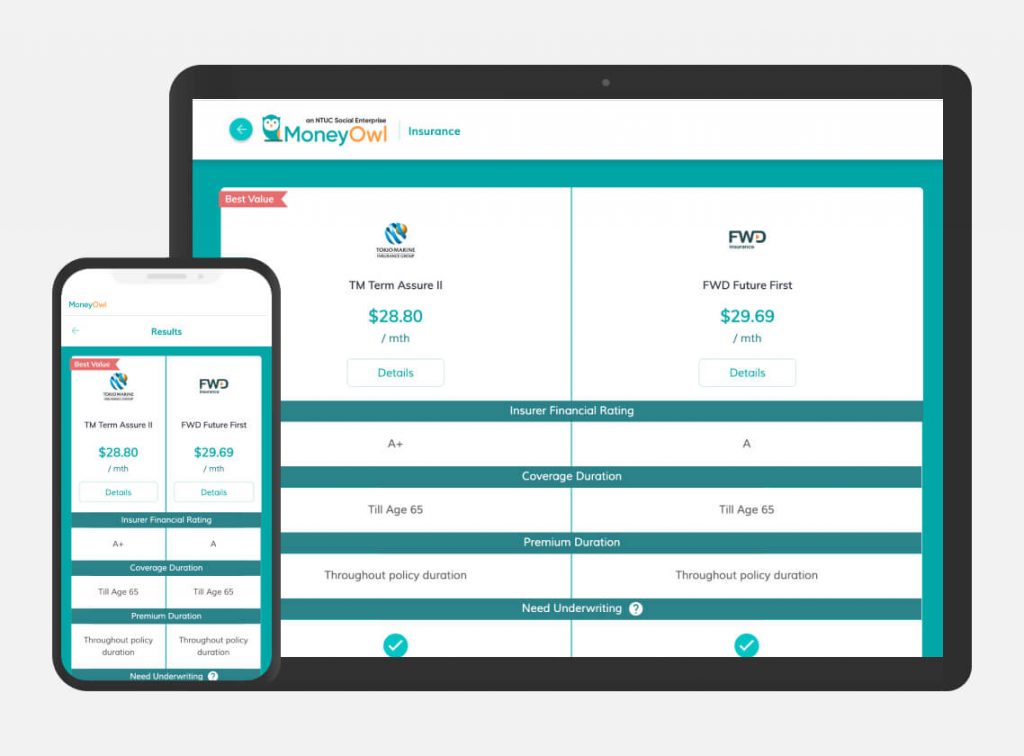

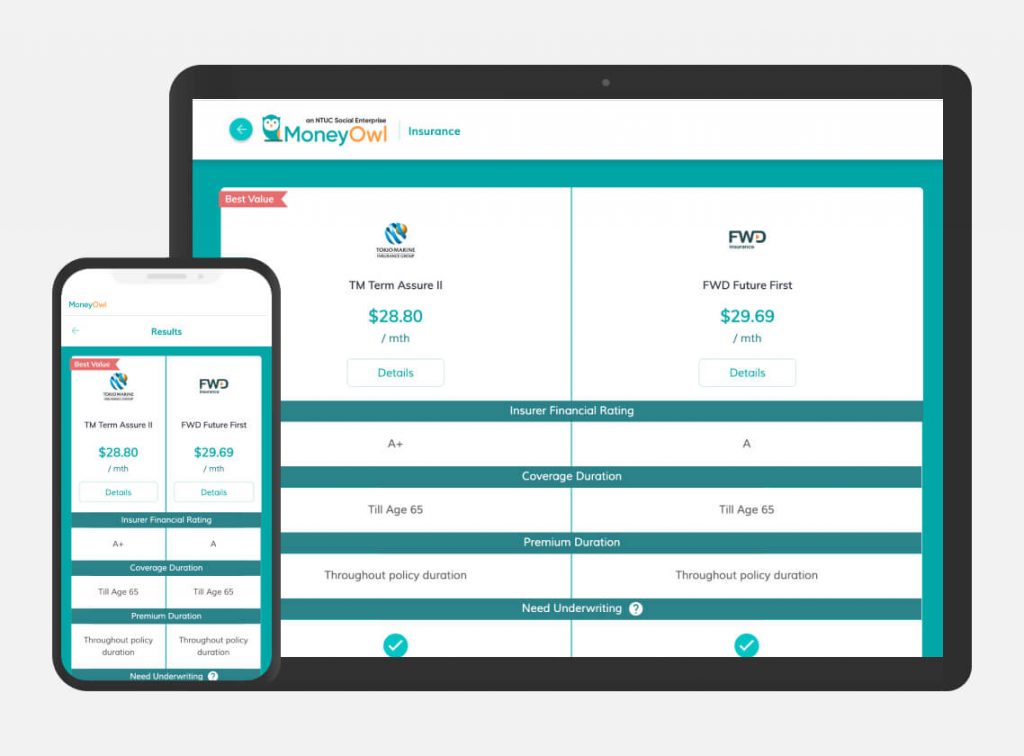

Access over 500,000 quotes instantly by using our insurance comparison tool, ensuring that you’ll find the ideal insurance for your needs.

Up to 50% First-Year Commissions Rebate

Save more when you buy with MoneyOwl! We rebate up to 50% of the first-year basic commissions directly to your bank account.

Get Conflict-Free Advice

MoneyOwl’s client advisers are fully salaried and don’t take commissions – you can trust their advice and be confident that they prioritise your best interests.

Receive Claims Support

Your dedicated client adviser and a team of Client Service Managers are here to assist you in times of need.

30% First-Year Commissions Rebate

Save more when you buy with MoneyOwl! We rebate 30% of the first-year basic commissions directly to your bank account.

Get Conflict-Free Advice

MoneyOwl’s client advisers are fully salaried and don’t take commissions – you can trust their advice and be confident that they prioritise your best interests.

Find The Best Insurance

Access over 500,000 quotes instantly by using our insurance comparison tool, ensuring that you’ll find the ideal insurance for your needs.

Low-Cost Solutions

Our client advisers are here to assist you to get the best insurance coverage at lowest cost.

Centre of Excellence

Recognised by Financial Planning Association of Singapore (FPAS) as an organisation to be competent and ethical when providing financial advice to our customers.

We believe everyone should get covered with the insurance they need without straining their budget. This is why we safeguard your well-being and financial security with fit-for-purpose and cost-effective insurance plans.

Find The Best Insurance

Access over 500,000 quotes instantly by using our insurance comparison tool, ensuring that you’ll find the ideal insurance for your needs.

Up to 50% First-Year Commissions Rebate

Save more when you buy with MoneyOwl! We rebate up to 50% of the first-year basic commissions directly to your bank account.

Get Conflict-Free Advice

MoneyOwl’s client advisers are fully salaried and don’t take commissions – you can trust their advice and be confident that they prioritise your best interests.

Receive Claims Support

Your dedicated client adviser and a team of Client Service Managers are here to assist you in times of need.

Term Life

Ensure your loved ones are financially protected, even when you are no longer around.

Help with:

Critical Illness

Get coverage you need in the event of early, intermediate or late-stage critical illnesses such as cancer, stroke and heart attack. Replace your income and cover medical costs.

Help with:

Long-Term Care

Get the financial support you need in the event of severe disability requiring long-term personal care. Covers caregiving needs not typically provided by health insurance.

Help with:

Hospitalisation

Get essential coverage during hospitalisation and surgery. Covers treatments, medical procedures and medication during your stay in hospital.

Help with:

Disability Income

Protect yourself against income loss due to partial or full disability. This offers a monthly payout to cover your daily expenses and ensures that your financial goals are not derailed.

Help with:

There are some insurances that can be conveniently purchased online, allowing you to get started quickly and easily. However, If you need assistance from an adviser, we can refer you too our partner, iFAST.

We offer a comprehensive suite of insurance products on our hassle-free platform.

We offer a comprehensive suite of insurance products on our hassle-free platform.

Term Life

Ensure your loved ones are financially protected, even when you are no longer around.

Critical Illness

Get coverage you need in the event of early, intermediate or late-stage critical illnesses such as cancer, stroke and heart attack. Replace your income and cover medical costs.

Long-Term Care

Get the financial support you need in the event of severe disability requiring long-term personal care. Covers caregiving needs not typically provided by health insurance.

Hospitalisation

Get essential coverage during hospitalisation and surgery. Covers treatments, medical procedures and medication during your stay in hospital.

Disability Income

Protect yourself against income loss due to partial or full disability. This offers a monthly payout to cover your daily expenses and ensures that your financial goals are not derailed.

Retirement Income

Guarantee a reliable income stream in retirement, with one lump sum or monthly payouts that supplement your CPF LIFE and existing retirement savings.

Hear from people we’ve supported along their financial journey.

When I expressed my interest for help to plan for my retirement, I was promptly contacted by MoneyOwl. I am very surprised that my advisor is so patient and attentive, knowledgeable and quick to understand my concerns.

Kat Koo

Had a very good experience chatting with MoneyOwl for my plan. My advisor was very patient and answered all my questions. He was also very thorough in going through every detail of my plan.

Celeste Heng

Great financial advice received at MoneyOwl and it’s good to know that they are not incentive or commission driven. I had a good financial planning analysis with my advisor as he has great knowledge of products.

Janet Callie Choo

Not sure what coverage you might need? Create your MoneyOwl account within seconds, and we’ll assess your financial situation and point you in the right direction. With a MoneyOwl account, you can:

Take advantage of current insurance promotions at MoneyOwl.

Find out everything you need to know about coverage, benefits, premiums and more.

Secure your next insurance plan today. Compare quotes, get personalised advice or find out exactly what coverage you need to get started.

Already have an insurance product in mind? Compare prices now from our database of 500,000+ quotes.

Our client advisers will contact you to clarify any doubts and help you find the right insurance plan for your needs.

Find out what coverage you need and identify gaps in your current insurance portfolio.

Our client advisers will contact you to clarify any doubts and help you find the right insurance plan for your needs.

Find out what coverage you need and identify gaps in your current insurance portfolio.

Sign up for our Owlhoots newsletter and never miss out on the latest financial news and updates!