______________

Find out how to draw a reliable retirement income from your investment with the 4% withdrawal rule

Investments come with the risk of losing money and for a retiree especially, can be a difficult thing to stomach when there is no longer a source of active income. This is probably why most literature caution retirees against taking on too many investments in their golden years and instead advise them to preserve their wealth in low-risk instruments like deposits and bonds.

Why do retirees still need to invest

However, that is only looking at one facet of the risks that retirees face during the de-cumulation stage of their planning. The bigger risk faced by Singaporean retirees, however, is that of outliving their savings due to longevity. A recent study released by the Ministry of Health found that Singaporeans may well be the world’s longest-living people at an average life expectancy of 84.8 years in 2017. While we celebrate our ability to live long lives, we also want to make sure we’re able to live them with dignity, this means ensuring that we have enough wealth to sustain us an income for life. Doing some maths as tabled below can make it quickly obvious that for most average households, choosing not to invest could be even more costly than doing so. The table shows how many years a starting sum of $200,000 can provide a different monthly payout based on different rates of return.

Key issues to address for investment during retirement

From the table, firstly, we can see that it would not be possible to sustain a $1,000 monthly payout for 20 years just by keeping the retirement savings in the bank or deposits that earn less than 1% per year. Compounded by longevity and inflation, it is thus necessary for the retiree to invest. The question though is what kind of asset allocation would provide the most optimal returns.

Secondly, there is also a need to determine a safe retirement withdrawal percentage so that there is little risk of the retiree overspending. From the table above, even if one invests and can get an average of 5% p.a. returns, drawing down an arbitrary $1,500 per month would put him at risk of utilising all his savings within 16 years.

Thirdly, the computation above assumes that any investment is able to provide a constant year-on-year return. It could lull one into thinking that if my investment earns an average of 5% p.a., I can simply withdraw 5% annually from my portfolio and it will last me perpetually. In reality, the market experiences a lot of short-term volatility which could negatively impact the payout duration.

Consider two retirees, Mr. Tan and Mr. Lee, who have retired. They both invest the same starting amount of $200,000 in portfolio with similar characteristics in terms of volatility and average returns (i.e. 7.07% p.a.). They will also withdraw $12,000 per year to fund their retirement. We notice that by the end of 20 years, Mr. Tan’s portfolio has only $30,000 left while Mr. Lee’s portfolio now has even more than he started with.

The main reason for this difference is due to the different order in which the returns are earned by the portfolio. Mr. Tan suffered almost an immediate drop in his investment returns when he started his retirement, while Mr. Lee only experienced this towards the tail-end of his retirement. This is one example of how a negative sequence of events can impact one’s payout duration and needs to be considered in any retirement solution.

Stress testing the 4% withdrawal rule

In designing a suitable retirement solution that addresses these key issues highlighted above, we researched various models used widely in the market. One of the most common and popular models used in the US is the 4% safe withdrawal rule which is based on William Bengen’s research released in 1994.

Bengen used the historical performance of the S&P500 over 66 years to simulate the retirement withdrawal experience of different hypothetical individuals. He found that by investing in a balanced portfolio comprising of equal weightage in equities and bonds, a retiree is able to withdraw 4% of the starting portfolio value, adjusted yearly for inflation to last for 30 years.

We decided to put his model to the test and determine if such a rule can be adapted for our local population. Instead of using the S&P500 which is focused on US large-cap, we used the MSCI World Index from 1970 to represent our global equities exposure and the US Treasury over the same period to represent our bonds exposure in a 60/40 allocation. In addition, we also used the Singapore historical inflation and a Total Expense Ratio (TER) of about 1.2% p.a. to mirror the local retiree’s experience. The TER refers to the total cost of managing and operating a unit trust paid by the investor. These would include the fund management, wrap, and platform fees.

With the dataset available, we could create a 21 30-year rolling periods. Our model shows a 100% probability that one can withdraw 4% of their starting portfolio value (i.e. with a $200,000 starting value, the first-year withdrawal would be $8,000) and adjust it annually for inflation to last 30 years. The ending portfolio value is charted below. This gives us great confidence to use this approach in our retirement planning solutions for our clients.

To further stress test the 4% withdrawal rule, we used our model to simulate other scenarios and found the following:

- Using 100% equities: 95% success rate

- Using 100% bonds: 86% success rate

- Using 5% withdrawal rate on 60/40 equities-bonds allocation: 81% success rate

- Using 2% TER on 60/40 equities-bonds allocation: 90% success rate

MoneyOwl’s Approach

With these results, we can address the earlier questions raised – what an optimal asset allocation for a retiree is and what is a safe withdrawal rule to use.

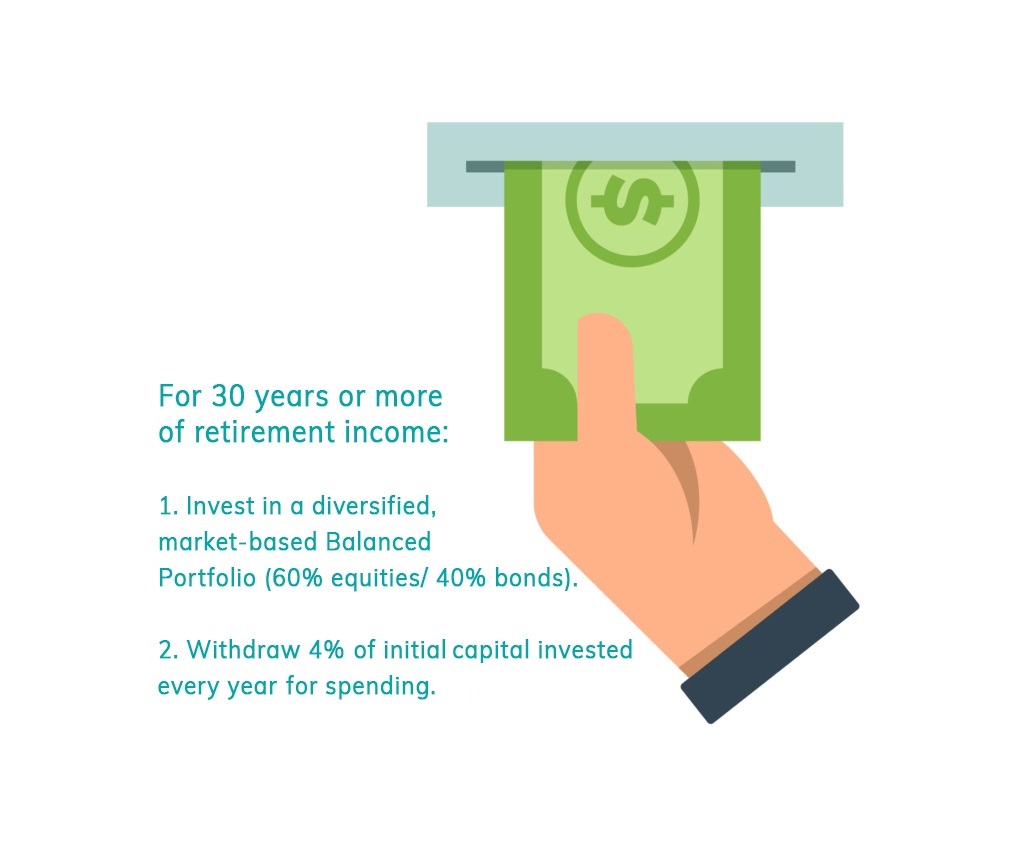

The optimal allocation is a portfolio with a 50 – 70% exposure to equities. While a 100% equities exposure can provide much growth to the retiree’s portfolio, it also introduces a lot of volatility which would adversely affect their payout duration should there be a negative sequence of events. On the other hand, a 100% bond exposure would not be able to deliver the returns required to sustain the income drawdown throughout the retirement years. This is also why at MoneyOwl, we would recommend a retiree to invest in at least a balanced portfolio (60% Equities/40% Bonds) given that they have the need and time horizon to do so.

The 4% withdrawal percentage adjusted annually for inflation over 30 years is safe. At MoneyOwl, for even greater peace of mind for our clients, we recommend maintaining a flat 4% of starting portfolio value without adjusting for inflation. Nonetheless, we also recognise this as a guideline and could be modified to cater to the retiree’s needs or in the event of extreme market conditions. Ultimately, there is a fine balance between not depleting one’s savings before time and leaving such a huge legacy behind at the expense of present enjoyment. Ultimately, there is a fine balance between not depleting one’s savings before time and leaving such a huge legacy behind at the expense of present enjoyment.

Lastly, the success of this retirement solution is also contingent on investing in low-cost instruments as they have a huge impact on the returns in the long run. As shown in our model, higher fees of 2% p.a. cause the model to fail 10% of the time.

As of 2024, you can access low-cost funds by Amundi via POEMS through MoneyOwl. Find out more here.

This article was contributed by MoneyOwl’s Solution Team.