Note: It was announced in November 2023 that MoneyOwl will be acquired by Temasek Trust to serve communities under a re-purposed model, and will move away from direct sale of financial products. The article is retained with original information relevant as at the date of the article only, and any mention of products or promotions is retained for reference purposes only.

______________

While news of the S&P500 going down may cause some to worry, we still believe in the importance of staying invested over the long term. Here’s why.

The S&P500 has been down around -7.7% in these first three weeks of January. MoneyOwl’s accumulation portfolios using Dimensional funds have been relatively resilient. For example, our equity portfolio is down -5.17%.

The reason why MoneyOwl’s Dimensional equity portfolio has been resilient is because of the tilt towards value. The sell-off has been mainly in tech, which tend to be the high growth darlings. But with inflation concerns and increasing bond yields, it seems that market players may be worried about them being overvalued. ESG funds are also suffering because of the tech concentration.

While we don’t really subscribe to the theory that there is a “right” analytical price for stocks, what Nobel prize-winning academic research by Dimensional scientists have demonstrated is that value stocks of relatively lower price, tend to outperform in the long run.

Being globally diversified, with more than 8,000 stocks, across all industries and comprising not just US market but also global and emerging market equities, have also contributed to the relative resilience of the Dimensional fund. This is not to say that MoneyOwl’s Dimensional portfolios will outperform in every short-term time period. They definitely will not, as the short-term rotation among factors, sectors and countries are rather random.

But do not mistake proliferation of fund managers for diversification; most active managers underperform the market, and as any workplace boss knows, diversifying among under-performers compounds and does not reduce the risk of missing your targets, even if they are cheap(er) under-performers. Do not be enticed by empty promises of high return and low risk based on cherry-picked return periods. Less is more, when the “less” is already the vast ocean of the markets.

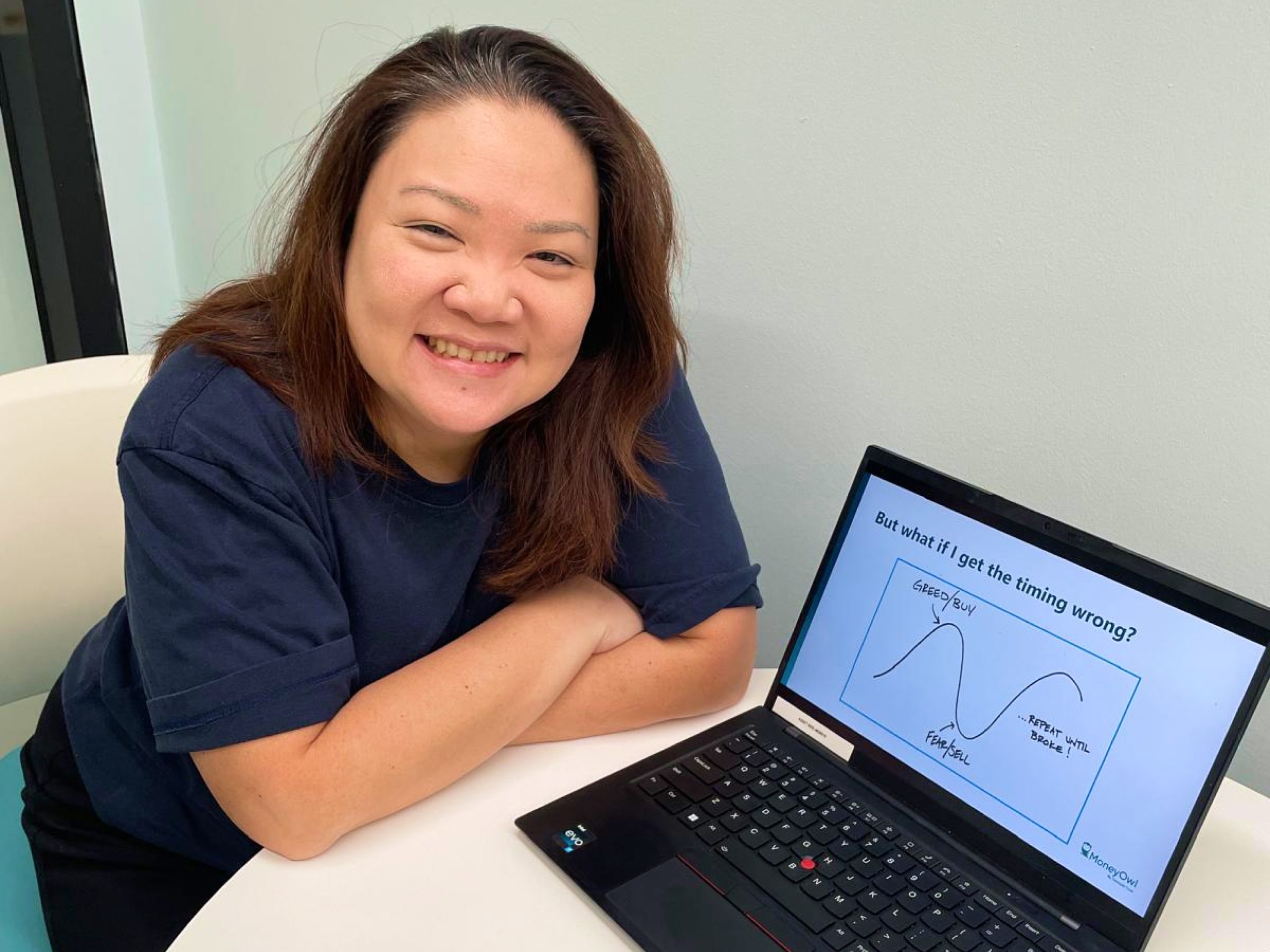

Thus, our message remains the same. An investment philosophy that is robust is one you can stick to through the short-term fluctuations, for a reliable long-term return. Stay invested in market-based, globally diversified portfolios, and don’t go in and out of the asset classes, sectors or markets. Your asset allocation should be according to your need, ability and willingness to take risk, and this work should have been done by your adviser (human, robo or bionic) beforehand. Less is also more, when it comes to short-term activity.

The only exception where doing something is better than nothing, is when there is a deeper cheap sale in the markets. We usually keep some budget for sales around festive periods, like CNY. Who knows, if one comes in the markets in the near future? If so, we can then take the opportunity to deploy some dry powder and do more, with less.