Attention!

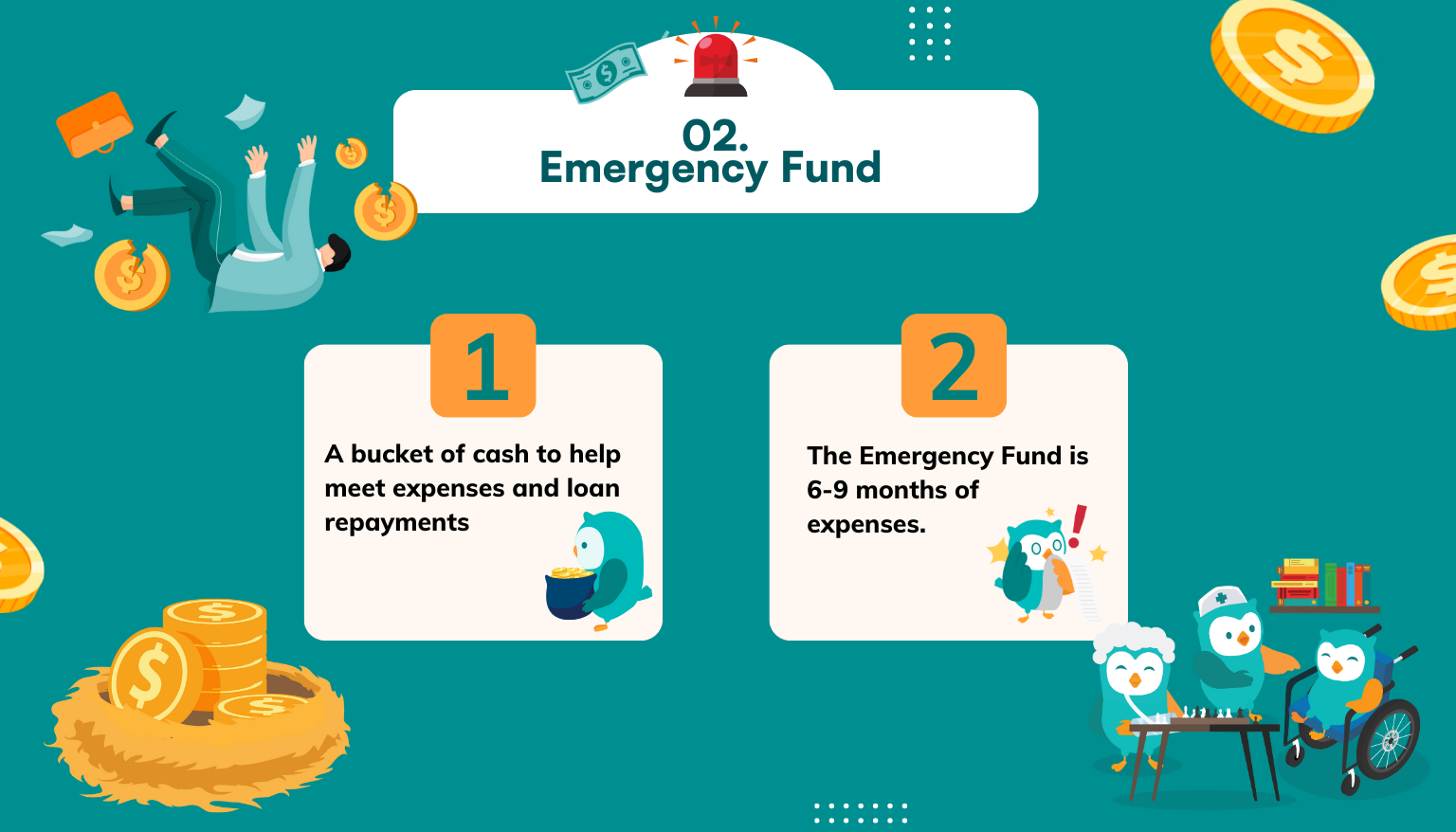

Emergency Fund should be kept in very safe and liquid instruments, like cash deposits

Singapore Savings Bonds are suitable but have up to one month “notice period” for selling.

Hence, at least one month of Emergency Fund should always be in a liquid bank account.

My gross monthly salary is $4,000 and take home $3,200 each month after CPF contributions.

Sign up for our Owlhoots newsletter and never miss out on the latest financial news and updates!