We Are MoneyOwl

Your Financial Adviser with a social mission

- No Direct Selling

- Holistic Advice

- Product Guidance

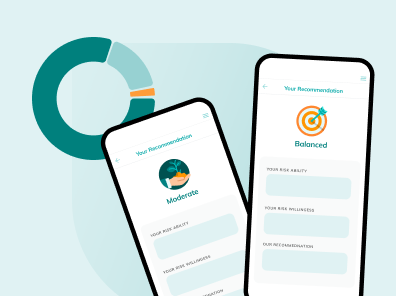

Discover Your

MoneyOwl Personality

MoneyOwl Personality

Bold or Wise? A Dreamer or a Practical Owl?

Take the quiz to find out!

We Are MoneyOwl

Your Financial Adviser with a social mission

- No Direct Selling

- Holistic Advice

- Product Guidance

Discover Your

MoneyOwl Personality

MoneyOwl Personality

Bold or Wise? A Dreamer or a Practical Owl?

Take the quiz to find out!

Tools & Calculators

Plan Wiser with Our Financial Calculators

Want to plan for a home, build an emergency fund, or set savings goals?

Our calculators help you do the math, so you get clear answers for smarter financial decisions.

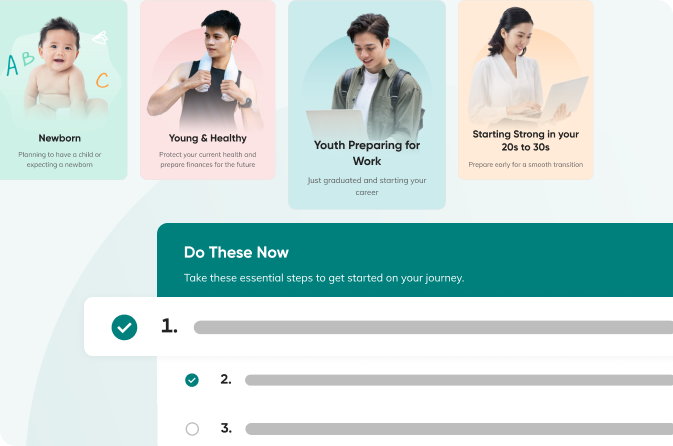

Financial Checklists

Navigate life's major milestones with our financial checklists

Comprehensive checklists and essential financial tips curated to guide you through key life stages.

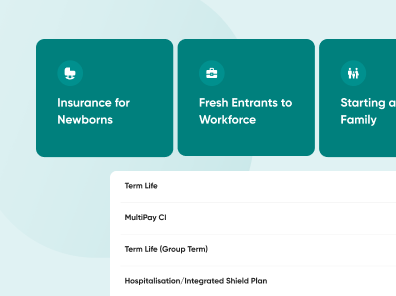

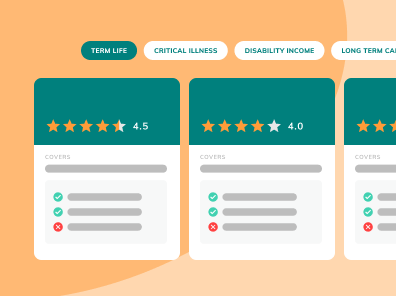

Solution Sets

Explore our tailored solution sets crafted to meet your financial needs,

from insurance product reviews and curated packages to investment solutions.

Insurance

OwlInsure

Curated insurance product sets for core protection needs for your life stage

Financial Literacy for All

For Individuals

Public Talks & Webinars

Gain practical tips and insights on key financial topics, including:

- Money Management

- CPF and Its Benefits

- Insurance Essentials

- Investment Strategies

For Corporates

MoneyOwl Corporate Programmes

We partner companies, unions and community associations to uplift the wellbeing of employees and member through financial literacy programmes, mostly free of charge.

- Learning and Development

- CPF, Investment, Insurance, Holistic Retirement, Estate Planning

- Bite-Sized MoneyTips