By Chuin Ting Weber, CFP, CFA, CAIA

CEO & Chief Investment Officer, MoneyOwl

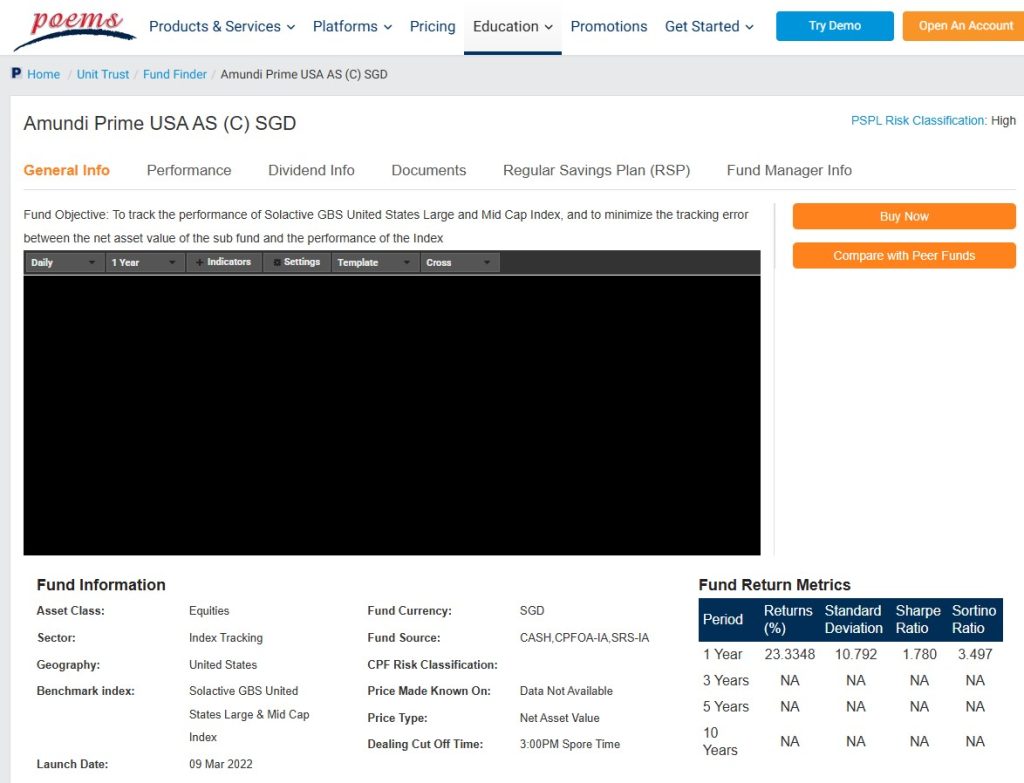

The answer is yes – MoneyOwl had asked POEMS to onboard the latest passive Amundi Prime USA Fund, after the global ones.

MoneyOwl generally prefers investing in the whole global market.

But the 100-yr old US market is an acceptable alternative, as its companies are largely global ones.

With this fund, Singapore DIY investors no longer need to go to the US exchanges to enjoy low-cost, diversified investing.

At 0.05% p.a., the Amundi US solution is near the levels of the cheapest US passive funds.

I would even argue that the Amundi solution is superior in some ways:

1️⃣ Starts from S$1. One US VOO share costs US$550+. You’d need to fractionalise a VOO share if you don’t have so much

2️⃣ Easier to do a Regular Savings Plan (RSP): set it up and leave it

3️⃣ No frictional charges like brokerage, forex spread; and risk of being liable for US estate duty. Also overall simpler mental accounting with NAV in SGD

4️⃣ Besides cash, you can do SRS and – if you’re suitable for it (think twice!) CPF Investing.

You just can’t tell the price real time .. but well, you shouldn’t be timing the market!

This is a breakthrough for investing fees in Singapore.

They say that Singapore is too small for such solutions to be possible, especially for the man in the street.

But when those with intent do the work to sow, water and weed, a tree grows.

The unsung heroes in the CPF Board Investment Schemes team have led the way over the years, signalling the importance of low cost investing: lowering charges and fee caps, then bringing in digital platforms and low-cost funds.

This awareness has spilled over to encourage low-cost cash investing.

What MoneyOwl has done is to push the envelope for DIY investors, who don’t need advice beyond the guidance we give on our website.

People ask how MoneyOwl got Phillip to say yes to not charging advisory or platform fees.

Well, sometimes you have to ask.

Lisa Lee, Phillip’s ED and I were on the Financial Planning Association of Singapore (FPAS) Exco together as volunteers (she still is).

As CFPs, we know deeply that everyone can build wealth – even if they start small, and it’s our responsibility to enable that.

And when you ask without any vested interest – because MoneyOwl under Temasek Trust does not do direct selling – you sometimes find partners who think strategically and long-term, and beyond short-term revenue.

A big thank you to Lisa and also her team, esp Esther Tian.

We hope there will be more platforms who would do the same!

Doesn’t it bring us all hope – that impact and breakthrough are possible when the public, private and philanthropic sectors go beyond ourselves and into intentional partnership?

Disclaimer: These funds are for DIY investors. This post is not a recommendation that you should buy them. Seek financial advice for what is suitable for you if you need it.

Read more of this fund on our OwlInvest page.

Subscribe here for our soon-to-come and free OwlHoots on financial planning insights and analysis.

Disclaimer:

While every reasonable care is taken to ensure the accuracy of information provided, no responsibility can be accepted for any loss or inconvenience caused by any error or omission. The information and opinions expressed herein are made in good faith and are based on sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy, completeness or correctness. The author and publisher shall have no liability for any loss or expense whatsoever relating to investment decisions made by the reader.