By Chuin Ting Weber, CFP, CFA, CAIA

CEO & Chief Investment Officer, MoneyOwl

Further support to enhance retirement adequacy through home monetisation was announced during the Committee of Supply debate.

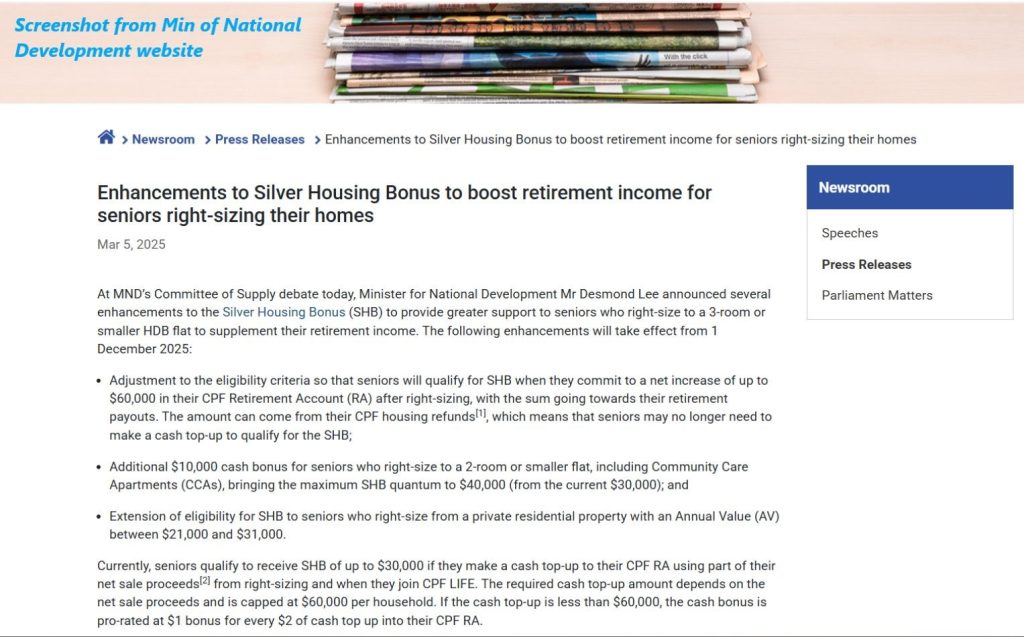

The Silver Housing Bonus (SHB) provides a cash bonus of up to $30k (now up to $40k) to a elderly couple if they “right-size” from a larger property to a smaller public flat.

To receive the bonus, there’s a condition that the CPF Retirement Account (RA) be topped up as well: $60k as a couple for the max bonus.

The enhancements in brief are (see screenshot):

1. No need for outright cash top-ups into CPF RA to get the bonus. Proceeds already coming back CPF through the current refund mechanism upon sale of flat can be used.

Impact: Lubricates the process. It makes sense, as users of scheme may already be cash-strapped.

2. Extra $10k cash bonus if a cheaper 2-room flat/ community apartment is chosen

Impact: Nudges retirees towards larger cash release and prioritising own needs first. 2-room flexis are much cheaper than 3-room but can’t be left as legacy.

3. Looser criteria that covers 3/4 of residential properties including more private property

Impact: Another 15k people can benefit.

From a policy lens, Singapore has achieved a feat in home ownership at close to 90%. With economic progress, many might build wealth in their home.

But the current cohorts of older Singaporeans have lower retirement balances in “cash” because they had lower incomes to start with.

The SHB scheme’s CPF RA top-up condition tries to unlock one for the other.

To illustrate:

If a husband and wife each has a $100k Retirement Account balance at 55 years old today, they can each expect a CPF LIFE Payout of average $850/month from 65 years old onwards.

If they top up by $30k each (or $60k altogether to get max SHB) they will get +$200/month.

Altogether more than $2k/ month in total. (Based on CPF LIFE Estimator/ Standard Plan.)

If it’s two 65-year olds, the increase is from avg $570 to avg $725.

But there’s more:

Retirees who sell their home are likely to get way more cash.

With the Enhanced Retirement Sum having been increased this year ($426k in 2025), they can choose to top up RA with those proceed for a higher CPF LIFE payout of $3,000+ each.

So far, 2,325 households have used SHB over 12 years.

Will more take it up?

The key issue for older folks in right-sizing might be emotional: not being able to age in place and not leaving much of a legacy.

I’m sure that over time, other home monetisation options like the lease buyback scheme will be further enhanced, to cater to these concerns.

But overall, the system works reasonably well.

For younger people, the takeaway might be to start investing towards retirement early. Housing is emotional and we all hope house prices will always go up (after we buy). But life is uncertain.

So, build financial literacy and build long-term investing “muscle”. These are life skills that are both necessary and rewarding!

Subscribe here for our soon-to-come and free OwlHoots on financial planning insights and analysis.

Disclaimer:

While every reasonable care is taken to ensure the accuracy of information provided, no responsibility can be accepted for any loss or inconvenience caused by any error or omission. The information and opinions expressed herein are made in good faith and are based on sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy, completeness or correctness. The author and publisher shall have no liability for any loss or expense whatsoever relating to investment decisions made by the reader.