By Chuin Ting Weber, CFP, CFA, CAIA

CEO & Chief Investment Officer, MoneyOwl

No.

As James Clear, author of “Atomic Habits” puts it:

Having money is not everything, but not having it is.

In 2015, then-DPM (now President) Tharman Shanmugaratnam described Singapore’s social security system as a trampoline.

In 2025 today, ten years on – even if you don’t care for a huge bounce, why not use a trampoline as a safety net, with an option for a light uplift for you and your family?

Use both CPF and low-cost instruments.

Start small.

Let your actions compound.

Just like building physical muscle.

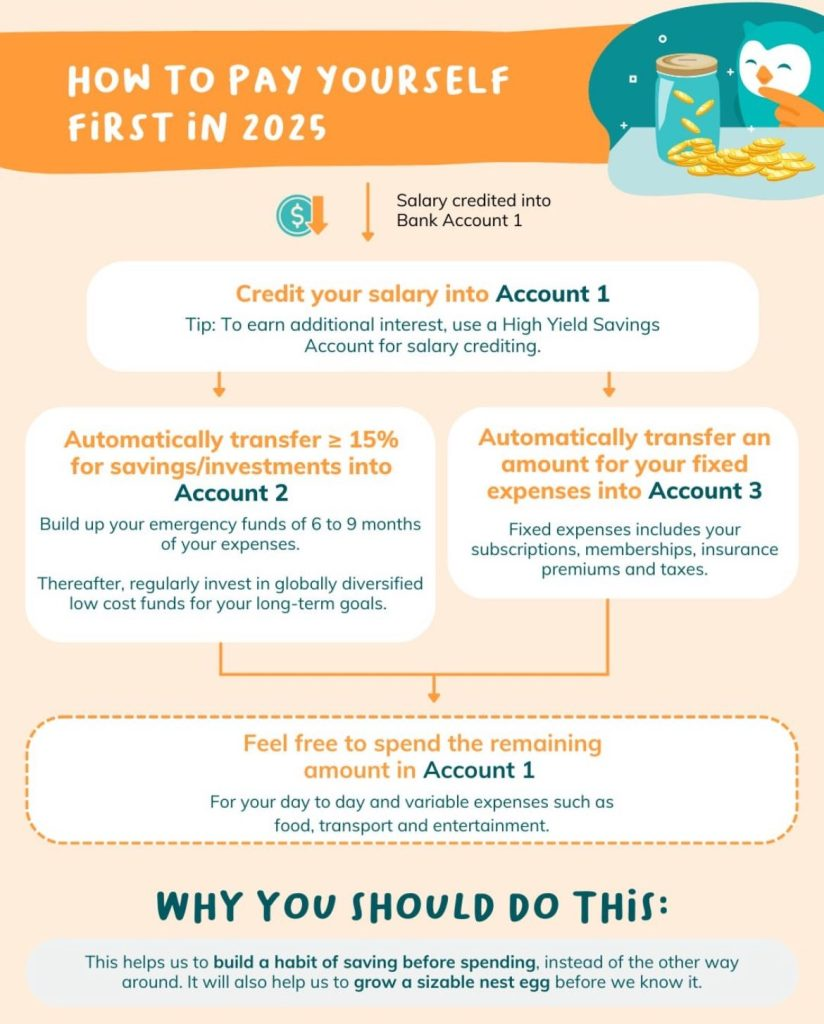

Check out MoneyOwl’s Pay Yourself First rubric and others on our website.

Subscribe here for our soon-to-come and free OwlHoots on financial planning insights and analysis.

Disclaimer:

While every reasonable care is taken to ensure the accuracy of information provided, no responsibility can be accepted for any loss or inconvenience caused by any error or omission. The information and opinions expressed herein are made in good faith and are based on sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy, completeness or correctness. The author and publisher shall have no liability for any loss or expense whatsoever relating to investment decisions made by the reader.