By Daphne Lye, AWP®

Financial Planning Solutions & Investment Management Lead, MoneyOwl

The concept of a ‘CPF millionaire’ is not new.

But most people think about achieving this through top-ups and possibly investing their CPF.

But what if you never made any additional contributions beyond your work – can you still accumulate $1 million of wealth in some form in your CPF?

Using MoneyOwl’s in-house CPF Analyser tool1 we found that it’s not that far off to be able to grow $1 million of retirement wealth through work contributions alone compounding at the safe CPF interest rates.

This $1 million of wealth may “sit” in a combination of cash balances in the CPF Ordinary (OA) and Special/Retirement Accounts (SA/RA), or in your property.2

Granted that wealth in housing is not the same as wealth in cash.

But let’s look at the model first: three personas in two scenarios of wage growth.

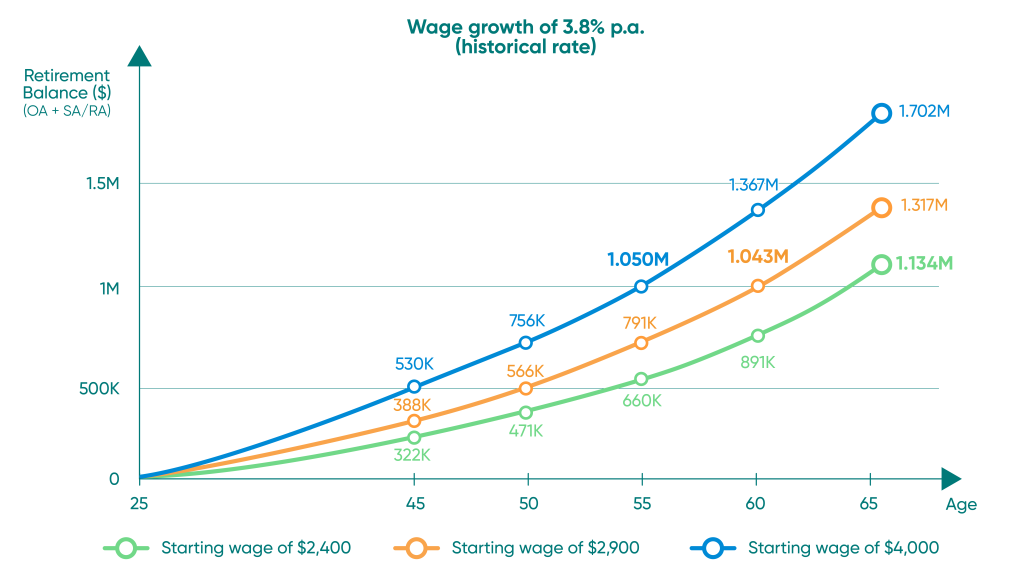

Scenario 1: Wage growth of 3.8% p.a.3 (historical rate)*

*Figures are rounded to the nearest thousand.

We start with three wage levels at age 25: $2,400, $2,900 and $4,000, which respectively correspond to the median starting wages of an ITE, polytechnic, and university graduate.

We then apply a wage growth rate of 3.8% p.a. and project their CPF retirement balances at key ages.

We find that all three persons are able to attain $1 million worth of assets by age 65, just by compounding at CPF interest rates.

The actual amounts may be higher, as we did not factor in CPF from variable bonuses (or additional wages) nor Workfare payouts.

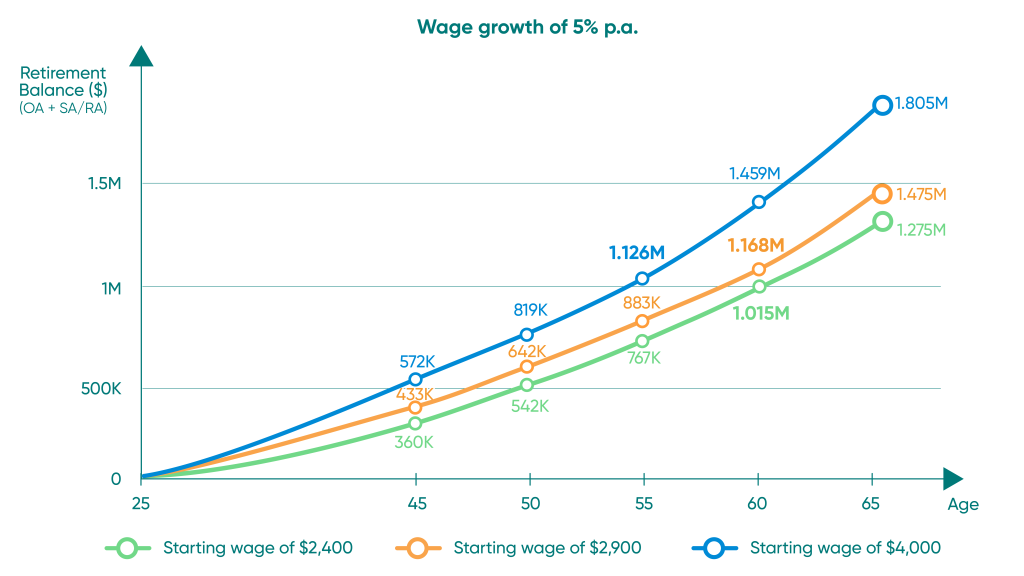

Scenario 2: Wage growth of 5% p.a.*

*Figures are rounded to the nearest thousand.

What if you experience a higher rate of wage growth?

Assuming a higher wage growth rate of 5% p.a., someone with the lower starting salary of $2,400 would hit the $1 million mark about 5 years earlier at age 60. And all three personas would have between 6% and 12% more retirement balance at age 65.

Insights

These figures are theoretical, but we can draw some insights.

The model is based on consistent work and regular monthly CPF contributions from age 25. The monthly contributions of 37% from our wages compound with risk-free CPF interest rates of up to 5% p.a. (in the SA) to grow these into sizeable amounts for one’s retirement.

This is why MoneyOwl advocates for platform workers to opt in for CPF contributions. While CPF contributions are required for those born on 1 January 1995 or later, older platform workers can also opt in for CPF contributions and CPF contribution rates will be gradually increased to match that with employees’.

By opting in for CPF contributions, platform workers will see an increase in their total salary as their platform operators will also contribute an additional 17% into their CPF, and they will also be able to save for their housing and retirement needs.

A higher salary means more savings and more wealth through CPF.

As the models show, even with a lower starting salary, you can achieve wealth earlier if you have a faster rate of salary increase.

You can upgrade your skills by enrolling in courses or pursuing higher education or professional certifications in high growth jobs or sectors.

Depending on the courses, you can get funding support in the form of training grants and SkillsFuture credits.

Your earning power is your most important financial asset!

With over 60% of our CPF contributions going into the OA in the initial working years, a large proportion of our CPF wealth is in the property we buy with our OA.

90% of Singapore households own their own home.4

This means that for many people, the current value of the assets (CPF-financed portion of property plus the “cash” balances) may well be much higher than the modelled balances, as property values have increased over the past few decades.

But there is a trade-off in our liquid retirement savings.

The more CPF savings are used for housing, the smaller the amount set aside in liquid retirement funds in OA and SA/RA.

A sizeable proportion of Singapore household wealth is tied up in housing. The data as of the end of 2024 shows that over 40% of Singapore households’ assets are in their residential property.5

While housing has been an appreciating asset, the continued upward trajectory movement of Singapore housing prices is not fully guaranteed.

It would depend on macro-economic and demographic factors, as well as future government policies. In any case, even if house prices continue to go up, you need to be prepared to monetise your home if that is needed to fund retirement expenses.

Examples of monetising the value of your home in retirement include renting out a spare bedroom, selling back the tail end of your home lease through the Lease Buyback Scheme (for HDB flats) or “right-sizing” with the Silver Housing Bonus (SHB) incentive.

For current retirees, from December 2025 onwards, you get up to a $40,000 cash bonus for moving to a 2-room flat, subject to required contributions to the CPF Retirement Account for your CPF LIFE payout.

If you don’t see yourself monetising your home, you should consider focusing on growing your CPF SA instead. We recommend everyone achieve at least the Full Retirement Sum.

Further Boosting Your Wealth

Sometimes, people think that optimising their CPF is about taking it out to invest to earn a higher return.

While some CPF members can achieve a higher return through investing, CPF investing is not for everyone.

It depends on whether you have at the time horizon to ride out short-term market volatility (we recommend at least 8 years) and the risk tolerance to stomach that.

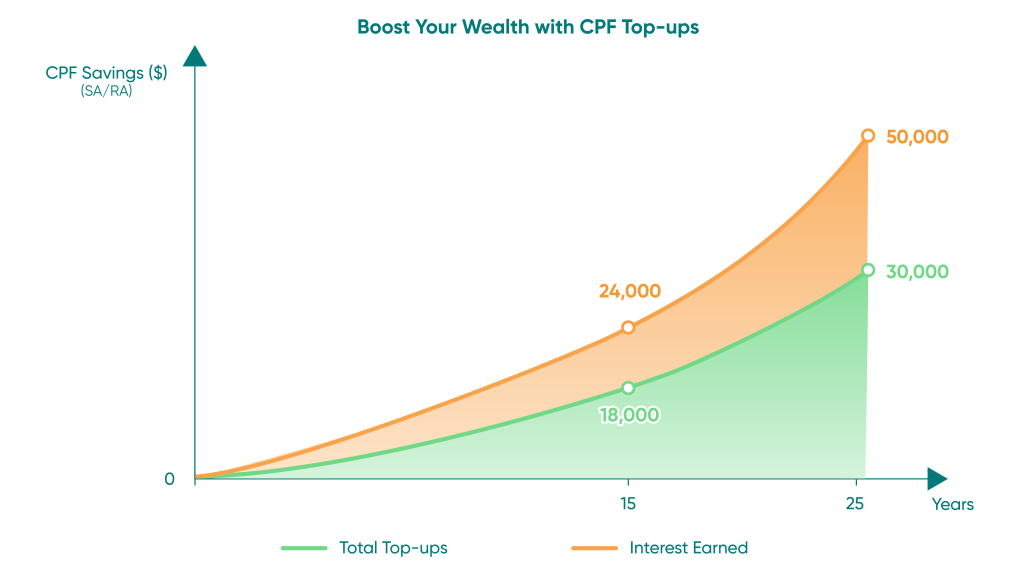

The real power of CPF lies in its inherent compounding power in the SA or RA at a AAA-rated government risk level. Optimising CPF is about making top-ups to harness this power.

According to CPF Board figures, if you top up $100 a month to your SA or RA for 15 years (total top-ups of $18,000), you would have saved over $24,000*. If you continue to top up for another 10 years (total top-up of $30,000), your savings would reach over $50,000* with compound interest.

Using the CPF Monthly Payout Estimator Tool, an additional $50,000 in retirement balance may provide you with about 20% higher CPF LIFE payouts6.

However, do note that such top-ups and transfers are irreversible, so you need to consider your own liquidity needs.

You also get to enjoy tax relief of up to $8,000 per year when you top up your SA or RA in cash. Instead of a lump sum top-up, you can also GIRO smaller amounts monthly to gradually build up your CPF retirement balance.

*Figures are rounded to the nearest thousand.

The CPF system helps one save and accumulate significant retirement assets, at very little risk, if one contributes regularly.

There are further steps and actions you can take to secure a larger CPF nest-egg for retirement, even at low risk. Growing your income and topping up your CPF accounts are some options.

Use the million-dollar safe compounding machine to your benefit!

Subscribe here for our free OwlHoots newsletter on financial planning insights and analysis.

Want to continue this discussion on CPF with MoneyOwl? Join our Telegram community here.

Disclaimer:

While every reasonable care is taken to ensure the accuracy of information provided, no responsibility can be accepted for any loss or inconvenience caused by any error or omission. The information and opinions expressed herein are made in good faith and are based on sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy, completeness or correctness. The author and publisher shall have no liability for any loss or expense whatsoever relating to investment decisions made by the reader.

- (1) MoneyOwl’s proprietary CPF Analyser has built in existing CPF rules, including contribution and allocation rates according to different age bands, interest rate structure, limits on wages and certain accounts, and so on. Hence, they are as accurate as possible based on current rules. ↩︎

- (2) Not taking in house price appreciation nor MediSave balances. ↩︎

- (3) MOM data – Change in Median Gross Monthly Income From Employment (Including Employer CPF Contributions) of Full-Time Employed Residents between 2014 and 2024 is 3.8%. ↩︎

- (4) Source – Singstat, Proportion of Owner-Occupied Resident Households, 2024. ↩︎

- (5) Source – Singstat Household Net Worth, Assets and Liabilities. ↩︎

- (6) 65 year old male on CPF LIFE Standard Plan with $250,000 will receive $1,380/ month, compared to $1,120 with $200,000 retirement balance ↩︎