By Daphne Lye, AWP®

Financial Planning Solutions & Investment Management Lead, MoneyOwl

I have always looked forward to Chinese New Year, when the extended family gathers to boisterously discuss the latest news and catch up with one another – who recently got attached / married / is expecting, how the kids did in their exams, and newly developed health ailments. One thing that was starkly missing were conversations about money.

This isn’t surprising – especially since access to investing wasn’t as easy as it is today; back then, the concept of investing online would have been akin to having an air con dome around Singapore today.

But it’s different now. Investment options are aplenty, and digital banking is right at our fingertips.

In the midst of the Chinese New Year festivities, your child may have amassed a sizeable pile of angbaos which signify the good wishes and blessings from your family and friends.

Depending on their age, your child may have started looking through the angbaos and declaring that they’re rich!

But between spending it or saving it – are there other options to make this ‘first pot of gold’ work for their future?

While a portion of the angbao money can be passed to older children for a tiny bump in their pocket money, it is also an opportunity to teach children about delayed gratification and show how money can multiply (钱生钱) through investing.

When you deposit the angbao money into your child’s bank account, the base interest rate is 0.05% p.a., a far cry from the latest inflation rate reported at 2.4%.

When you factor in inflation, the real return on your bank deposit – which is the adjusted return after accounting for inflation – shows that after 20 years, your $100 will eventually shrink to $88.

Instead, to preserve the value of your child’s wealth over the long term, you need to invest in the markets to harvest above-inflation returns that compounds over time.

But how exactly should I invest for my child, without taking on too much risk?

Investments might seem scary – especially if we’re doing it for a loved one. And oftentimes, leaving it in the bank might seem like the ‘safer’ and ‘less risky’ option.

While there is a possibility of a near-term loss when you invest due to market volatility, your savings will definitely lose its value over time when kept in safe instruments whose returns do not beat inflation.

Investing does not need to be scary or intimidating if we understand how markets work and how to invest.

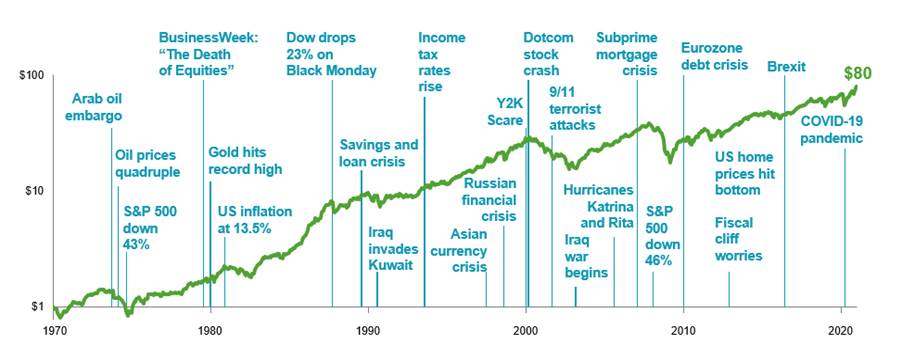

History has shown that capital markets have rewarded long-term investors with above-inflation returns.

The chart below shows how much a dollar will grow if invested in the MSCI World Index – which covers about 1,400 large and mid-cap companies in developed markets. The $1 invested in 1970 would have grown to about $80 in 2023.

While short-term volatility and minor dips will occur, over the long term, markets are expected to give above-inflation returns.

Chart 1: Growth Of The US Dollar – MSCI World Index (Net Dividends), 1970 – 2023*

*Source: MSCI data © MSCI 2023, all rights reserved. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is no guarantee of future results.

At MoneyOwl, we believe that when you invest in a low-cost globally diversified portfolio in an asset allocation (combination of stocks and bonds) suited for your time horizon and risk profile, there is a high chance you will get reliable and sufficient returns over the long-term.

Consider starting with low-cost passive Amundi funds

If you are unsure about where to start, we have made it simple for you.

We combed through investment products accessible in Singapore, to curate 4 low-cost passive and diversified funds which you can consider forming an investment portfolio for your child.

As an entity under Temasek Trust, to enable financial security for all without vested interest nor profit motive, we have made these funds available on the POEMS platform so your returns will not be further eaten by advisory nor platform fees.

| Amundi Index MSCI World A12S (C) SGD | Amundi Index MSCI Emerging Markets A12S (C) SGD | Amundi Global Aggregate Bond A12HS (C) SGD | Amundi Prime USA AS (C) SGD | |

| Objective of Fund | To track the performance of the MSCI World Index, which provides exposure to a diverse range of large and mid-cap stocks across 23 developed markets. | To track the performance of MSCI Emerging Markets Index, which comprises of large and mid-cap companies across 23 emerging market countries | To track the performance of the Bloomberg Global Aggregate Index, which provides broad exposure to global investment-grade bonds from both developed and emerging markets | To track the performance of Solactive GBS United States Large and Mid Cap Index, which has high correlation to the S&P 500 Index |

| Expense Ratio (aka management fee/investment cost) | 0.10% | 0.20% | 0.10% | 0.05% |

More information on how to start investing in these funds can be found at https://www.moneyowl.com.sg/owlinvest/.

This page includes:

- A step-by-step guide on how to start investing in the Amundi funds on the POEMS platform

- A risk profiling tool to find out your recommended portfolio asset allocation based on your ability to take risk (based on time horizon) and willingness to take risk (tolerance for fluctuations).

Give your child a head start in their financial journey

In the bestselling personal finance book, Rich Dad, Poor Dad, an important lesson was on taking calculated risks to build wealth.

When you start your child on their investment journey, they will get an early head start both in terms of having a sizeable pot of gold when they reach adulthood, as well as learning about investments and creating positive money habits to set them up for continued success in their later lives.

Time is a powerful ally in investing, and there is no better time to start than now.

And if you’re not a parent reading this, but you wished your parents had invested your angbao money for you – why not go ahead and invest for yourself?

We can’t rewind the clock, but we can always take charge of our future.

Disclaimer:

While every reasonable care is taken to ensure the accuracy of information provided, no responsibility can be accepted for any loss or inconvenience caused by any error or omission. The information and opinions expressed herein are made in good faith and are based on sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy, completeness or correctness. The author and publisher shall have no liability for any loss or expense whatsoever relating to investment decisions made by the reader.