Note: It was announced in November 2023 that MoneyOwl will be acquired by Temasek Trust to serve communities under a re-purposed model, and will move away from direct sale of financial products. The article is retained with original information relevant as at the date of the article only, and any mention of products or promotions is retained for reference purposes only.

______________

Retirement planning is simple and not complicated. Find out how you can make use of the SRS for your retirement needs.

Now is the best time to save more and pay less tax.

The Supplementary Retirement Scheme (SRS) was started in 2001 and the scheme has been getting popular. When you contribute to your SRS account, you enjoy the same dollar amount which you have contributed in tax relief for your following year’s income tax assessment. Thus, the higher your income tax rate is the bigger your incentive.

The government encourages us to keep our SRS savings for our old age. When you withdraw your SRS savings at age 62 or later, only 50% of the amount withdrawn for the year will be assessed in the following year’s tax computation. By spreading your SRS withdrawals over a period of up to 10 years, you can minimise or you may not even need to pay any tax on your SRS.

The maximum SRS you can contribute currently $12,750 per year. If your marginal tax bracket is at 11.5% (i.e. chargeable income from $80,000 to $120,000) and you contribute $12,750 to SRS this year, you can enjoy $1,466 in tax savings next year!

You have only about one month till the end of the year to contribute to your SRS for this year if you have not already done so that you can enjoy tax relief next year!

What can you do with your SRS savings?

You can invest in a wide range of financial instruments including shares, unit trust, insurance, bonds and fixed deposits. The other alternative is to leave your SRS monies in cash, which does not make much financial sense because of the current low-interest rate environment. It is surprising that as of 2014, one-third of all SRS monies are left in cash!

These are the 3 types of SRS-approved insurance policies you can consider to meet your retirement income objectives.

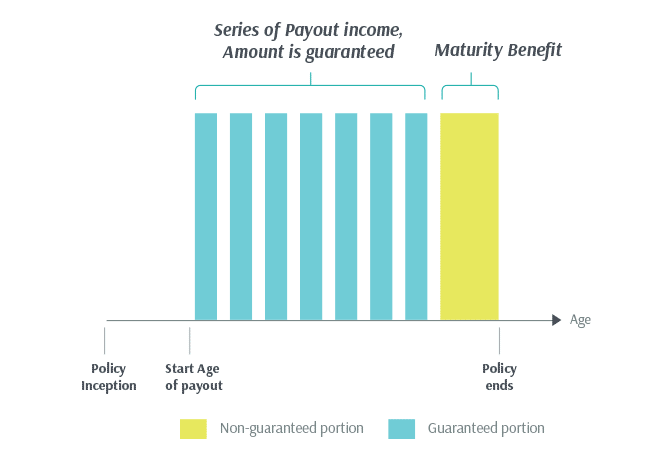

1. Retirement Income stream with Guaranteed Amount for limited years

This type of product is designed to pay an income stream starting from a specified age in the future and paid out over a limited number of years (e.g., 10/15/20 years). On the final payout, an additional maturity benefit may be payable to us. The unique feature of this type of product is that the regular income payout amount is fully guaranteed. Hence this is good for those who are risk-averse but yet desire a good return on their SRS money.

Example: Person age 52

(Note: the payout age and the duration of the payout may be adjustable)

2. Retirement Income stream with Variable Amount for limited years

The difference with this product as compared to the first is that instead of a fully guaranteed payment amount that is paid out to you, the payout amount which you receive is only partially guaranteed. If you have chosen this product and have decided to bear with some risks (uncertainty) in your payout, you could potentially receive a higher payout as compared to the first type of product. This product type is suitable for those who are prepared to bear with some fluctuations in exchange for a higher potential payout.

Example: Person age 36

3. Retirement Income with Increasing Amount for life

This product type is quite different from the earlier first two. The income portion for this type of product is payable for as long as you live. If you think you might live up to a ripe old age, this product is a good consideration. Another good product feature is that the amount of income payout has the potential to increase! Whenever the insurer declares a bonus, the income amount will increase to a higher level and the income amount would be guaranteed from thereon. In this way, this policy not only pays for life, but the amount can also increase to offset inflation.

Example: Person age 45

For an annuity plan, the longer the life-span, the better the return.

Whilst it is good to contribute into SRS to build up your retirement nest egg, you should also optimise your SRS savings by investing appropriately to grow your nest egg bigger and achieve your retirement objectives. There are other rules on SRS such as treatment for early death, migration and bankruptcy which you may find out more from the Ministry of Finance.

The above examples are for illustration purposes only. Policy projections are non-guaranteed and actual figures are dependent on the performance of their life funds.

MoneyOwl’s Solutions Team is the author of this monthly comparison table. If you need more information about insurance plans, feel free to reach out to friendly Client Advisers here.