By Chuin Ting Weber, CFP, CFA, CAIA

CEO & CIO, MoneyOwl

China has been a pain trade.

For quite a few years, the Chinese market has been doing badly.

It dragged down the performance of many a macro fund manager.

Some held on to the growth story if they could survive the client pressure, while others and sold – possibly just before the run-up in the last week and a half. 😖

On 9 October, there was a big swing down for the Chinese market, by more than 7%.

For those invested – perhaps some felt they should have “taken profit”.

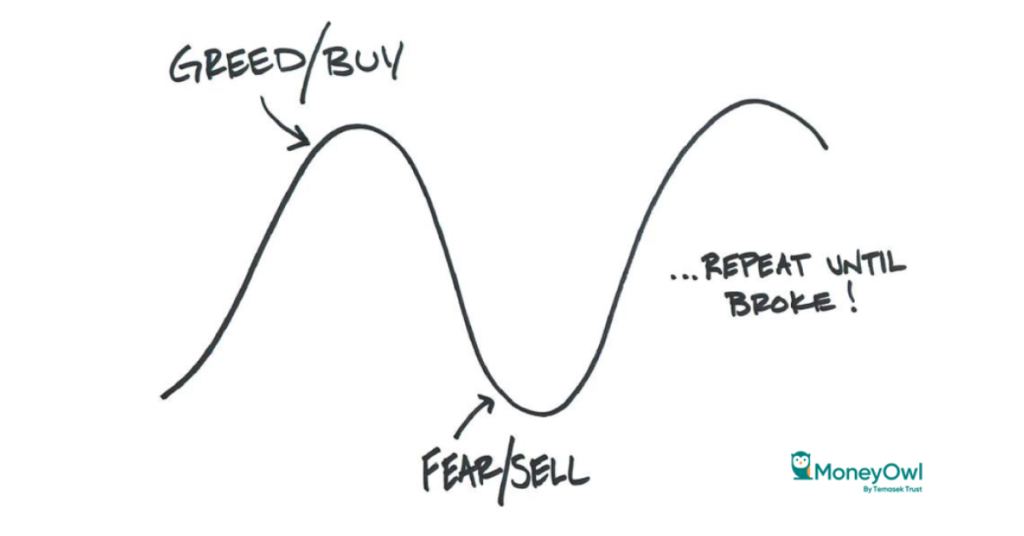

Unfortunately, while you can time the market, you can’t time it right all the time.

MoneyOwl has always advocated keeping investments globally diversified (using a broad-based index like MSCI All Country World for stocks or near equivalent) for the core of your needs, say 80 cents of every dollar, and staying invested through its ups and downs.

That’s why MoneyOwl advocates for time in the market, not timing the market.

It’s boring but it works.

You get the average return, which is quite a healthy, inflation-beating (high single digit %) which will be substantial when compounded over the long term.

As for single country bets and single stock bets, go for them if you really want to. But consider keeping it to 20 cents on the dollar — and be prepared to lose all of that 20 cents.

Because those are ultimately bets.

The price of active trading in this small part is that you would always have to decide when to sell. (Buying is not the problem.)

The pain of regret is real.

Some suggestions:

1️⃣ Hold it lightly. It was always just a bet with a small part

2️⃣ Be clear why you entered this trade – what was the thesis, and is it still true? This could be a “fundamental” call, or a “technical” reason.

3️⃣ When movement takes place, walk through in your mind what are the scenarios of what you would do, relating it back to your thesis.

At which price points or valuations or time frames you would sell, or on what basis would you change your mind when those are reached?

For example, if you believed in a stock because it’s meant to be world-changing, then you’re probably looking at multiple x returns. You might also have had a time frame in mind.

4️⃣Then just stick to it and don’t look back.

Please note – the above is a suggestion on how to TRADE if you choose to do so, for what should be a small, able-to-lose-it-all portion of your portfolio.

They do not apply for investing in the core portfolio, which should be set and forget: taking profit and then staying out of market there, can cause you a lot of your nest egg.

Investing is almost all psychology.

We must protect ourselves from allowing the markets to traumatise us and turn us away from this powerful generator of wealth.

Being boring does the job, but if you look for more, conquering the greed and fear by limiting your exposure and thinking through your approach in advance, can help you build investing muscle. 💪

All the best!

Subscribe here for our soon-to-come and free monthly OwlHoots on financial planning insights and analysis.

Disclaimer:

While every reasonable care is taken to ensure the accuracy of information provided, no responsibility can be accepted for any loss or inconvenience caused by any error or omission. The information and opinions expressed herein are made in good faith and are based on sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy, completeness or correctness. The author and publisher shall have no liability for any loss or expense whatsoever relating to investment decisions made by the reader.