By Chuin Ting Weber, CFP, CFA, CAIA

CEO & Chief Investment Officer, MoneyOwl

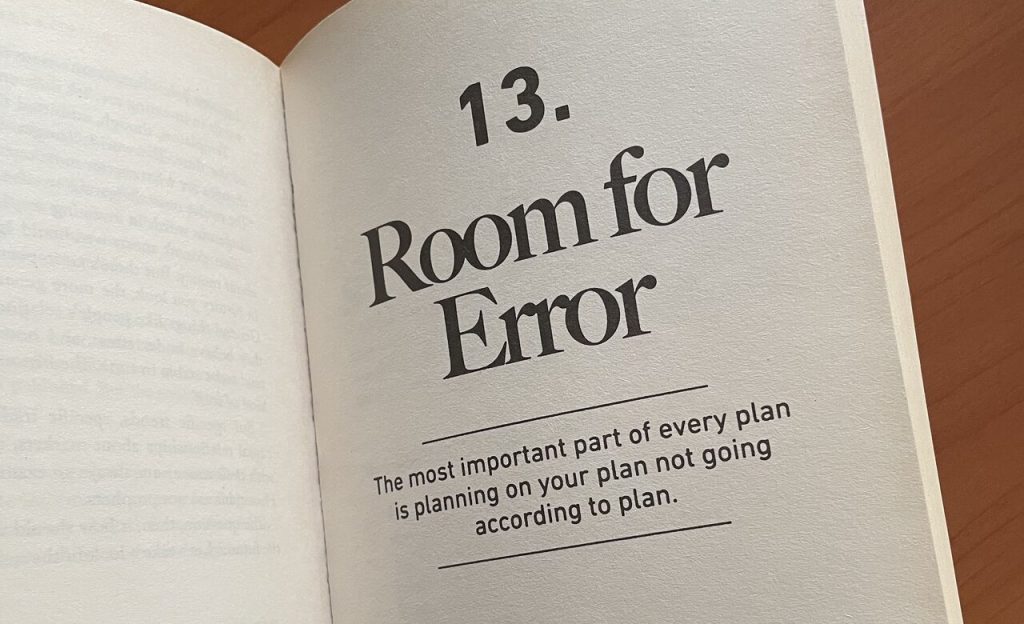

The hard truth is that most people have little room for error.

Yesterday, MoneyOwl CFO/ Co-Head of Partnerships Harry Ch’ng and I were at a gathering of Chiefs of HR.

Harry shared sobering data from OCBC Financial Wellness Index and Credit Counselling Singapore that:

- A majority don’t have an emergency fund large enough to pay 6 months’ expenses if they lost their income

- A majority feel they cannot spend beyond basics expenses most of the time

- Unsecured debt increased across all age groups in 2024

Just only on day-to-day (hand-to-mouth?) living.

Not yet counting retirement adequacy or protection gaps.

We have to be ever more resilient now.

Because the list of things that can go wrong is ever longer.

Be it trade wars and tariffs, or A.I. and economic restructuring – some of the very things the HR folks talked about after our session.

When you leave a person who has no room for error as he is, you risk not just his finances.

You’re risking the mental and practical well-being of an entire family. 🏚️💔

But when you help build financial literacy for yourself and others, you help an entire family build resilience when the uncontrollable things happen. 🏡

Is this a worthwhile investment of your time and effort? 🙋♀️

Photo: From Morgan Housel’s “The Psychology of Money”

Subscribe here for our soon-to-come and free OwlHoots on financial planning insights and analysis.

Disclaimer:

While every reasonable care is taken to ensure the accuracy of information provided, no responsibility can be accepted for any loss or inconvenience caused by any error or omission. The information and opinions expressed herein are made in good faith and are based on sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy, completeness or correctness. The author and publisher shall have no liability for any loss or expense whatsoever relating to investment decisions made by the reader.