By Daphne Lye, CFP

Financial Planning Solutions & Investment Management Lead, MoneyOwl

If you’re reading this, you are likely to be working and looking forward to when you can slow down from the rat race to enjoy your golden years.

Or perhaps you view retirement with some trepidation and are unsure if you are fully ready to stop working for a regular paycheck.

The good news is that most working Singaporeans have been preparing for their retirement – many are halfway there.

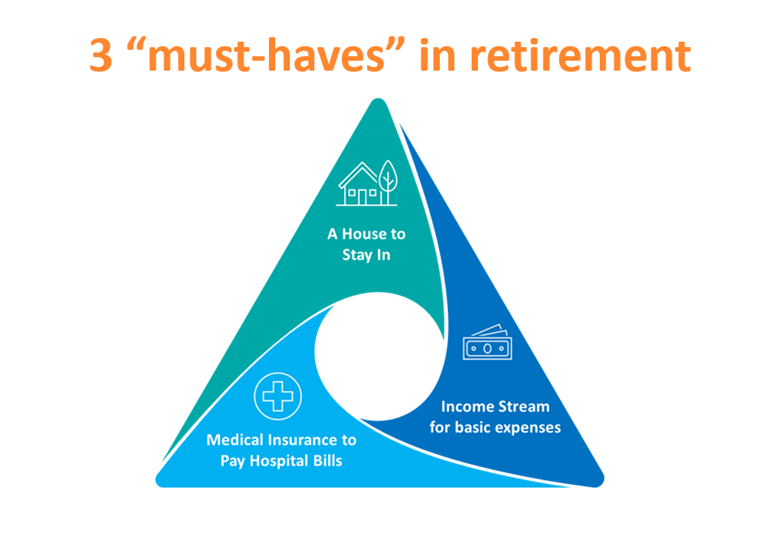

Planning for your retirement need not be complex. Just plan for these 3 must-haves and you will make good progress toward to a financially secure retirement.

1. A Fully Paid Home

As a nation of homeowners, as of 2023, close to 90% of Singapore resident households own their own homes.

Besides being homeowners, to have greater peace of mind, we should also aim to fully pay off our home loan by the time we retire.

This will free up our retirement income for other needs, such as travel, hobbies, or healthcare.

You will also have more options to monetise your home, such as downsizing, renting out a room, or tapping on schemes such as the Lease Buyback Scheme to generate additional income during your retirement.

2. Healthcare Insurance and Savings

Healthcare costs will be a top concern as we get older, as we tend to fall ill more often, more seriously, and take a longer time to recover.

Without healthcare insurance provided by employers as we exit the workforce, we need adequate personal medical insurance and savings as a key plank of our retirement planning.

Fortunately, there are affordable national schemes such as MediShield Life and CareShield Life to provide basic healthcare coverage.

Understand what they are and how they work so you can decide whether you’d like to top up with private insurance.

Beyond medical insurance, you should also have savings to fund out-of-pocket medical expenses. This will be in the form of your CPF MediSave savings.

3. Lifelong Stable Retirement Income

“Retirement is not an age. It’s a financial number,” according to American personal finance expert Dave Ramsey.

For a fulfilling and stress-free retirement, you need to save up for a nest egg that can provide you with a stable and sustainable stream of income after you stop work.

For many Singaporeans, the CPF LIFE annuity payouts form your safe retirement income floor, providing you with monthly payouts for as long as you live.

When you turn 55, savings from your CPF Special Account and Ordinary Account will be used to form the Retirement Account, up to the Full Retirement Sum (FRS).

The FRS is adjusted upwards every year due to inflation and improvements in the standard of living. You will know your FRS as you approach 55.

We encourage Singaporeans to save up to the FRS for an adequate level of safe retirement income. Based on the 2025 FRS of $213,000, this will give you about $1,700 a month for as long as you live.

To get an even higher level of safe retirement income, you can save up to the Enhanced Retirement Sum (ERS), which will be 2 times of the FRS from 2025. This will bump up your monthly lifelong payouts to about $3,300 a month.

This is an option for those who have sufficient liquidity to meet shorter-term needs – as CPF LIFE payouts will only start 10 years later from age 65 – and remain in good health.

To boost your retirement income further, you can draw from your cash investments. A popular rule of thumb is to add up all your investments – ideally parked in a balanced portfolio comprising 60% global equities and 40% global bonds – and withdraw 4% from it every year. This should last you for 30 years of your retirement.

An alternative is retirement income plans offered by insurers. Compared to investment drawdowns, these provide more certainty in terms of the payout amount and duration, and some plans offer additional benefits such as capital guarantees or extra payouts upon illness or disability.

Conclusion: Building a Strong Foundation for a Fulfilling Retirement

Retirement is a new chapter in our lives, marking the transition from decades of work to enjoying the fruits of your labour.

It is not the end of the road, but the beginning of an open highway.

To have a financially secure and fulfilling retirement, take the first step to stay informed and engaged by finding out and understanding the 3 must-haves for a secure retirement in Singapore.

Subscribe here for our soon-to-come and free monthly OwlHoots on financial planning insights and analysis.

Disclaimer:

While every reasonable care is taken to ensure the accuracy of information provided, no responsibility can be accepted for any loss or inconvenience caused by any error or omission. The information and opinions expressed herein are made in good faith and are based on sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy, completeness or correctness. The author and publisher shall have no liability for any loss or expense whatsoever relating to investment decisions made by the reader.