Note: It was announced in November 2023 that MoneyOwl will be acquired by Temasek Trust to serve communities under a re-purposed model, and will move away from direct sale of financial products. The article is retained with original information relevant as at the date of the article only, and any mention of products or promotions is retained for reference purposes only.

______________

Understanding Integrated Shield Plan and why it is an important hospital insurance

While MediShield Life will be offering better benefits than its predecessor, MediShield, it is nonetheless meant for hospitalisation in B2/C wards. People who want higher class wards in B1/A or even at private hospitals would have to purchase Integrated Shield Plans (IPs) from private insurers, namely, AIA, AXA, Aviva, Great Eastern, NTUC Income, and Prudential.

This article is a continuation from Part 2: Is MediShield Life Affordable?

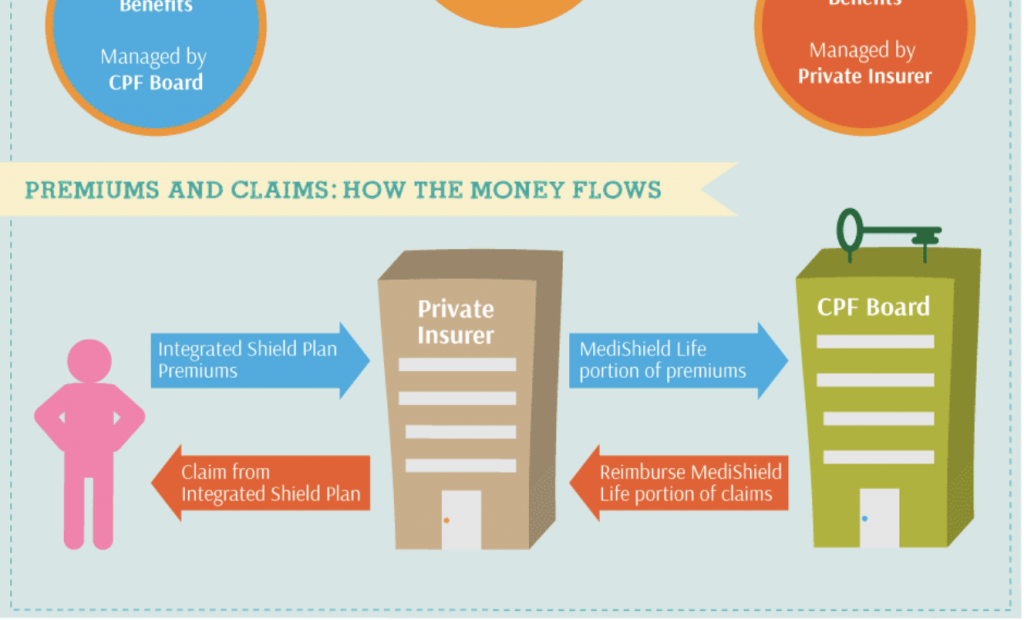

An Integrated Shield Plan is essentially made up of 2 parts:

- A basic MediShield, which is managed by the CPF Board and;

- A top-up portion with enhanced benefits managed by the private insurer

Operationally, the private insurer acts as the point-of-contact to deal with all communication with the integrated shield plan (IP) policyholders from the collection of premium to the settlement of a claim. When the premium is collected from the policyholder, the private insurer will then split and pass the portion of premium attributed to MediShield Life to CPF Board. In the event of getting a claim, the private insurer settles the claim with the policyholder and gets reimbursed from CPF Board for the MediShield Life portion of the claim.

Consumers’ Dissatisfaction with IPs

More than 60% of Singaporeans (data from the Ministry of Health) have a MediShield Life.

Some insights from focused group discussions are:

1. People Overstretching Themselves To Buy IPs

The majority of Singaporeans want higher coverage than the basic wards in B2/C. This behaviour is understandable as there are plenty of anecdotal stories that subsidised wards are perpetually over-crowded, long waiting time and lower quality of care. However, many seem to have overstretched themselves in getting higher coverage, especially when they are still young and working since the premiums are quite affordable and can be paid by Medisave. Some have the intention to downgrade later when premiums become more expensive at an older age.

2. Not Fully Utilising Their Entitlement

The table below shows the types of IPs people have and the choice of ward to stay in during hospitalisation:

More than half of policyholders who have higher coverage in Class A-ward and private hospitals are not making full use of IPs. They are over-insuring themselves resulting in wastage of personal resources.

3. Poor understanding of IPs

People have limited knowledge about the IPs they have signed up for. They may know the wards they are entitled to, but pay little attention to aspects such as computation of claims, how much premiums they have to pay and whether their pre-existing medical conditions are excluded. Hence, dissatisfaction usually arises when they need to file a claim or when they have to pay more during renewal.

4. Affordability

There were 2 major premium hikes for IPs in 2008 and 2013 with some experiencing a sharp rise by more than 100%. IPs providers would justify the reason for the hike to be medical inflation, the revision to MediShield and further enhancements added to their IPs. However, the magnitude of the increase over a short period has caused people to wonder about the sustainability and affordability of IPs.

5. Exclusion of Pre-existing Conditions

Some policyholders are not aware that their pre-existing conditions were excluded in their IPs until they filed for claims. They were unhappy that such exclusion was not communicated to them clearly. Others felt that the underwriting for IP is too strict to exclude minor pre-existing conditions. They wanted insurers to be more flexible and discerning in underwriting.

6. Insurer practices create uncertainty among policyholders

Insurers’ practice of revising policy benefits and premiums, leaving policyholders with little choice over whether to accept, downgrade or switch insurer (if they are still healthy) causes a lot of frustration. They hope the government can step in to regulate how these changes are made.

MediShield Life Review Recommendations to make IPs work better

One significant outcome of the MediShield Life Review is the much-needed call to review and improve the way IP is being managed. The main suggestions and recommendations by the Review Committee are:

- Government to work with insurers to develop the key features for a Standard IP meant for B1 ward. Standardisation of plans will make comparison across insurers easier to understand. Since benefits are similar, the premiums across IP insurers should not vary too much.

- Premiums for the Standard IP should form the basis for setting MediSave Withdrawal Limits for IPs. This will benefit the older policyholders as more of their Medisave can be used to pay the higher premiums.

- Allowing IP insurers to manage pre-existing conditions differently. Instead of applying exclusion to pre-existing conditions, insurers can consider other ways such as risk-loading (i.e. premium loading) for policyholders who wish to pay more to have any pre-existing conditions covered.

- Reviewing the regulation of IP and industry practices. This includes improving the way IPs are sold and clearer communication between the insurers and the policyholders.

- Suggestion to insurers to look into cost management measures to manage medical inflation. The main reasons for the increase in premiums are the generous “as-charged” feature and the high professional fees in the private healthcare sectors. Insurers should consider establishing benchmarks for professional fees to support cost management efforts and explore shared data to allow better scrutiny of unusually large bills.

Conclusion

The Integrated Shield Plan is important hospital insurance catering to those who want coverage higher than B2/C wards. However, the way IPs are currently operating has caused much concern and frustration. Now that the government has stepped in to initiate improvements, the future of IPs will hopefully become more relevant, more sustainable, and more affordable.