Note: It was announced in November 2023 that MoneyOwl will be acquired by Temasek Trust to serve communities under a re-purposed model, and will move away from direct sale of financial products. The article is retained with original information relevant as at the date of the article only, and any mention of products or promotions is retained for reference purposes only.

______________

Income stream is one of the top thoughts in mind near the beginning of one’s retirement.

Retirees need a reliable stream of income to fund their living expenses. This income stream can come from several sources such as CPF LIFE, annuities, rental income and dividends. They could also fund their retirement lifestyle by drawing down from bank deposits and investments.

In recent years, insurance companies have been rolling out many types of retirement products into the market. Because of its complexity, a typical consumer usually finds it hard to understand or compare.

At MoneyOwl, we try to make it easier by categorising retirement income products based on:

1. Nature of income payout

1a) Variable income amount

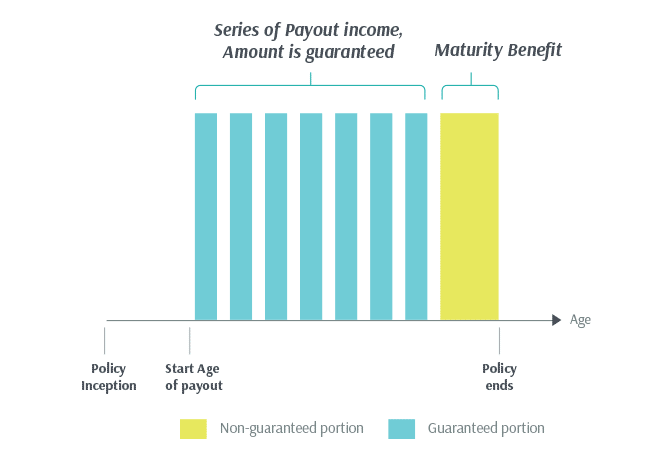

The income payout is made up of a guaranteed amount and a non-guaranteed projected amount. As the non-guaranteed amount is subject to the performance of the insurer, the actual income payout would be variable year by year.

1b) Fixed income amount

The income payout per year is fixed and guaranteed. It is not subject to the performance of the insurer.

1c) Increasing income amount

The income payout per year can increase in the future.

2. Duration of Income Payout

2a) For a limited number of years

The income stream is payable for a fixed number of years

2b) For the entire life

The stream of income is payable for the entire life

The suitability of retirement income products depends on several factors such as:

- How much retirement income you need

- How long an income stream you require

- How much resources you can set aside

- Existing sources of income for retirement purpose

- Is there a need to have additional payout during maturity

- Is there a need for a high death benefit

Hopefully, this article provides you with a better understanding of getting a plan that suits your retirement needs.