Webinar: 2025 CPF Changes and What They Mean for You

About this event With the significant CPF changes in 2025, whether you are over or under 55, you may be wondering how do these changes affect your retirement planning and if you need to adjust your approach to financial planning. Join us as MoneyOwl’s Financial Literacy Trainer, Albert Tan CFP®, AEPP®, Financial Literacy Trainer, and MoneyOwl’s CEO & Chief […]

Spring Clean Your Finances Before 2025

Join us for an insightful session to review your financial health and set yourself up for success in 2025.

Webinar – CPF Simplified: Making Sense of CPF Schemes

Join Albert Tan to help you make sense of our CPF schemes and maximise your savings.

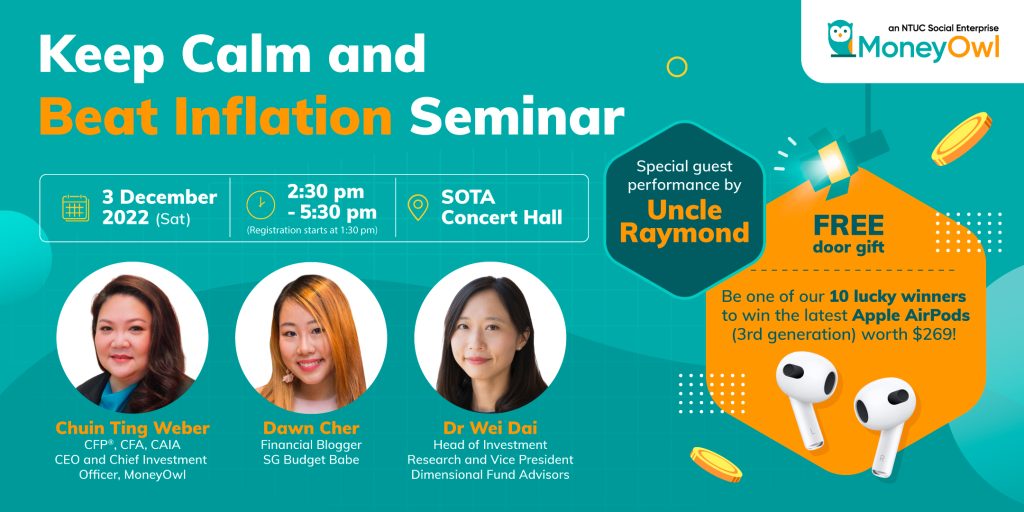

Seminar – Keep Calm and Beat Inflation

Amidst the current market volatility and surge in inflation, how should you invest your savings?

SRS Webinar: How to Save on Taxes, Multiply Your Savings and Beat Inflation

It is important to plan for a good retirement so you can enjoy the rest of your golden years. With SRS, not only can it help you multiply your retirement savings, but it also allows you to save on taxes and beat the ever-rising inflation!

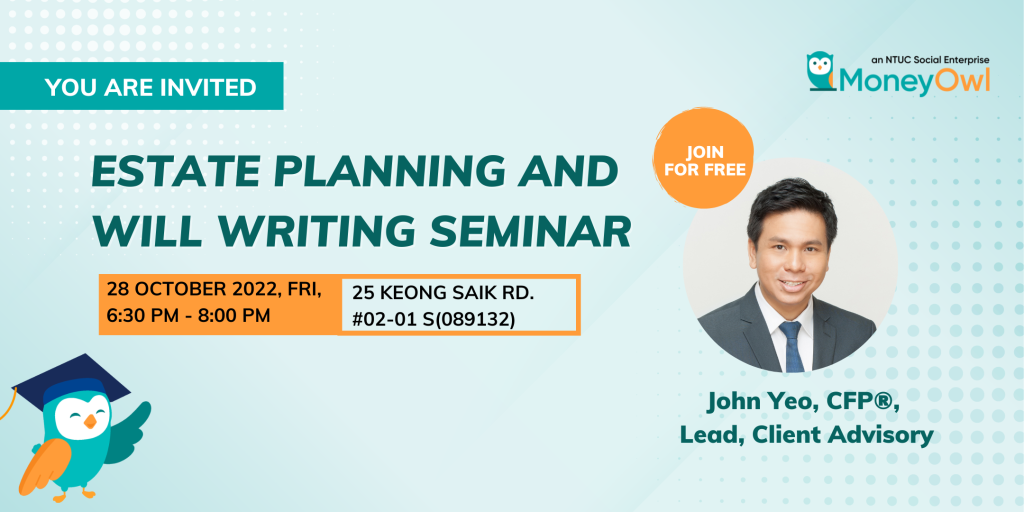

Seminar – Estate Planning and Will Writing

It’s never too early to start thinking about the type of legacy you want to leave behind.

Webinar – Family Planning 101: Raising kids in Singapore

Being a parent can be dirty and scary and beautiful and hard and miraculous and exhausting all at once, will you ever be ready for it?

Webinar – Invest in your holistic wellness now for a better retirement future

Thank you for your support, we have sold out on all the seats for this webinar. Do look out for our future webinars! The greatest wealth is your health! Start planning for your retirement early so you can retire in good health, wealth and happiness! About this event Nowadays, the life expectancy for Singaporeans has […]

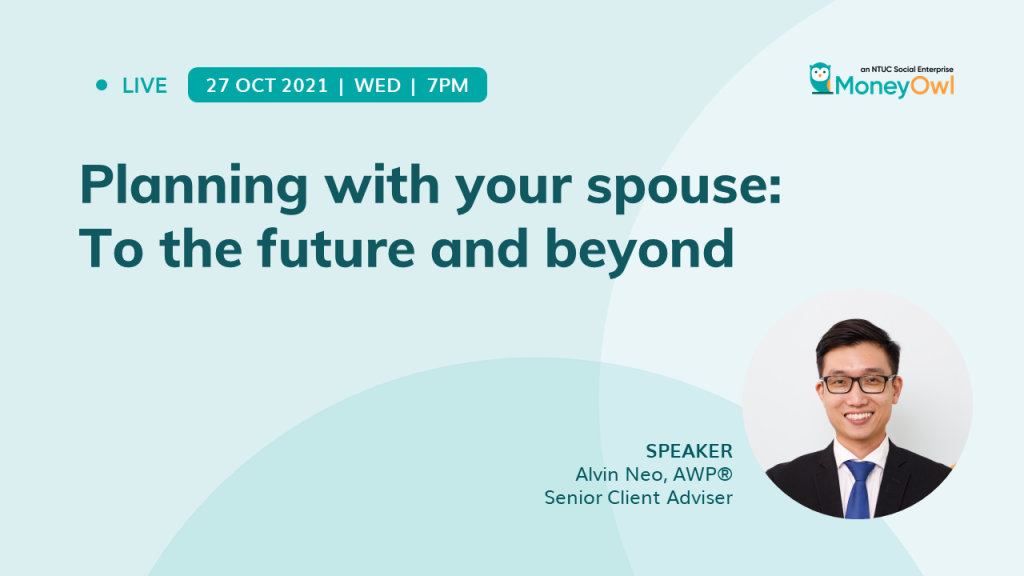

Webinar: Planning with Your Spouse – To the Future and Beyond

Common Issues And Topics For Newly Married Couples covering finances, milestones, and safety nets to hopefully give you a great head start to the journey ahead

Webinar: Adulting 101 – Step by Step to Planning It Right

Lost in your adulting journey? Join us as we run through what you should be looking out for covering personal finance and more.