It’s never too early to start thinking about the type of legacy you want to leave behind.

About this event

Death planning has never been an easy or comfortable topic to discuss. However, it is important to consider what if we are no longer around to provide for our family and are unable to relay our intentions? What are the consequences to our family’s livelihood and harmony amongst loved ones?

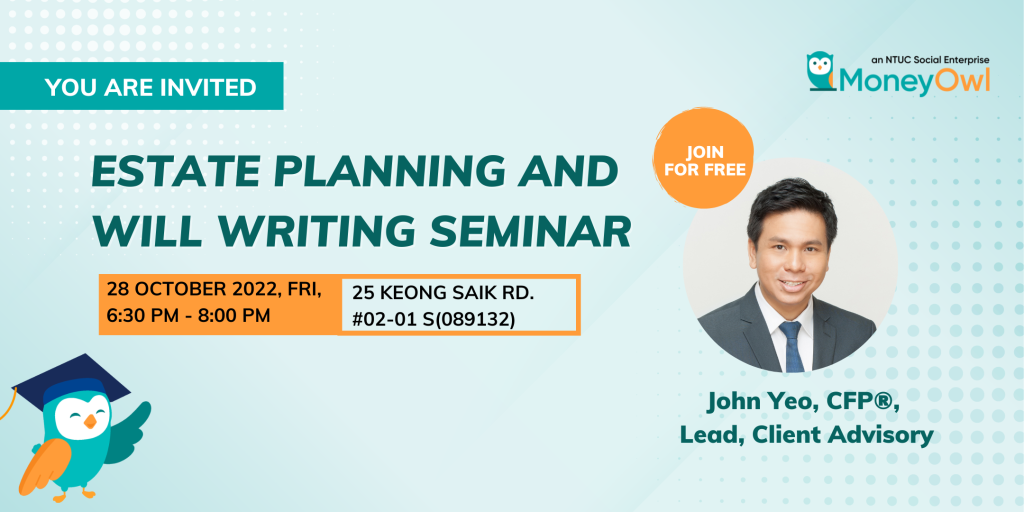

Join John Yeo, CFP®, Lead Client Adviser from MoneyOwl to start your Estate Planning and Will Writing journey now by registering for the Seminar!

Date: 28 October 2022 | Time: 6:30pm – 8:00pm

Venue: 25 Keong Saik Road #02-01 Singapore, 089132 | Dinner will start at 6:30pm

Topics covered

The following are some aspects to be covered in the upcoming seminar:

- Will my family receive all my assets in the event of my demise?

- Do I have enough funds for my family in the event of my untimely demise?

- What happens if I lose my mental capacity and cannot access my money?

Key Benefits of preparing a will in advance

- Appoint a Guardian – If you have children under 21 years of age, a guardian will ensure that their needs are met and protected in your absence.

- Appoint an Executor & Trustee – Choose people whom you know and trust to execute your will and manage your assets for your minor children.

- Prevent Unnecessary Disputes – A comprehensive will gives clear instructions on how to distribute your assets, helping prevent conflict and disharmony.

- Protect Your Beneficiaries – A will ensures the distribution of your assets according to your wishes. Leaving it to chance could lead to your intended beneficiaries being omitted or provided with less.

About the Speaker

John Yeo, CFP®, Lead, Client Advisory, MoneyOwl

John is a Certified Financial Planner and one of the 2019 FPAS Financial Planner Awards winners. Having been in the financial advisory industry for more than 15 years, he specialises in planning for families. He is passionate about transferring his wealth of financial and estate planning knowledge to the public and has conducted seminars for MNCs and SMEs, including MoneySense. In estate planning, John has planned for families with young children or vulnerable members through the use of will, trust and LPA.

If you’ve missed out our previous webinar, check them out here: https://www.dev.moneyowl.com.sg/events/