新加坡银行储蓄户头利率再跌 定存利率趋近2%

MoneyOwl in Lianhe Zaobao

How financial literacy and trust can guide investment decisions towards better financial health

MoneyOwl on The Straits Times

理财锦囊:四成公积金投资没赚头懂风险守纪律才能钱生钱

MoneyOwl on Lianhe Zaobao

Money and Me: Can You Become a CPF Millionaire without top-ups?

MoneyOwl on MoneyFM: Your Money with Michelle Martin

Investment-linked insurance: No panacea for returns or protection

MoneyOwl on The Business Times

理财锦囊:为娃娃填补公积金 “存出”百万小富翁

MoneyOwl on Lianhe Zaobao

淡马锡基金旗下MoneyOwl 推全新财务规划服务模式

MoneyOwl on 8world

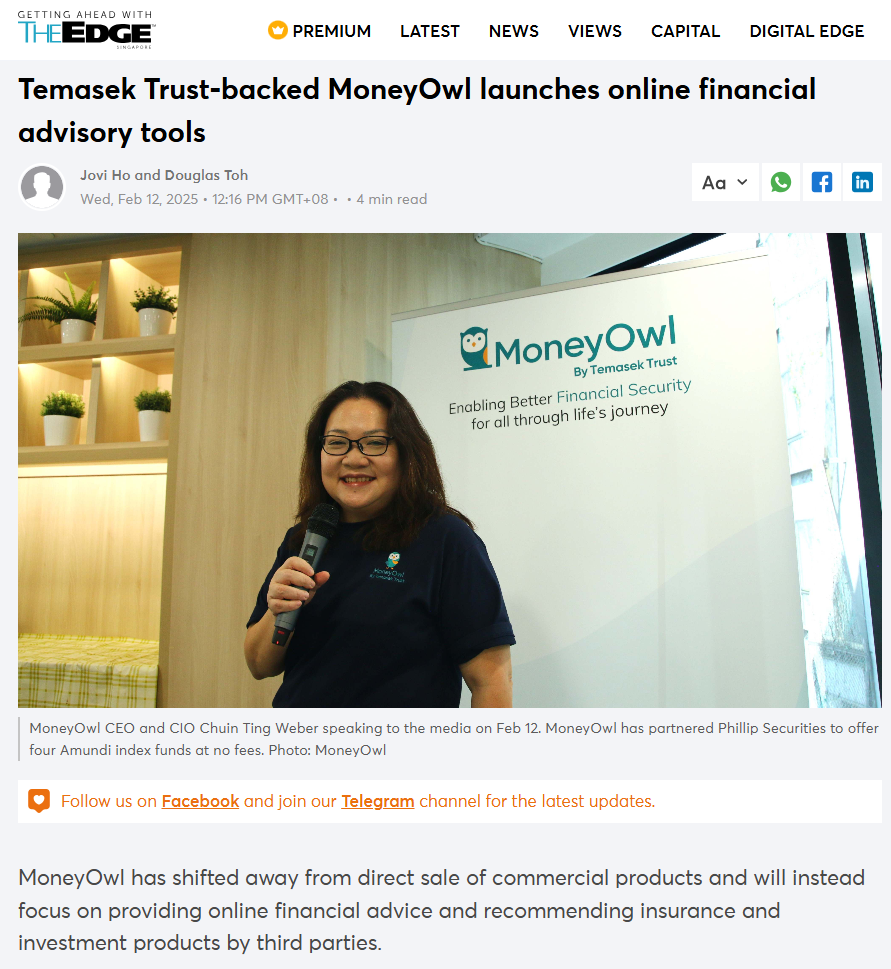

Temasek Trust-backed MoneyOwl launches online financial advisory tools

MoneyOwl on The Edge

Temasek Trust’s MoneyOwl launches new financial portal for young adults, gig workers

MoneyOwl on Channel News Asia

MoneyOwl launches insurance product ratings, investment help on its website

MoneyOwl on The Straits Times