MoneyOwl's Insurance Philosophy:

Buy As Much Protection As You Need But Pay As Little As You Can

Insurance is for protection. Insurance is not something on which we want a return, but an expense for transferring away major risks. We buy as much protection as we need but pay as little as we can, so that we have enough money left both to live purposefully now and to save for the future. To achieve this, we use cost-effective insurance, especially term insurance for income replacement needs. We avoid using insurance for both protection and saving as such two-in-one structures give us insufficient returns due to high embedded distribution (commissions) and other costs.

What, How Long, and How Much?

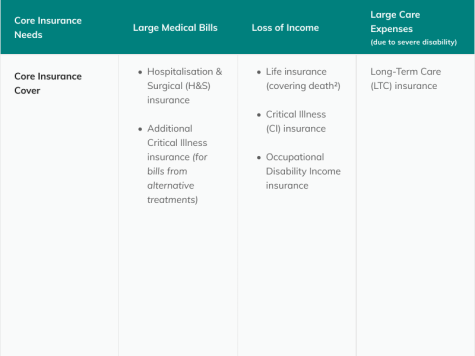

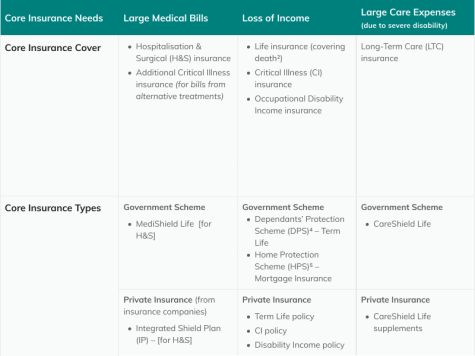

1. What should you cover?

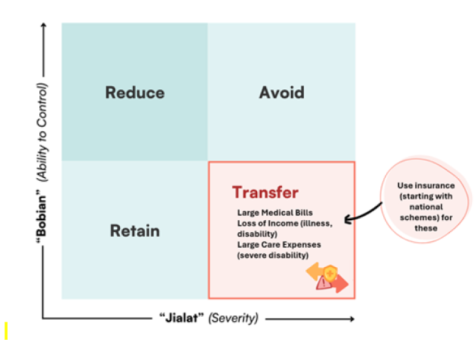

Insurance is a way of managing risk. We can categorise risk events in terms of our ability to control them and their severity, and each has a different risk management strategy. Because our money is limited, we cannot buy insurance for everything. We transfer risk using insurance only for risks we cannot control (“bo bian”) and which would have a severe impact (“jia lat”) on our finances.

2. How long should you cover for?

- Duration of each type of insurance should match with the duration of the need

We do not recommend “maximising” the duration of all types of insurance. Premiums for whole life plans or policies that extend into very old age tend to be very much higher than term life plans ending at retirement age. - Whole life coverage for Critical Illness (CI)

A major area of concern is whether term insurance is sufficient for CI, given that we are more likely to get the risk of getting a CI (heart attack, cancer, stroke etc.) when older and thus need money for treatments. The key information to note is that the major medical costs associated with critical illness, including chemotherapy and kidney dialysis, are covered by MediShield Life and your Integrated Shield Plan (IP).

The main purpose of CI insurance is therefore to replace lost income while you are unable to work due to treatment and recuperation. Once you retire and no longer have dependants, there is no income that needs to be covered. - Alternative Medicine/Treatments for Critical Illness (CI)

However, if you want to cater for alternative medicines/treatments that are not covered by an IP, you can consider a whole life plan with CI rider to pay out a lump sum to help with these other costs, but only after you get the CI term plan to cover loss of income.

It is hard to estimate the amount of additional CI insurance needed to cover such alternative medicines/ treatments ahead of any event. The comfort is that your MediShield Life and IP covers you for the main key treatments, which are periodically reviewed by the Health Ministry to ensure continued protection against major health episodes that result in large medical bills. - Prioritise your family’s insurance coverage

With the same rationale – that CI insurance is mainly to protect against loss of income – it is important for parents to cover themselves against CI first, before buying CI insurance for their children.

If we do buy CI insurance for our children, we can consider an early CI or multi-pay CI plan to allow a parent to stop work for a while to take care of the child. However, this is a lower priority than the parents’ own Core Insurance Cover, and other savings and investments.

3. How much coverage should you get?

Estimating the level of coverage or sums assured needed is not an absolute science. The nature of risk is such that we cannot tell in advance when we die or get sick, and what the costs would be at that time. There are also subjective factors like unique individual circumstance and preference.

Below are some principles for how much insurance you should get for the types of Core Insurance Cover.

1. Hospitalisation & Surgical (H&S, for Large Medical Bills

- H&S insurance reimburses expenses. It does not pay a lump sum.

- Get the best H&S / IP coverage we need to reduce the largest out-of-pocket expenses for peace of mind and lock in coverage at this high level while we are healthy, but always subject to what we can afford.

- Be prepared to downgrade in future if premiums get too expensive. We also do not “over-consume” medical services just because we have insurance, because it will drive up premiums for everyone, including for our family.

2. Life insurance (Loss of Income)

- Life insurance pays a lump sum upon Death, Terminal Illness (TI) or Total Permanent Disability (TPD).

- TPD riders should be purchased along with basic death and TI cover as the marginal cost is usually very low.

- The sum assured required is what your dependants would need to live as normally as possible in case you passed away prematurely.

3. Critical Illness Insurance (CI, Loss of Income, Additional Alternative Treatment Bills)

- CI insurance pays a lump sum upon diagnosis of a late-stage critical illness.

- The sum assured of 4x annual income is recommended, in line with MAS’s Basic Financial Planning Guide.

- The rationale is that CI insurance is primarily for replacement of income, as explained above, for a patient to stop work for a period and recuperate. With late-stage CI, if death does not occur soon after diagnosis, empirically patients might require about 4 years to undergo treatment and recover fully.

4. Occupational Disability Income Insurance (Loss of Income)

- Disability income insurance provides a monthly cash payment to replace your income, after a waiting period and only insofar as your disability is maintained. There may be terms and conditions that reduce your payout if you are able to work, including in other occupations besides your original one.

- In principle, the sum assured should be as close as possible to your monthly gross income. Current plans tend to provide for a replacement income of 75% of salary (or 65% for self-employed persons), after a waiting period in which disability is maintained.

5. Long-Term Care Insurance (Large Care Expenses)

- CareShield Life (CSL) pays out a monthly cash payment upon severe disability, defined as not being able to perform 3 out of 6 Activities of Daily Living: Washing, Dressing, Feeding, Toileting, Mobility, and Transferring.

- CSL and other Long-Term Care insurance defray general care costs of disabled living that are outside the H&S insurance, e.g., cost of transport, home helper, or nursing home fees.

- We recommend opting in to CSL (for those for whom it is not compulsory). Whether additional CSL Supplement is needed to increase the monthly support amount will depend on your overall retirement income19 situation as well as your expectation on the level of care (day care centres vs. home-based care vs. nursing home).

At inception in 2020, CSL payouts start at $600 a month and accounted for about 25% of median nursing home fees before Government subsidy18. CSL Supplements by private insurers upsize this amount and can be paid using MediSave up to a certain amount.

Download Ebook

Discover how MoneyOwl’s unique insurance philosophy can help you make informed choices and secure your financial future—download our comprehensive insurance eBook today!

Upon filling up the form, the ebook will be sent to your email address.