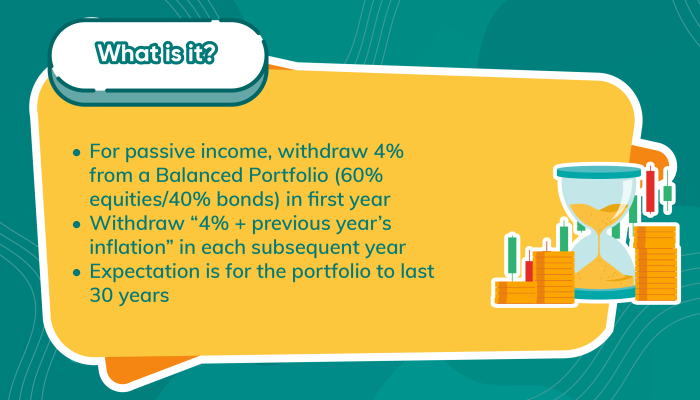

4% Retirement Withdrawal Rule

What, Why and How

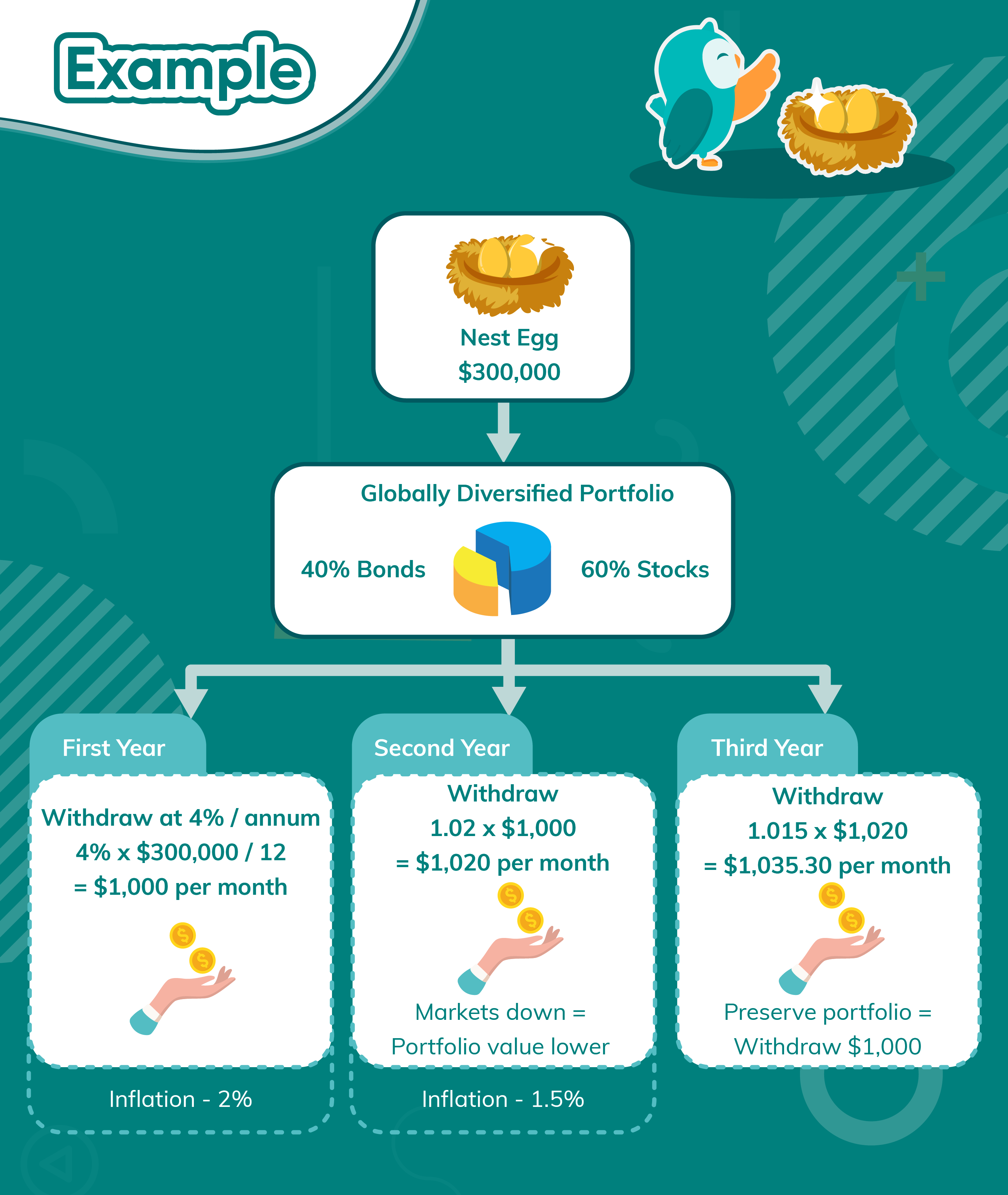

Example

Attention

- CPF LIFE should be the Safe Retirement Income Floor – use CPF LIFE to provide all of your most essential income

- It is not a guarantee that your assets will outlast 30 years as there is sequence-of-returns risk

- You need to have the risk appetite for the Balanced Portfolio

- Read our MoneyOwl Retirement Philosophy to understand other options under our “CPFA” Framework (Certainty, Probability, Flexibility, Accessibility)