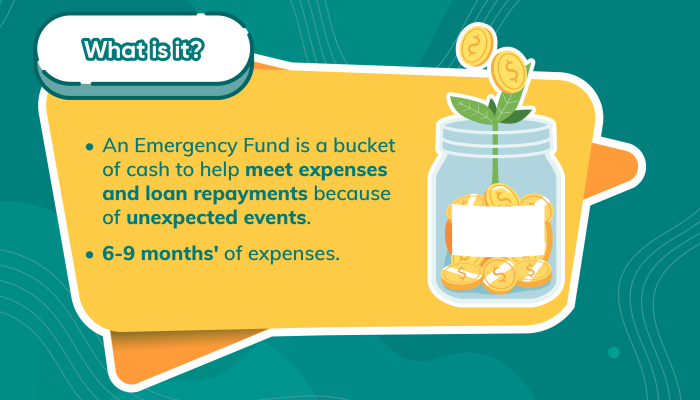

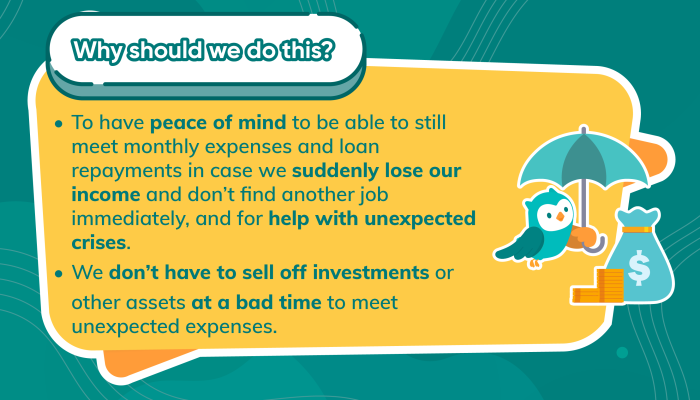

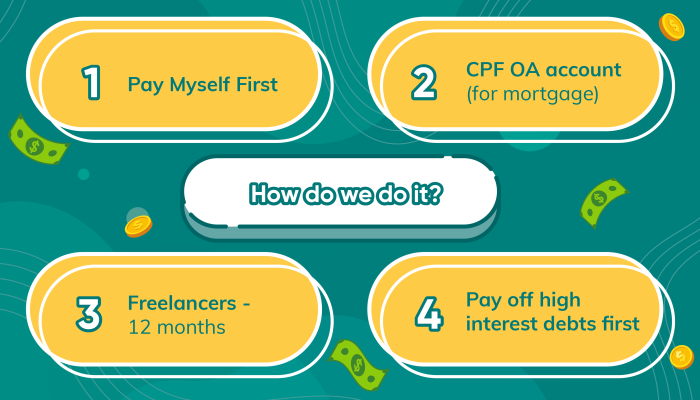

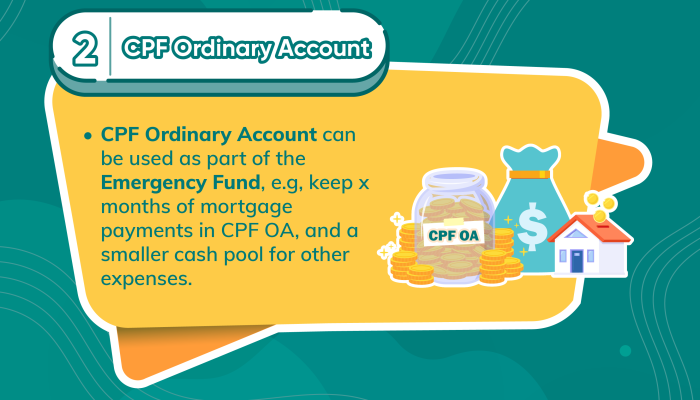

Building an Emergency Fund

What, Why and How

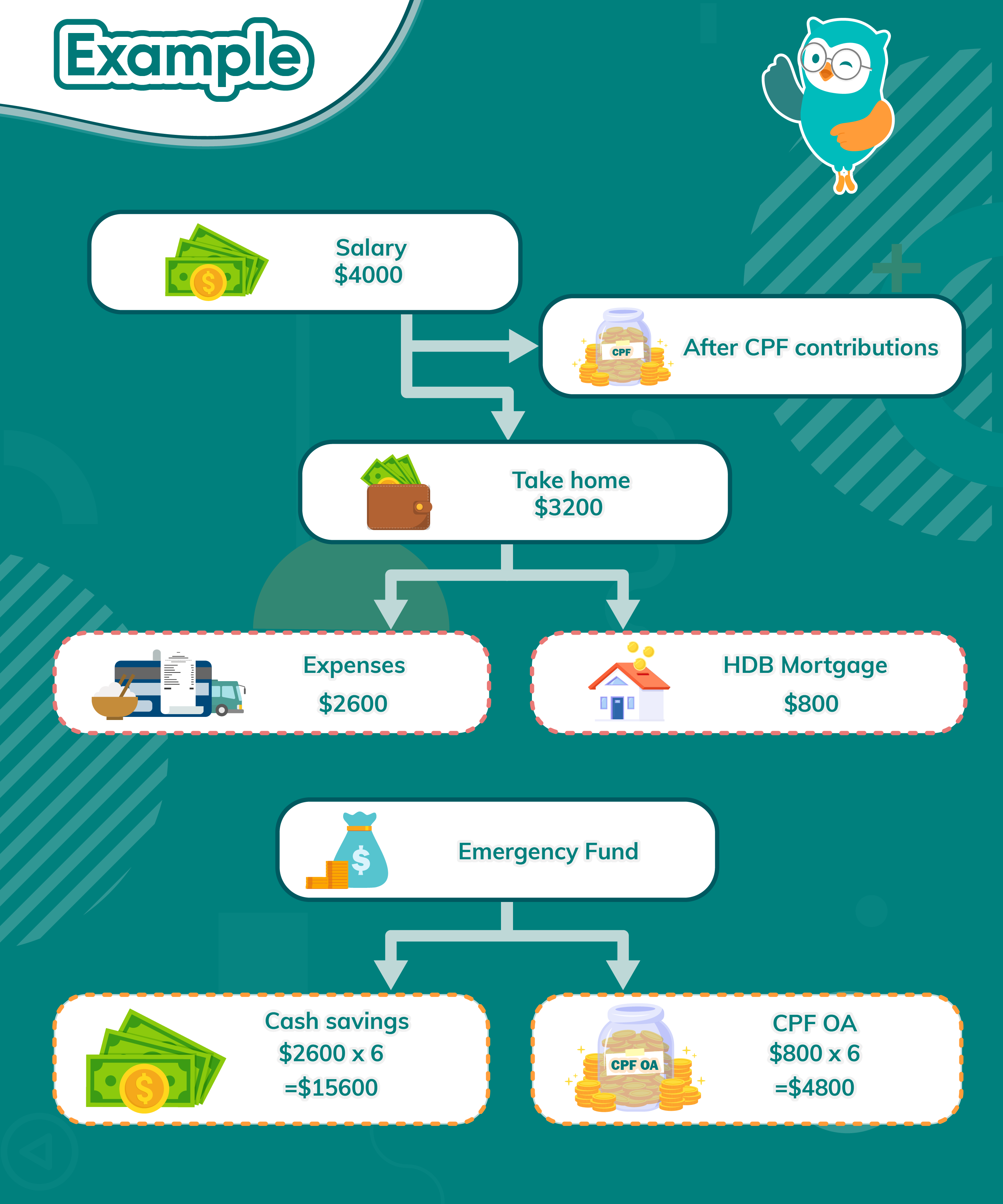

Example

Attention

- Emergency Fund should be kept in very safe and liquid instruments, like cash deposits

- Singapore Savings Bonds are suitable but have up to one month "notice period" for selling. Hence, at least one month of Emergency Fund should always be in a liquid bank account.