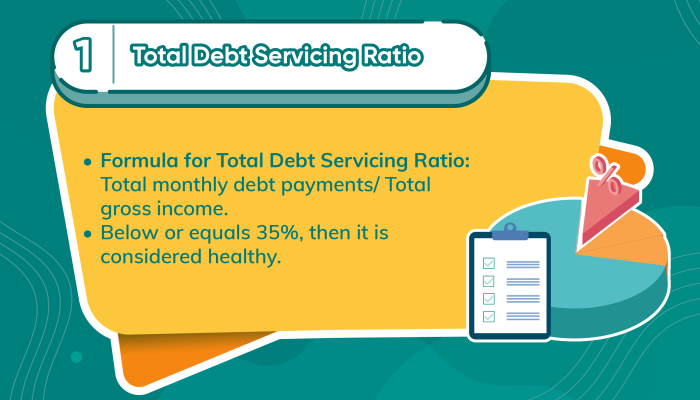

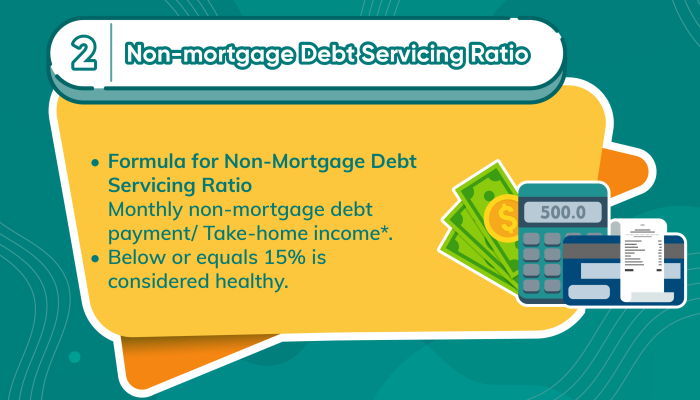

Debt Ratios

What, Why and How

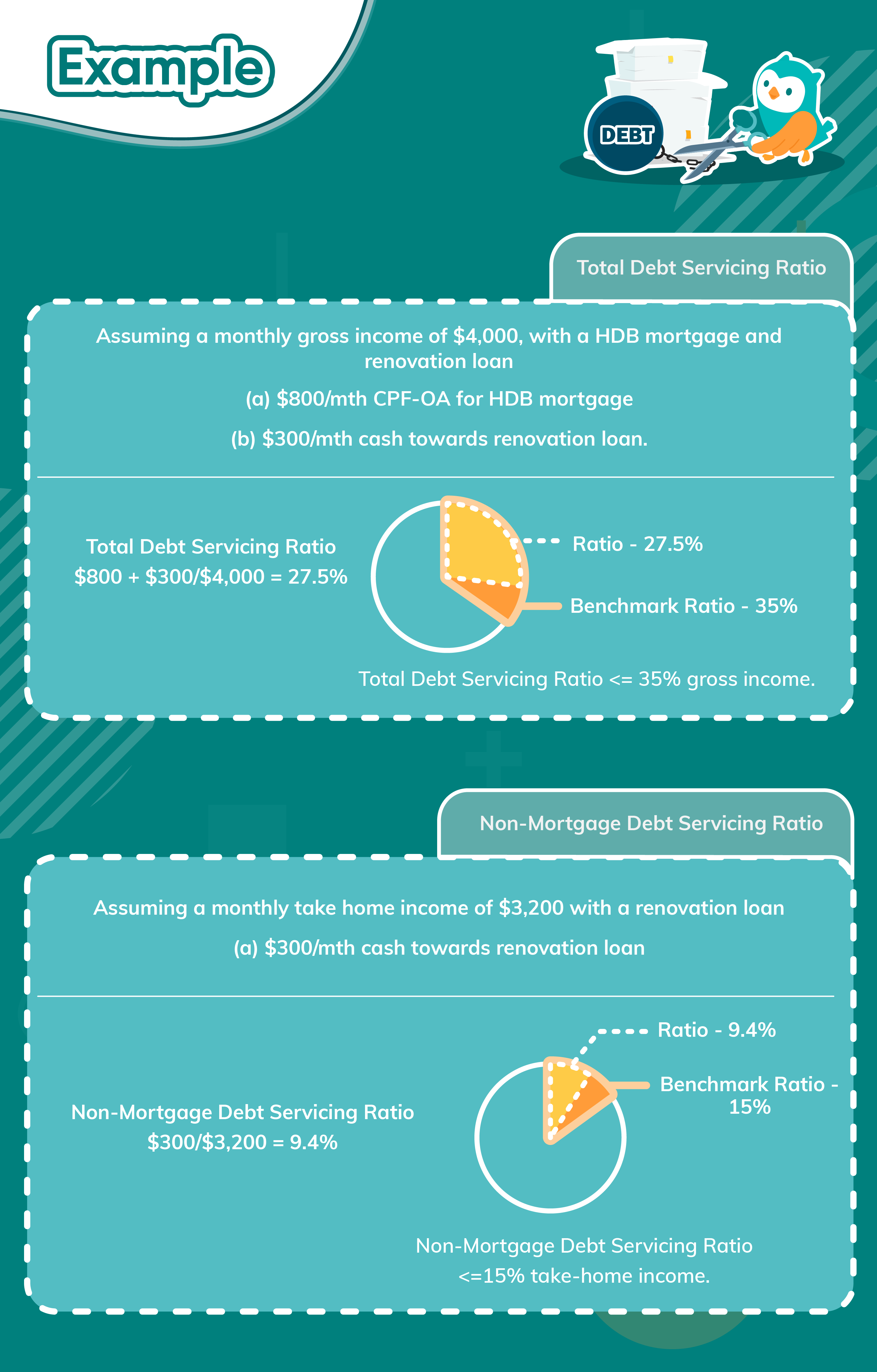

Example

Attention

- Consider Buy Now, Pay Later (BNPL) payments as part of the numerator for these ratios.

- BNPL tends to cause us to over-estimate our spending power and puts us at risk of rolling them over into actual debt.