Full Retirement Sum (FRS) as Base

What, Why and How

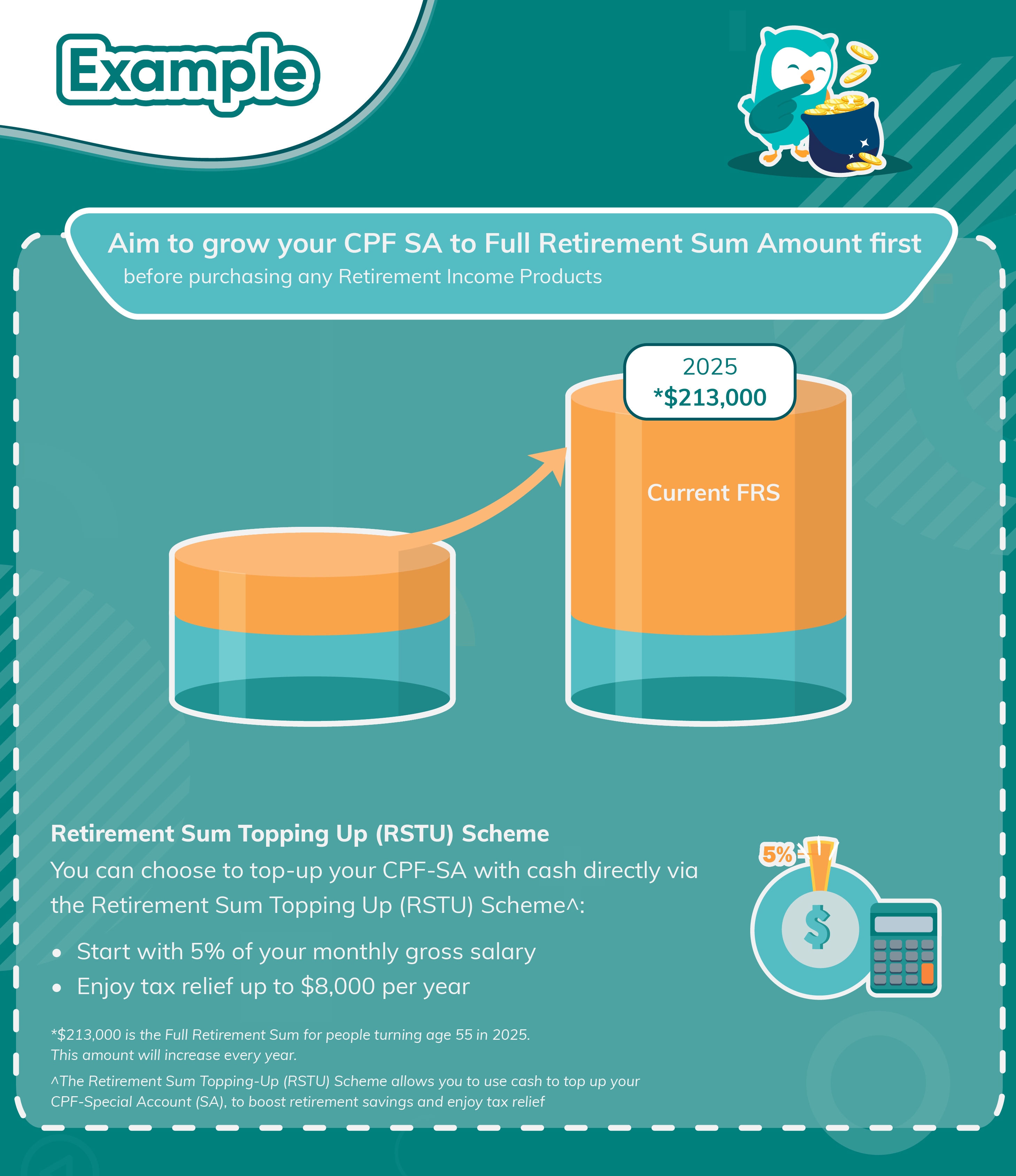

Example

Attention

- Top-ups to CPF SA are one-way/ irreversible, so be sure that we do not need the money.

- Even though private annuities claim to be more flexible. e.g., they may be surrendered, there are usually penalties.

- Read our MoneyOwl Retirement Philosophy to understand other options under our “CPFA" (Certainty, Probability, Flexibility, Accessibility) Framework.