Implementing a Personal Budget

What, Why and How

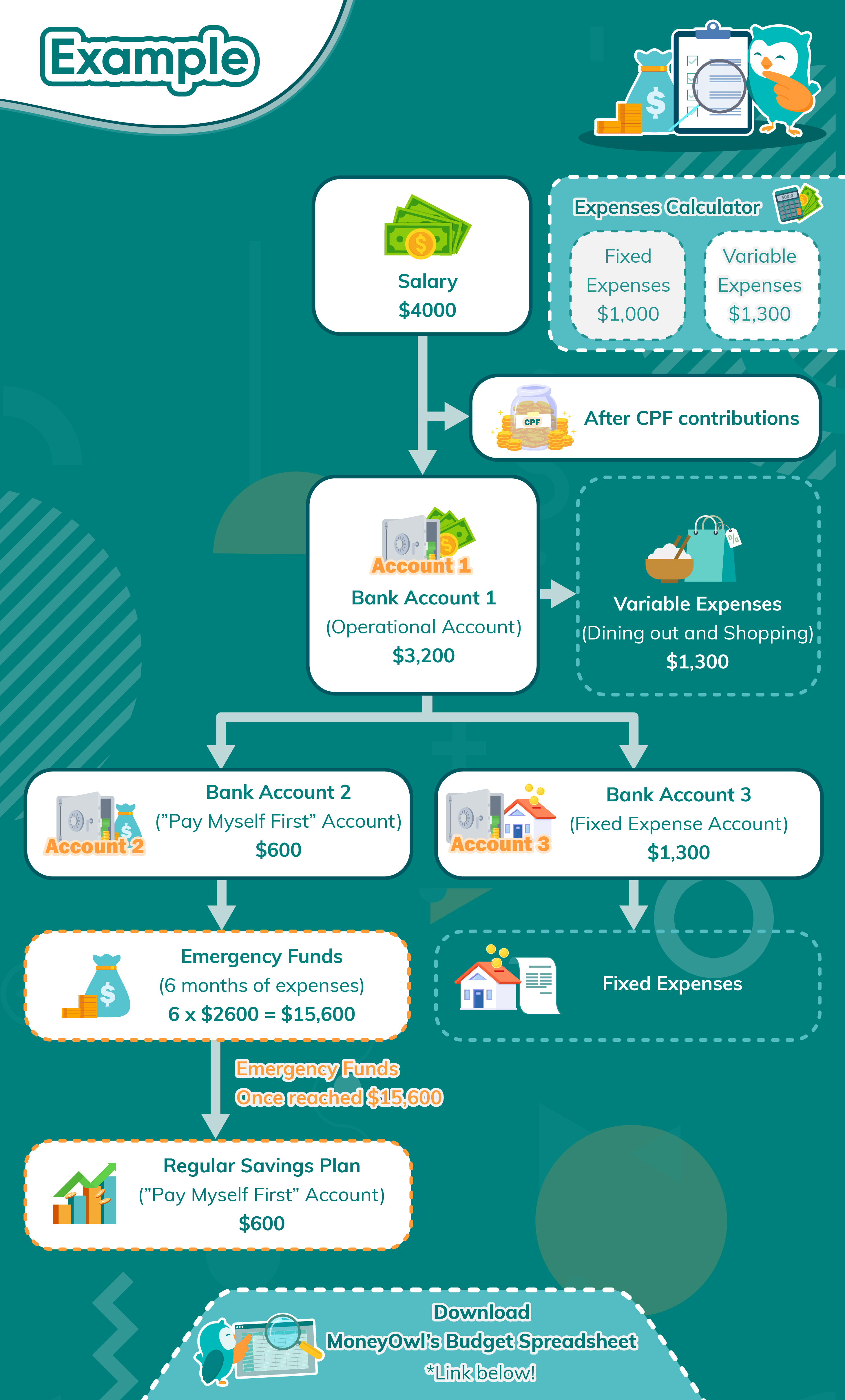

Example

Attention

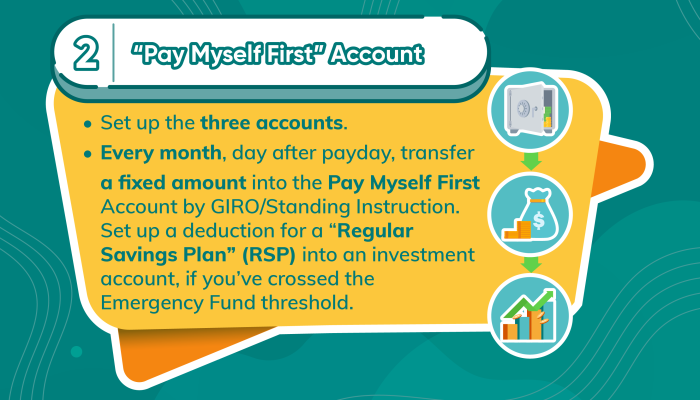

- Fixed expenses are annual, e.g. insurance premiums.

- Split up the annual amount into monthly amounts to be transferred into the Fixed Expense Account.

- It’s a one-time set up effort, but be careful not to let things slip in transition.

- Choose bank accounts that have no fall-below fees. (Fees charged if your average account balance that month is not above a certain amount.)

- Download MoneyOwl budgeting spreadsheet here.