Pay Myself First, and More Each Year

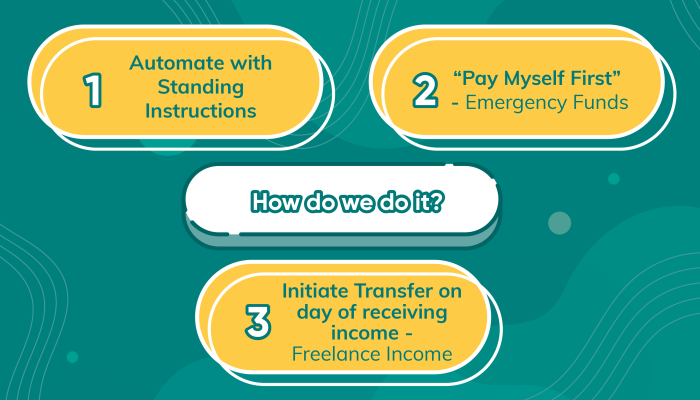

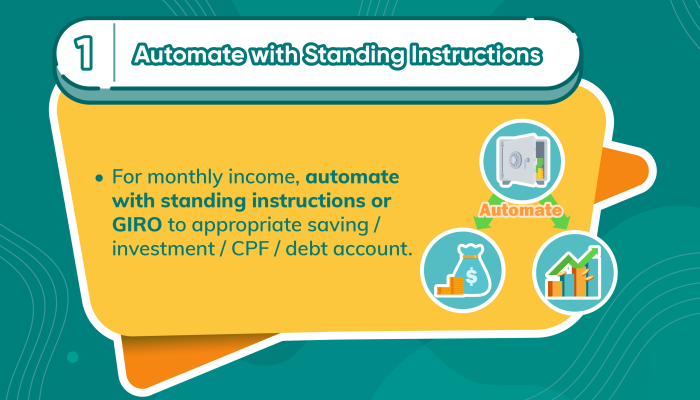

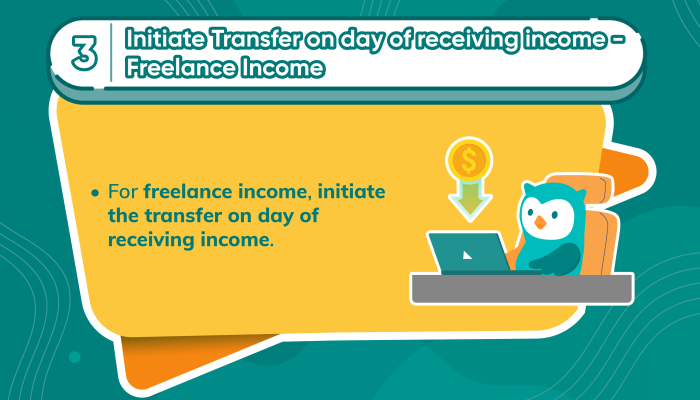

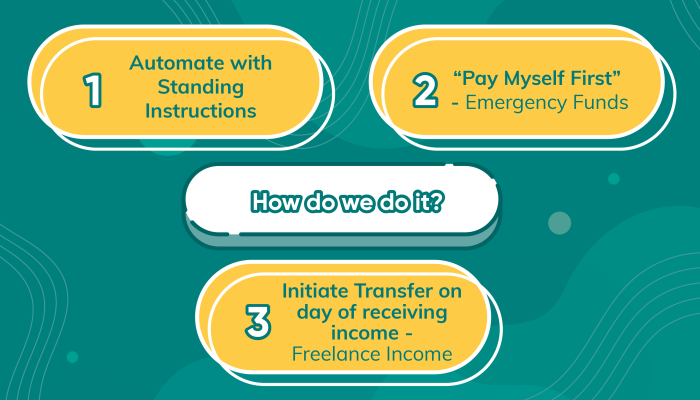

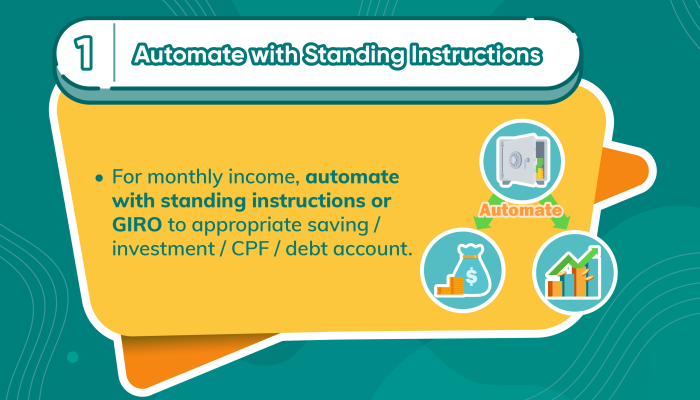

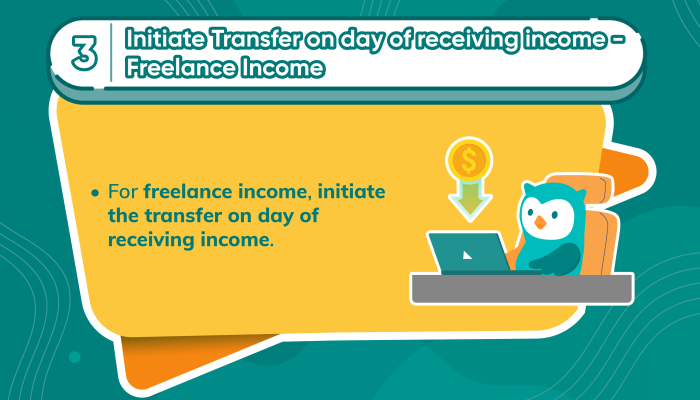

What, Why and How

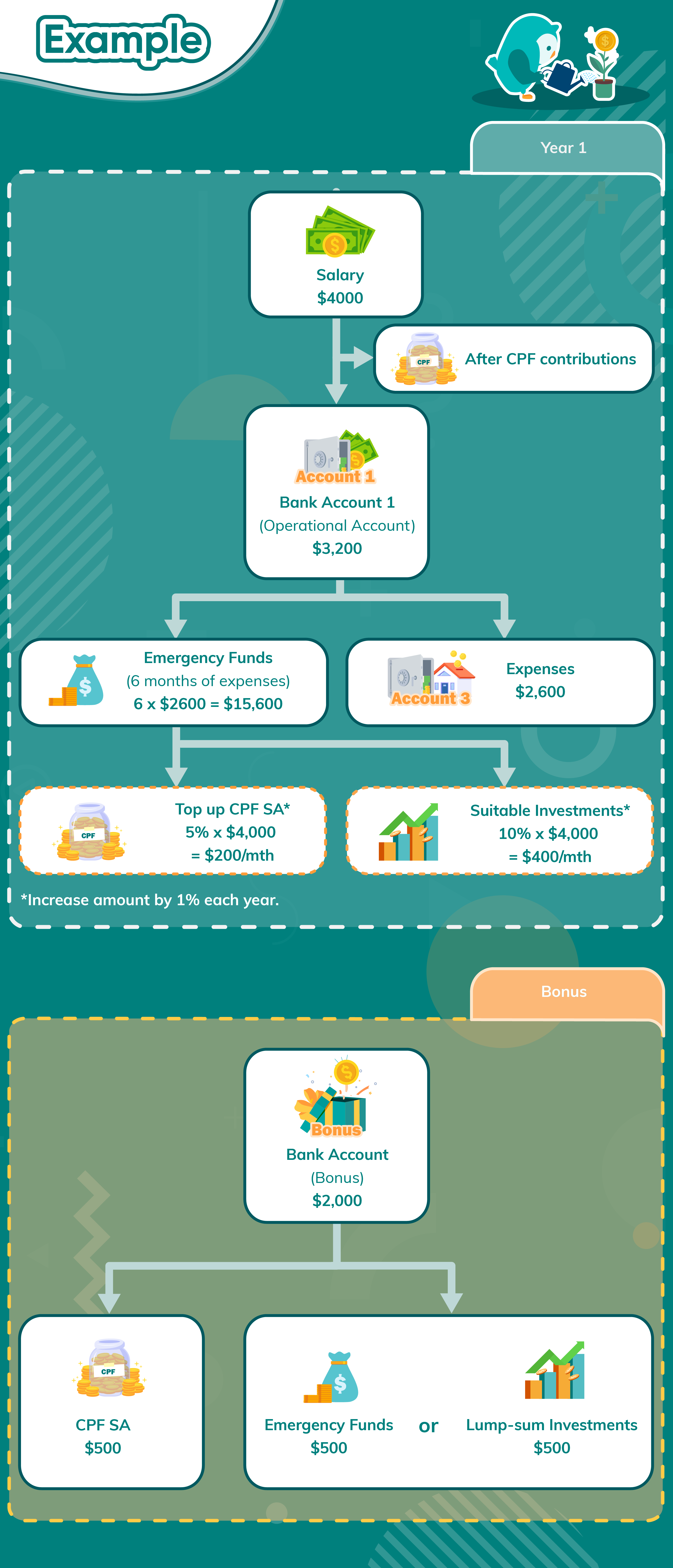

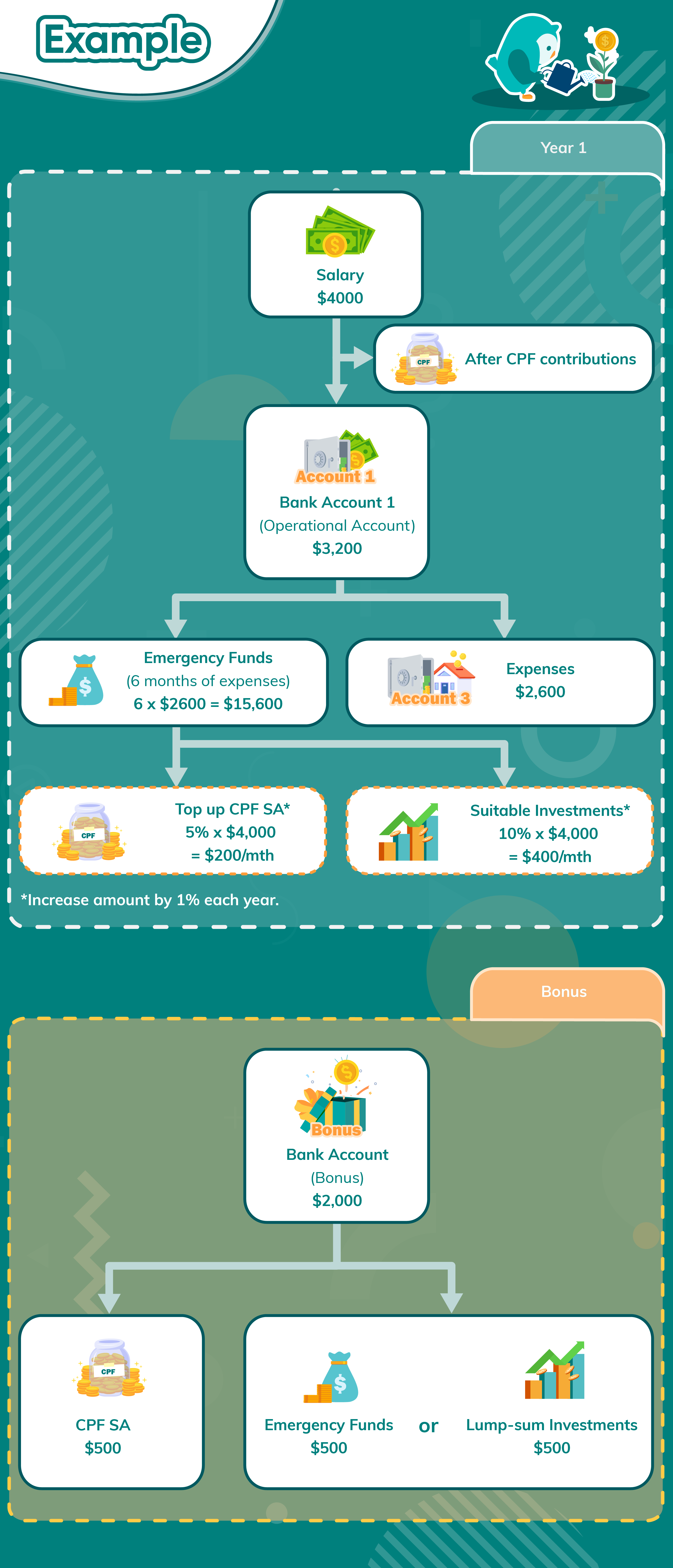

Example

Attention

- Automating it and developing the habit is more important than the actual amount.

- We can start with a small amount and increase it every year.

Essential tips to navigate major life stages

Investment Solutions for your goals

Insurance Solutions for your life stage

Breaking down life’s financial curiosities

First-of-its kind insurance plan rating & commentary

Breaking down life’s financial curiosities

First-of-its kind insurance plan rating & commentary

Comprehensive guidance and principles

Understand your needs. Identify your coverage gaps

Estimate your eligible grants, loan amount, and maximum BTO price you can afford

Find your HDB Resale Grants and plan your finances with confidence

Write your will online and leave a financial legacy for your loved ones

Take OwlPersonality Quiz to discover your money personality

Get guided to the right insurance with help from our referral partners

Latest financial tips and insights from MoneyOwl’s experts

Videos on financial planning, investments, and insurance needs

See MoneyOwl in the news with media highlights and press releases

Join our public talks and webinars to learn financial literacy from expert advisers

Discover our purpose, mission, and CEO’s message on financial security for every life stage

Our Board provides strategic guidance and uphold MoneyOwl’s mission

Get to know the team behind MoneyOwl, building better financial guidance for every life stage