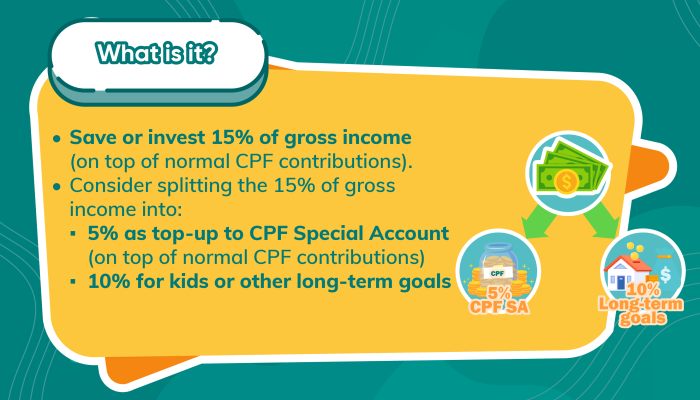

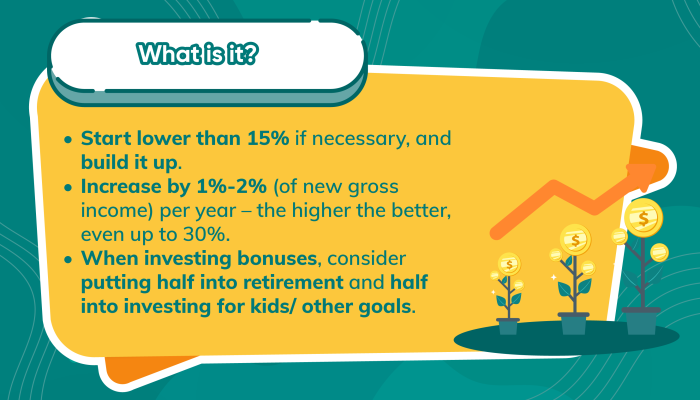

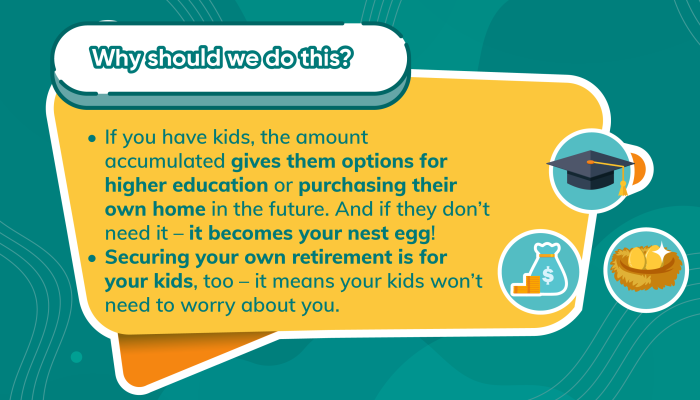

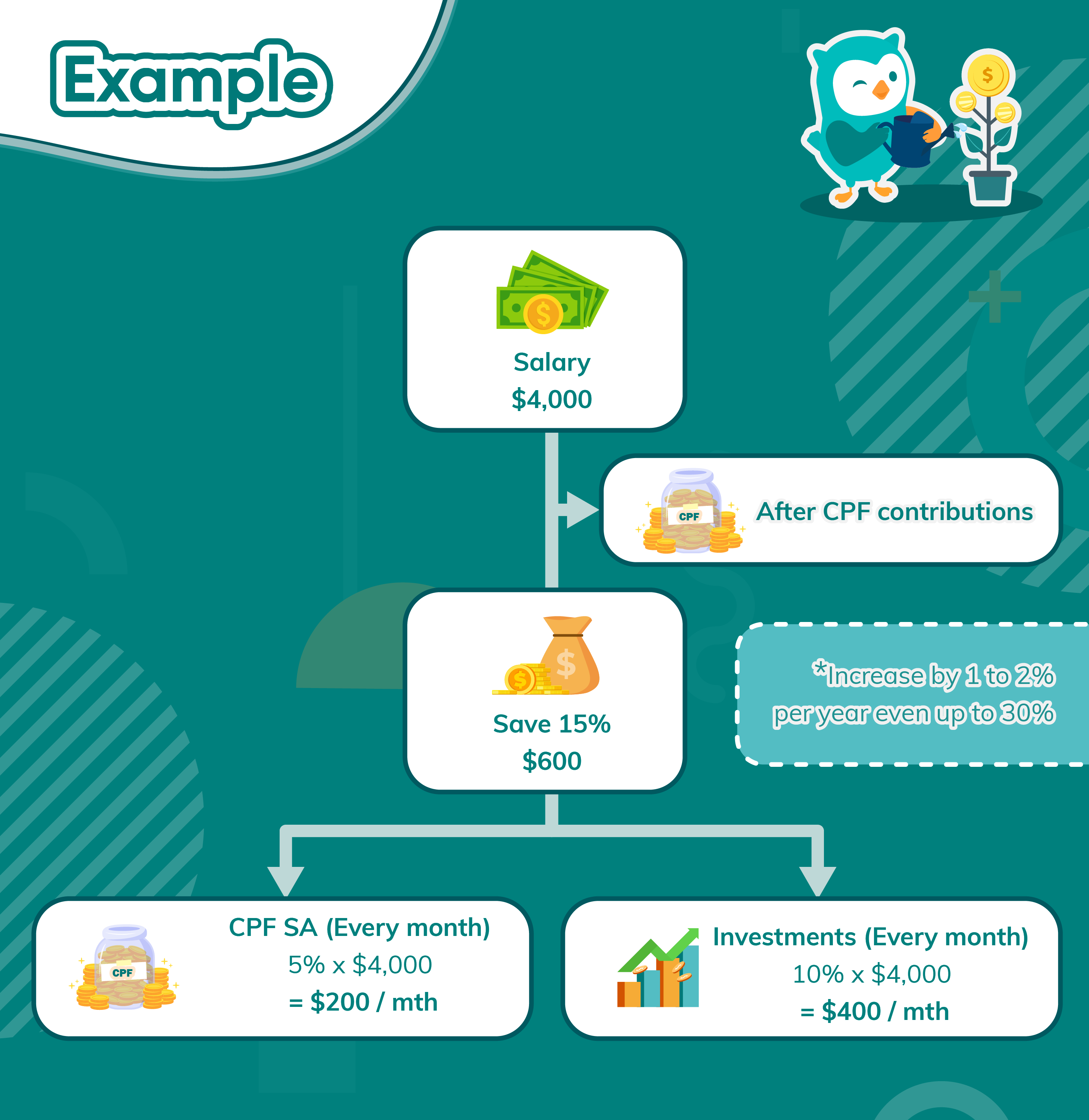

Saving or Investing 15%

What, Why and How

Example

Attention

Pre-conditions for investing:

- You have an emergency fund.

- Your debt servicing ratios are healthy.

- You don’t have high-interest debt: otherwise, pay off debt first.

- You have a suitable risk appetite.

- You need to be able to stay invested in a suitable portfolio.

Top-ups to CPF SA are one-way/ irreversible, so be sure that you do not need the money.