Achieve financial security and peace of mind in your golden years

Which stage are you in now?

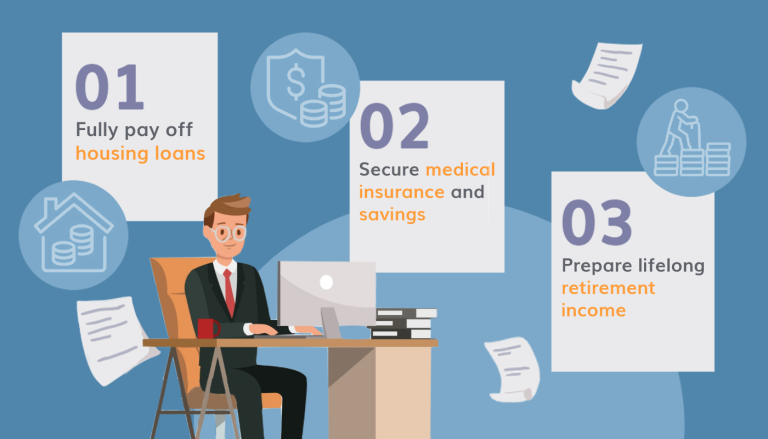

Prepare early for a smooth transition

Strengthening your finances for a secure retirement

Enjoy a fulfilling retirement with peace of mind

Explore the personalised checklist to help you navigate this chapter of your life with ease.

10 minutes

SRS (Supplementary Retirement Scheme) is a voluntary scheme to encourage us to save for retirement, over and above our CPF Savings. Contributing to it helps you enjoy a certain amount of tax savings, in terms of Tax Relief.

Click below to view an easy-to-understand visual guide on SRS account.

Visual Guide to the SRS | MoneyOwl

Click on the button below to visit CPF’s website for more information on cash top-ups.

Review your financial situation and goals before making the top-up

30 minutes

While CPF LIFE payouts form the foundation of your retirement income, you can build additional income. Assess various options based on Certainty, Probability, Flexibility and Accessibility (“CPFA”).

Click below to download our Retirement Philosophy eBook which describes our “CPFA” framework.

The hospital ward class you are covered for

Having adequate hospitalisation insurance helps ensure that your savings will not be prematurely depleted from large medical bills.

All Singaporeans and PRs are covered under MediShield Life, and over 7 in 10 also have Integrated Shield Plans that pay for private care in hospitals.

Depending on your healthcare expectations, buy an Integrated Shield Plan when you are young, healthy and insurable.

Click on the button below to read more about Integrated Shield Plans

If you are born in 1980 or later, you will be covered under CareShield Life when you turn 30 years old. CareShield Life is a long-term care insurance scheme that provides basic financial support when you develop severe disability.

In event of your untimely demise, the distribution of your assets will be determined by Singapore’s intestacy laws. This means that your estate may not be distributed according to your wishes.

Writing a will ensures that your wishes are clearly stated and provides protection for your loved ones.

Craft your Will using MoneyOwl’s Digital Will-Writing service

10 minutes

Understanding your mortgage status is important factor while planning for your retirement. Knowing exactly when you’ll complete your mortgage payments can give you a clearer picture to plan ahead.

To review your housing loan information, follow these steps based on the type of loan you have:

Having adequate hospitalisation insurance helps ensure that your savings will not be prematurely depleted from large medical bills.

All Singaporeans and PRs are covered under MediShield Life, and over 7 in 10 also have Integrated Shield Plans that pay for private care in hospitals.

Depending on your healthcare expectations, buy an Integrated Shield Plan when you are in good health.

30 minutes

1 in 2 healthy Singaporeans aged 65 could develop severe disability in their lifetime and need long-term care.

CareShield Life was introduced in 2020 to provide lifetime protection for basic long-term care needs in such scenarios. All Singapore residents born in 1980 or later are covered.

Consider whether to opt into CareShield Life and get supplements from private insurers to have higher coverage.

Click below to read more about CareShield Life.

From age 65, you can start to receive monthly payouts through the CPF Lifelong Income For the Elderly (CPF LIFE) scheme.

To assess whether the CPF Life payouts will meet your basic expenses:

To receive a higher level of CPF payouts, you can top up to your CPF Special Account and earn up to 5% p.a. risk-free interest (before age 55) or top up to your CPF Retirement Account and earn up to 6% p.a. risk-free interest (55 and above).

While CPF LIFE payouts form the foundation of your retirement income, you can build additional income. Assess various options based on Certainty, Probability, Flexibility and Accessibility (“CPFA”).

In event of your untimely demise, the distribution of your assets will be determined by Singapore’s intestacy laws. This means that your estate may not be distributed according to your wishes.

Writing a will ensures that your wishes are clearly stated and provides protection for your loved ones.

Craft your Will using MoneyOwl’s Digital Will-Writing service

As you approach 55, you can check the latest retirement sums and estimate how much they will be when you turn 55.

10 minutes

Review your expenses to see how they compare to your expected retirement income.

Review your CPF RA amount and drawdown plan, considering top-ups, withdrawal start date, and type of CPF LIFE plan.

For personalized advice, members who are starting their CPF payouts are eligible to book an appointment with the CPF Retirement Planning Service. Click on the button below to find out more.

Contrary to popular intuition, you can still invest in markets during your retirement years. Given that an average retirement can span 15 to 20 years today, you have the time horizon to invest at least a portion of your savings that you do not immediately need in a balanced fund (60% equities, 40% bonds).

You can then withdraw 4% from your portfolio each year, which should last over 30 years.

Stay flexible and evaluate your plan annually or when needed. For example, if the market performs poorly, you cut down on some discretionary spend. If the market does well, you may be more inclined to draw down more to spend on some “nice to haves”.

30 minutes

If your CPF and cash savings are not enough for your retirement, you can consider monetising your home to supplement your retirement needs.

There are mainly 3 housing monetisation options to help you unlock the value of your home:

In event of your untimely demise, the distribution of your assets will be determined by Singapore’s intestacy laws. This means that your estate may not be distributed according to your wishes.

Writing a will ensures that your wishes are clearly stated and provides protection for your loved ones.

Craft your Will using MoneyOwl’s Digital Will-Writing service.

Sign up for our Owlhoots newsletter and never miss out on the latest financial news and updates!