Note: It was announced in November 2023 that MoneyOwl will be acquired by Temasek Trust to serve communities under a re-purposed model, and will move away from direct sale of financial products. The article is retained with original information relevant as at the date of the article only, and any mention of products or promotions is retained for reference purposes only.

______________

Find out more about The new Medishield Life Premium on the various subsidies and modes of support, affordability, and coverage.

With better insurance benefits and universal coverage that includes all regardless of one’s health condition, the new MediShield Life premiums will naturally cost more. The burning question is how affordable it is going to be and who will be most affected?

This article is a continuation of Part 1: MediShield Life In A Nutshell.

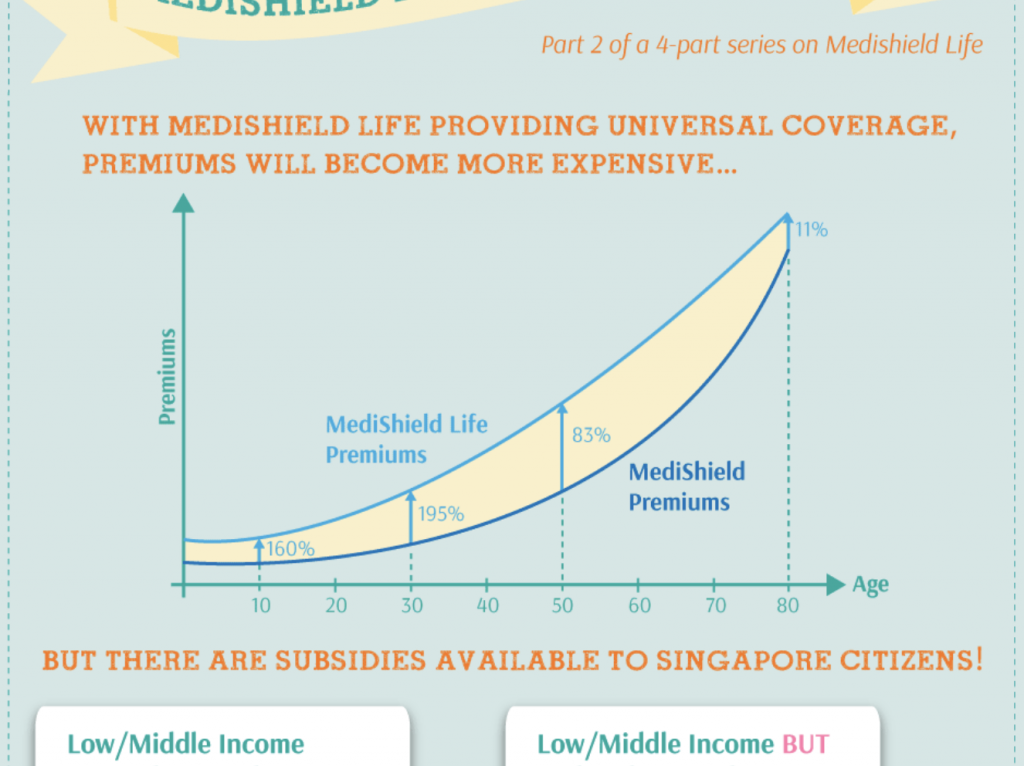

To begin, let’s compare the premiums for MediShield and MediShield Life before any subsidy.

Observations on MediShield Life premiums:

- A steep increase in premium by 160% for age 1 to 20 and nearly 200% from age 21 to 40.

- From age 41 to 60, the increase in premium will be around 83% to 98%.

- From age 61 onwards, the increase will be smaller ranging from 66% to as low as 11%.

- You pay more when you’re young so that the rise in premium will be lesser during retirement.

Obviously, with such premium rates, MediShield Life will not be cheap. However, the government will incorporate a series of subsidies, top-ups, and measures to make it more affordable.

Financial support

The government will provide support to all Singaporeans to keep MediShield Life affordable. Those who will benefit the most are the lower-to-middle income households, the elderly, and the needy. There are Permanent Subsidies that will be ongoing and Transitional Subsidies that will apply only for the first 4 years.

Permanent Subsidies

1Per capita household income (PCHI) is calculated by taking the total gross household monthly income divided by the total number of family members living together

Transitional Subsidies

Support for the Needy

Compare MediShield Life premiums factoring in financial support

The 2 tables below show the premium outcome after including the Permanent and Transitional Subsidies.

(1) In the first year (2015) with Transitional Subsidies

Source: Ministry of Health (MOH)

(2) In year 2019, after Transitional Subsidies are phased out

Source: Ministry of Health (MOH)

Observations & Remarks:

- The Pioneer Generation (see *) will end up paying less than the current MediShield premium

- During the first year of MediShield Life (2015), the maximum premium increase will be less than $30 per year for the lower-income and not more than $60 per year for the high income.

- After phasing out the Transitional Subsidies of 4 years (Year 2019), the premium will increase by an average of $36 to $128 per year for the lower-income and $80 to $300 per year for the high income.

- The above premium tables are for those staying in residence with an Annual Value (AV) of less than $13,000. Those with an AV > of more than $13,000 will receive lesser subsidies, hence a higher increase in premiums.

- PRs will receive half the amount of subsidies compared to Singapore citizens if they belong to the lower-middle-income. However, they will not be able to enjoy Transitional Subsidies.

Other Financial Support

To make the increase in premiums less painful, other avenues of financial support will be implemented.

- Additional 1% Medisave contribution by the employer.

This can be quite significant especially for the high-income group who do not enjoy the Permanent Subsidies that the lower-middle-income group get.

For example, those earning more than $5,000/mth will see an increase of $600 per year added into their Medisave account. - MediShield Life premiums can be fully paid through Medisave.

Hence, no out-of-pocket expenses for MediShield Life provided you have sufficient Medisave for the deduction. - Premium rebates for MediShield Life starting earlier from age 66.

Existing policyholders will start receiving rebates from age 71, which would help reduce the net premium. Having paid a prepaid premium at a younger age, Singaporeans above 66 years old will get to enjoy the benefits earlier. The rebate is structured such that those who join the Medishield scheme earlier will receive more rebates. Also, the older you become the higher the rebate given.

Conclusion

After understanding the various subsidies and modes of support, do you think the new MediShield Life premium is affordable? I reckon it depends on an individual’s perspective on the social benefits of universal coverage.

Considering the range of protection benefits and financial support given, I think that the premium increase is justifiable. Also, I would like to commend the MediShield Life Review Committee for putting together a well thought out recommendation report for the benefit of all Singaporeans.